As this article is being prepared, the price of Bitcoin continues to linger around the $42,000 region. The latest Federal Reserve statements have been of the kind to dampen optimism. However, it would be unrealistic to expect that all members will predict serious interest rate cuts next year. So, what’s the latest situation on the Shiba Coin front?

Shiba Inu (SHIB) Analysis

The second-largest meme coin has been following a declining resistance line since January. The negativity continued strongly until June 10, resulting in a low of $0.0000048. After four unsuccessful breakout attempts, the line was surpassed on December 3, supported by the rapid recovery of the BTC price. However, there were no closing above the resistance area this time either, and the December 11 bearish candle significantly dampened the bulls’ spirits.

The sixth issue of The Shib magazine was released on December 12, and Shibarium surpassed the 100 million transaction limit. However, Shiba Coin, which always stands out with its exciting products and creates a buzz, has been unable to support its price with news lately. This shows the disbelief brought about by many unsuccessful attempts. The situation does not look good with failed ventures in the Metaverse, NFT, DeFi, and now an unsuccessful layer2 solution.

Shiba Coin, which tries to build its own ecosystem in the meme coin area, something no one else has done, may continue to remain in the shadow of newly-emerged, hype-driven competitors like BONK Coin if it fails to gather enough demand for its products. If new meme coins like PEPE and BONK manage to retain interest in 2024, it will not bode well.

Shiba Coin Price Predictions

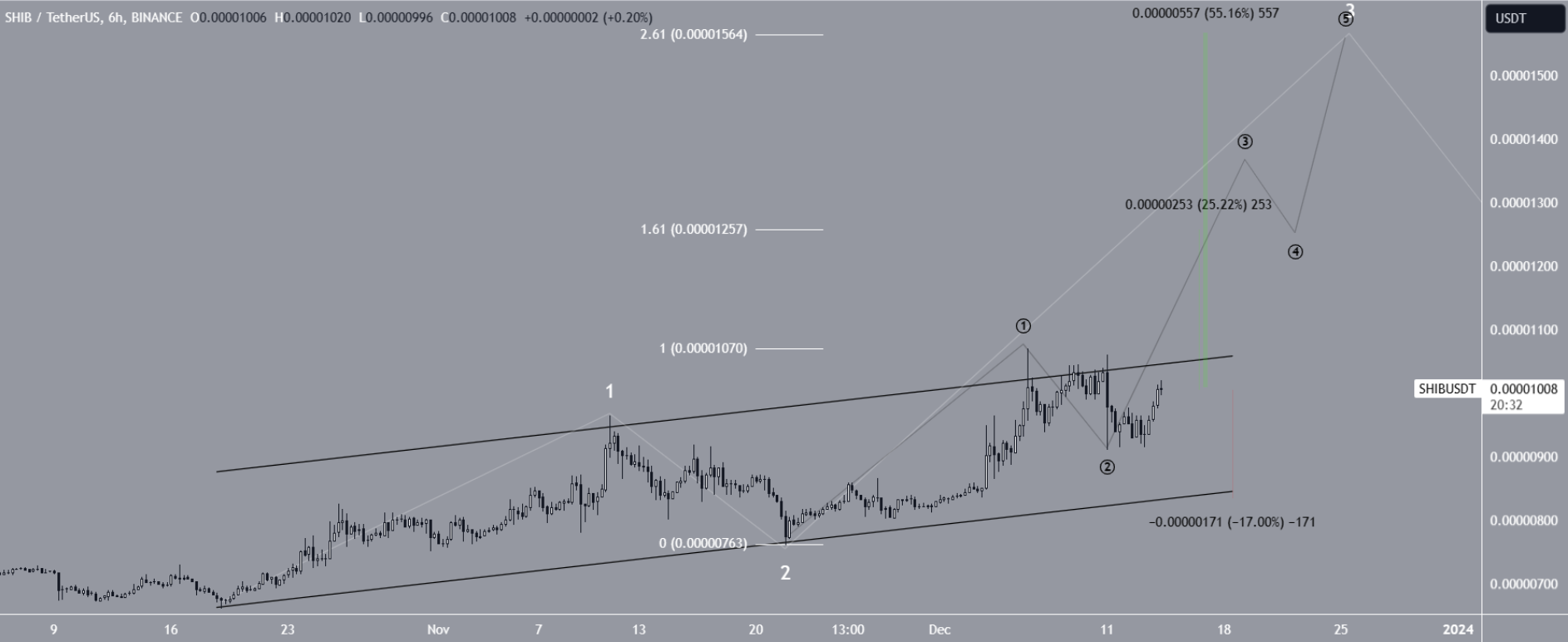

The six-hour chart’s Elliot wave count indicates a new upward movement. The most likely count suggests that the price is in the third wave of a five-wave upward move. However, there is a problem: BTC has not allowed for the expected growth of this peak wave. Although the price continues to hover on the verge of removing one zero, every BTC drop triggers sales of Shiba Coin.

Reduced volumes over the weekend and the possibility of BTC closing its first red candle in weeks may embolden the bears. BTC has been closing green for eight weeks straight. However, the December 11 sell-off has given the bulls the opportunity to reverse the steady rise that has been ongoing for two months.

Shiba Inu is trying to break out from a parallel channel. A successful exit would confirm the upward trend. The first potential target for the peak of the move is approximately 25% higher at $0.0000125. However, the subwave count suggests the rally could end up 55% higher at $0.0000156.

In the opposite scenario, a fall to $0.0000084 and $0.000007 could be seen.