The largest cryptocurrency, Bitcoin (BTC), after recent sales driven by short-term investors (STHs) who make up the more speculative segment of the investor base, is showing signs of recovery from $42,200, indicating the beginning of a new uptrend. The king of Altcoins, Ethereum (ETH), is also signaling recovery, having surpassed $2,270. In the background, a high influx of funds into BTC and ETH has been detected, which, as expected, could influence the price of the two largest cryptocurrencies.

High Influx of Funds into Bitcoin and Ethereum

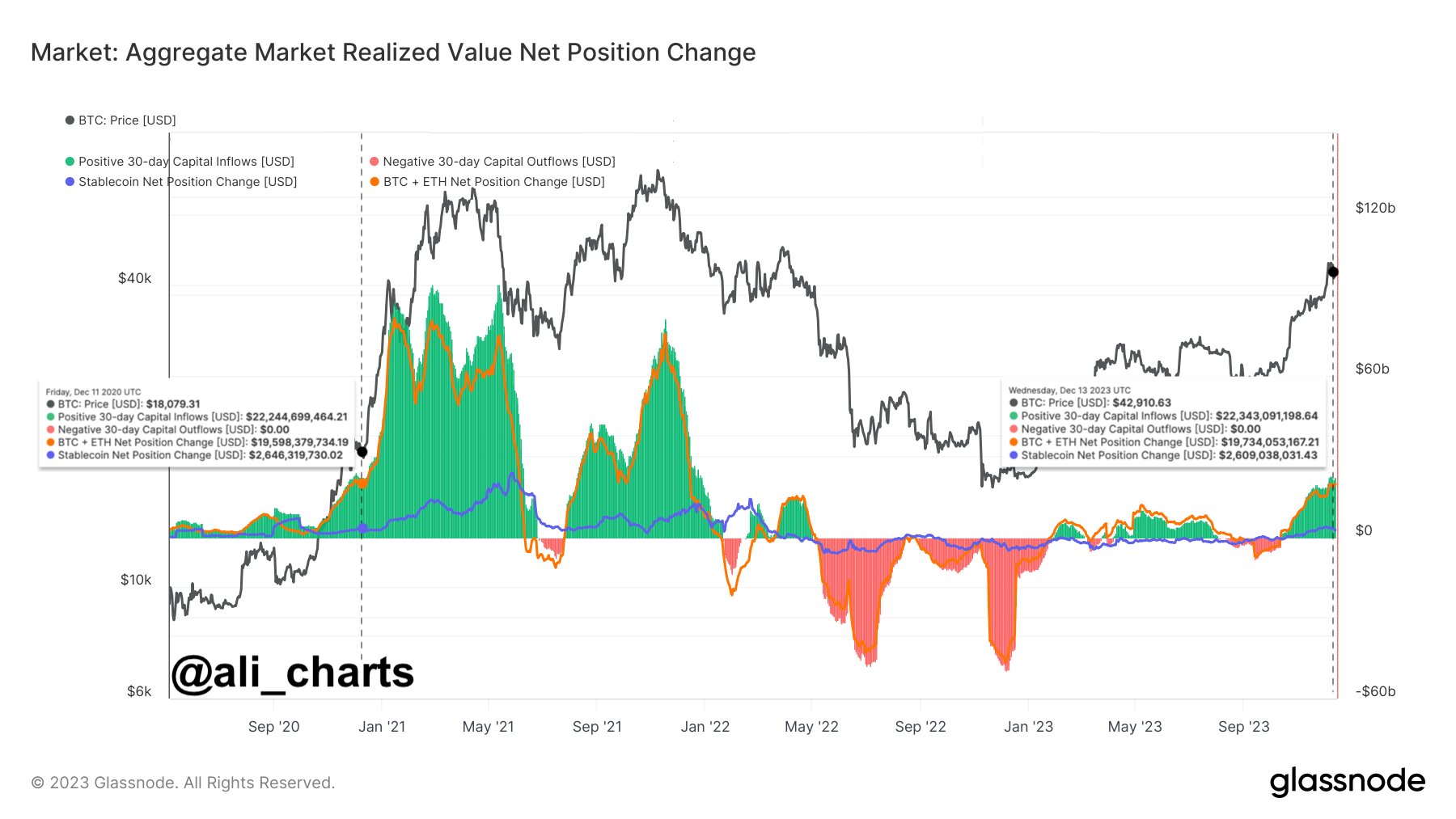

According to experienced on-chain analyst Ali Martinez, on December 14th, Bitcoin and Ethereum witnessed an influx of funds exceeding $19.7 billion. This figure is reminiscent of the high influx of funds seen just before Bitcoin’s rise from $18,000 to $65,000 three years ago. If historical patterns were to repeat themselves, the potential for the largest cryptocurrency to follow a trajectory similar to the 2020 cycle and reach new heights could be possible.

Additionally, Greek.live has revealed that BTC options took the lead in the midst of the mid-week rally, accounting for 50% of the total volume. Half of the trades executed as block trades in the options market actively purchased options expiring on December 29, 2023. Despite being significantly below average, it was observed that particularly a giant whale preferred to take long positions in the rising market by the end of the year.

Bullish Outlook in the Cryptocurrency Market

Bitcoin’s current strong rally has slowed down somewhat as short-term investors have started to take profits. This triggered the third sharpest sell-off of 2023. On-chain data platform Glassnode’s analysis pointed out that Bitcoin entered a short-term exhaustion phase after reaching the highest level of the year at $44,500. Furthermore, the decreasing supply of BTC in cryptocurrency exchanges reflects the sensitivity of investors to protect their assets and a reduced desire to sell.

Many market commentators who have recently made optimistic price predictions for Bitcoin suggest that they expect the largest cryptocurrency to surpass the $42,000 to $45,000 range by the end of next week. Moreover, from this point on, they indicate that there is no significant barrier up to $63,000 and expect the price to rise to this level.

In addition to all this, BitMEX’s co-founder and former CEO Arthur Hayes has reiterated his previous prediction that the price of Bitcoin will eventually reach $1 million. He continues to relate this to broader economic changes that are reducing the value of national currencies.

Türkçe

Türkçe Español

Español