Bitcoin and the altcoin market experienced activity following the ETF news that emerged overnight. After the opening of Asian markets, the price of BTC increased by 5.5% and surpassed the $43,000 level. This price movement excited investors about the possibility of a new upward trend. In the last 24 hours, Bitcoin’s market value saw an increase of over $50 billion. The price increase came after positive developments in Bitcoin ETF applications, following the submission of an updated S1 file by BlackRock and WisdomTree.

S-1 Update in ETFs

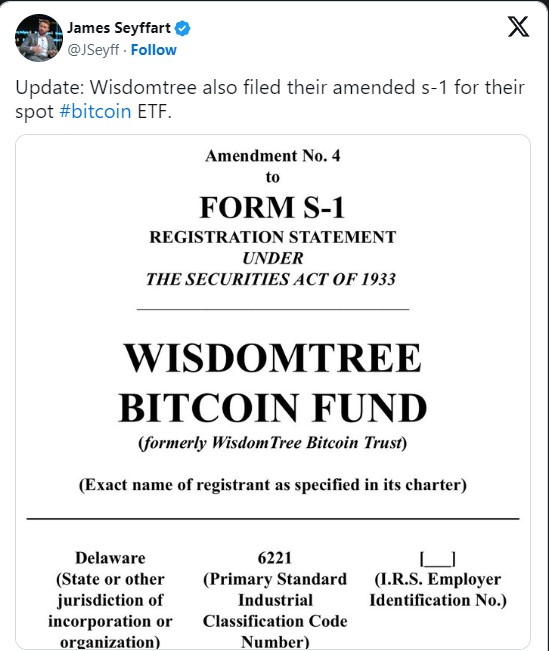

Bloomberg’s leading analyst James Seyffart, in his sharing today, indicated that significant developments have occurred in the spot Bitcoin exchange-traded fund (ETF) proposed by BlackRock. He announced that an S-1 amendment, which signals an important step forward and contains plans for the proposed ETF, has been made.

BlackRock’s adoption of the Securities and Exchange Commission’s (SEC) guidance on cash creation indicates a change in its strategy towards achieving success. The company concluded the debate by stating that only a cash approach would be accepted, postponing the discussion about other types of creations to a later date. This strategic move by BlackRock is interpreted as a stable step that brings together all elements in preparation for the upcoming process.

Following the decision, the emphasis on cash creations in the S-1 amendment is seen as a positive decision for the advancement of BlackRock’s spot Bitcoin ETF. Shortly after BlackRock, WisdomTree also announced that it had made an S-1 amendment.

BTC Price Movements

Crypto analyst Ali Martinez recently shed light on the current chart formation of Bitcoin, highlighting the formation of a descending triangle pattern on the hourly chart. In this analysis, Martinez pointed out key support levels at $41,900 and $40,700 as important focal points for traders.

The significance of these levels lies in the potential outcomes that a decisive close above or below this range could trigger. According to Martinez, a price movement could trigger a sharp 8% to 9% price movement in Bitcoin’s price, depending on the direction of the breakout.

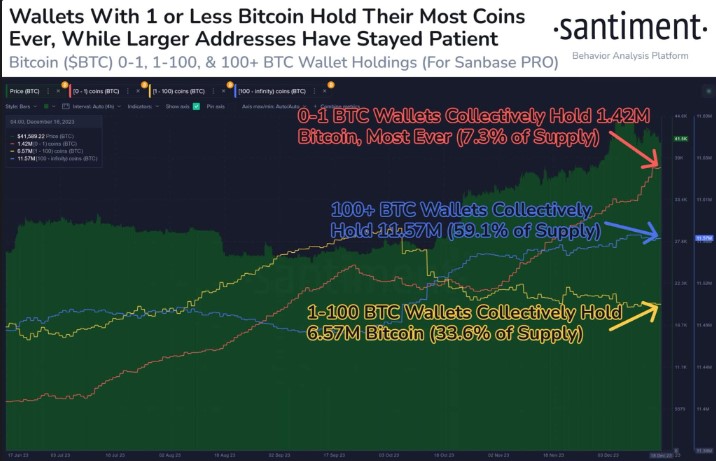

Another notable aspect of Bitcoin is that wallets containing 1 Bitcoin or less have reached the highest asset accumulation of all time. Since the beginning of November, these small investors have been aggressively buying, seemingly paving the way for a diversification of coin ownership.

In contrast, wallets that are not classified as whales but are not small either have seen a slight decrease in Bitcoin investments since last month, while larger whale wallets have preferred to increase their Bitcoin investments.