Unlocking of Blur tokens continues to progress. During this process, more tokens have been transferred to exchanges. So, what changes have occurred in the token’s price performance following these recent developments?

Unlocking of Blur Token Locks

According to data provided by Etherscan, the unlocking of approximately 49.8 million Blur tokens, valued at about $23.2 million, has recently taken place. Following the unlock, these tokens were initially transferred from a multi-signature address and later reached Coinbase Prime.

Since the start of the unlocking period for Blur, approximately 485 million tokens worth about $226 million have been unlocked and transferred to Coinbase Prime. Additionally, according to data from CoinMarketCap, the current circulating supply is seen to be over 1.1 billion, and the total supply is stated to be 3 billion according to the latest review.

This situation indicates that despite the volume of tokens unlocked so far, the circulating supply remains significantly below the total supply.

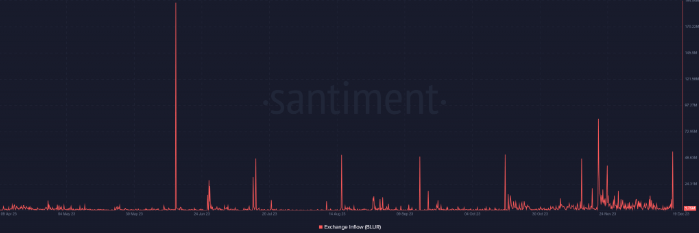

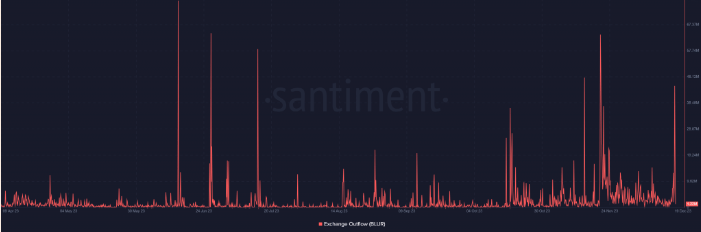

Blur’s Exchange Flow

Analysis of the exchange flow chart shows a noticeable impact resulting from the recent token unlock. Charts indicate a significant increase in activity following the unlocking of the latest locks.

As of the time of writing, the entry chart above showed that more than 54 million Blur tokens had been transferred to exchanges. In particular, this month marked the first time that such high volume was reflected in the charts. This generally indicates that tokens are being moved for sale.

Conversely, exits are also occurring. When examining the exchange exit chart, it is seen that approximately 45 million tokens have exited various exchanges.

This reflects an increase in token withdrawals by traders and suggests that accumulation is also taking place. The current analysis of exchange flows shows that tokens inside and outside of exchanges are moving in a coordinated manner.

BLUR’s Rise

Following the unlocking of the tokens, a positive price movement occurred, and as shown in the daily time frame chart, a favorable trend was experienced. Looking at the current values reflected in the chart, a clear increase of over 7% is observed.

After Blur’s 7.5% increase during this period, the price rose to $0.48. Additionally, the recent price increase is reflected in the Relative Strength Index (RSI) as an upward price movement. As of this writing, the RSI line was slightly above the neutral 50 level. Overall, this is considered a reflection of a weak but noticeable upward trend.

Türkçe

Türkçe Español

Español