In a significant move, an investor has deposited $69 million into the staking pool operated by Lido Finance (LDO), a leading liquid staking protocol. This announcement, shared by Nansen CEO Alex Svanevik, reinforces Lido’s strength in the market. Let’s look at LDO’s performance this year and other developments.

Lido’s Staking Dominance and Tripled Deposits

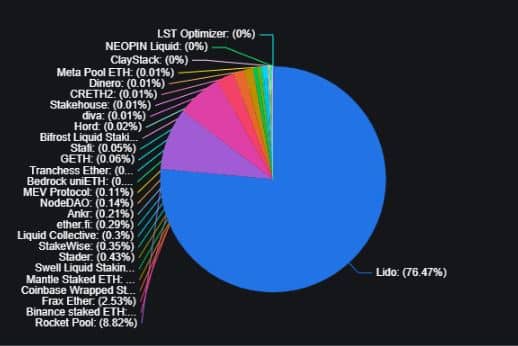

According to DeFiLlama data, Lido holds an impressive 76.47% share of the ETH staking market, with approximately $20.2 billion worth of ETH currently locked on the platform. Including deposits of other tokens such as MATIC, Lido’s total value locked (TVL) exceeds $20.37 billion, significantly solidifying its position as the largest decentralized finance (DeFi) project.

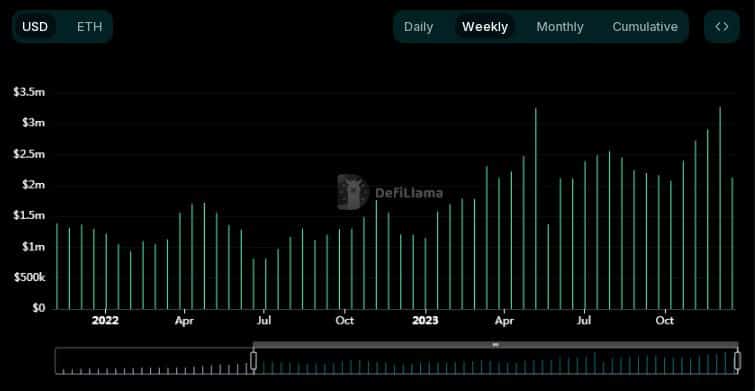

In particular, the value of deposits in Lido has more than tripled since the beginning of 2023. This growth is evidence of LDO’s significant market expansion and demand. Developments such as the launch of version 2, which allows users to withdraw Staked ETH [stETH] to Ethereum, played a crucial role. This update followed the Shapella upgrade in May, contributing to Lido’s increasing popularity.

The recent increase in ETH’s market value has further boosted the USD value of the funds deposited, strengthening Lido’s dominance in the staking sector.

Financial Success and Increase in Token Value

Along with the increase in the supply of staked ETH, Lido’s protocol revenue has seen a significant rise in 2023. The protocol recorded an impressive revenue of $3.27 million for the week starting December 3rd. This marks a notable jump from the weekly averages of $1 million in 2022 and demonstrates the platform’s growing success.

This financial success has translated into increased demand for Lido’s service token, LDO. At the time of writing, LDO is trading at $2.11, more than doubling in value since the beginning of 2023, reflecting the platform’s success. LDO holders also benefit from a 50% cut of Lido’s revenue, aligning the token’s value with the project’s ongoing growth.

In summary, Lido Finance’s dominance in the ETH staking market, combined with its meteoric rise in 2023, positions it as a formidable player in the evolving environment of decentralized finance.

Türkçe

Türkçe Español

Español