Binance Coin (BNB) price predictions vary widely, with different analysts offering conflicting forecasts. This divergence in views regarding the potential price direction of the cryptocurrency adds complexity to the situation. While one analyst suggests a possible breakout above $300 followed by an increase, another expects a move below $200.

BNB Price Analysis

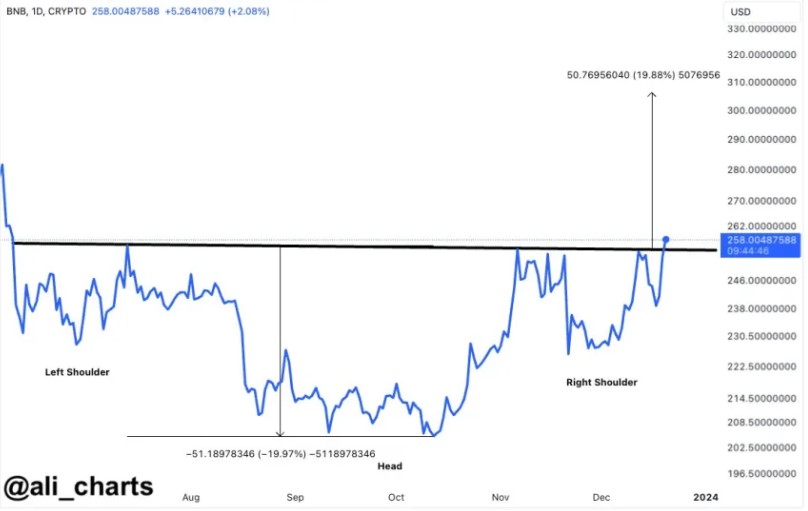

Crypto analyst Ali Martinez, known for his recent analyses, points out the formation of a Head and Shoulders pattern on the BNB price chart, indicating that the altcoin’s price might be on the verge of breaking out from this formation.

According to Martinez, a sustained close above $261 is crucial for catalyzing a rise towards $310. The recent 2.9% gain in BNB price over the last 24 hours, along with a 12% rise over the past fourteen days, aligns with Martinez’s breakout thesis.

Martinez’s analysis, based on the daily chart, identifies the $257 level as a significant breakout point, signaling a potential change in the trend.

If the upward trend continues, BNB’s price could see a significant gain of 19.8% in a very short time, potentially pushing the price to $310. However, even this price prediction falls short of BNB’s annual high of $350 achieved in April.

Bearish Outlook for Binance Coin

Crypto analyst and YouTuber Daan de Rover, contrary to Ali Martinez’s bullish expectations, highlights a bearish trend structure on the weekly chart for BNB. De Rover believes that the current BNB price movement is weak and raises concerns about the continuation of the downward price action that emerged earlier this year.

As indicated in the chart below, the “green box” on the weekly chart continues to be a critical support level. If this support is lost, BNB could experience a sharper decline, potentially triggering a move below the $200 level.

BNB Chain Growth

According to data from Token Terminal, BNB’s circulating market value has seen a slight decrease of 1.56%, falling to $39.83 billion. Meanwhile, the fully diluted market value remains stable at $39.83 billion, indicating a steady period for BNB.

BNB’s annual calculated revenue has increased by 30.37%, pointing to a value of $16.46 million. The revenue figure for the last 30 days shows a growth of 21.33%, reaching $1.35 million, reflecting this expansion to cryptocurrency followers.

There is a positive atmosphere on the BNB Chain. In the last 30 days, there has been a 20.92% increase, reaching $14.22 million, and a positive structure has formed in terms of fees collected.

Uncertainty continues regarding the future direction of BNB’s price and the underlying blockchain. Future developments related to Binance and BNB could change all plans and take the entire project to an unexpected point.

Türkçe

Türkçe Español

Español