We’ve heard the name frequently this year in the cryptocurrency markets, which triggered massive surges in many cryptocurrencies. After the disappearance of Alameda, 3AC, and others, DWF Labs suddenly emerged and skyrocketed prices with deals made with altcoins. There are things you need to know about this company that entered our lives at a very right time when there was a lack of market makers.

The Founding of DWF Labs

Born in Uzbekistan, Grachev received education in organizational management at Orenburg State University. In 2016, he entered the crypto world by operating a small mining operation. Two years later, at the age of 30, he became the CEO of Huobi Russia.

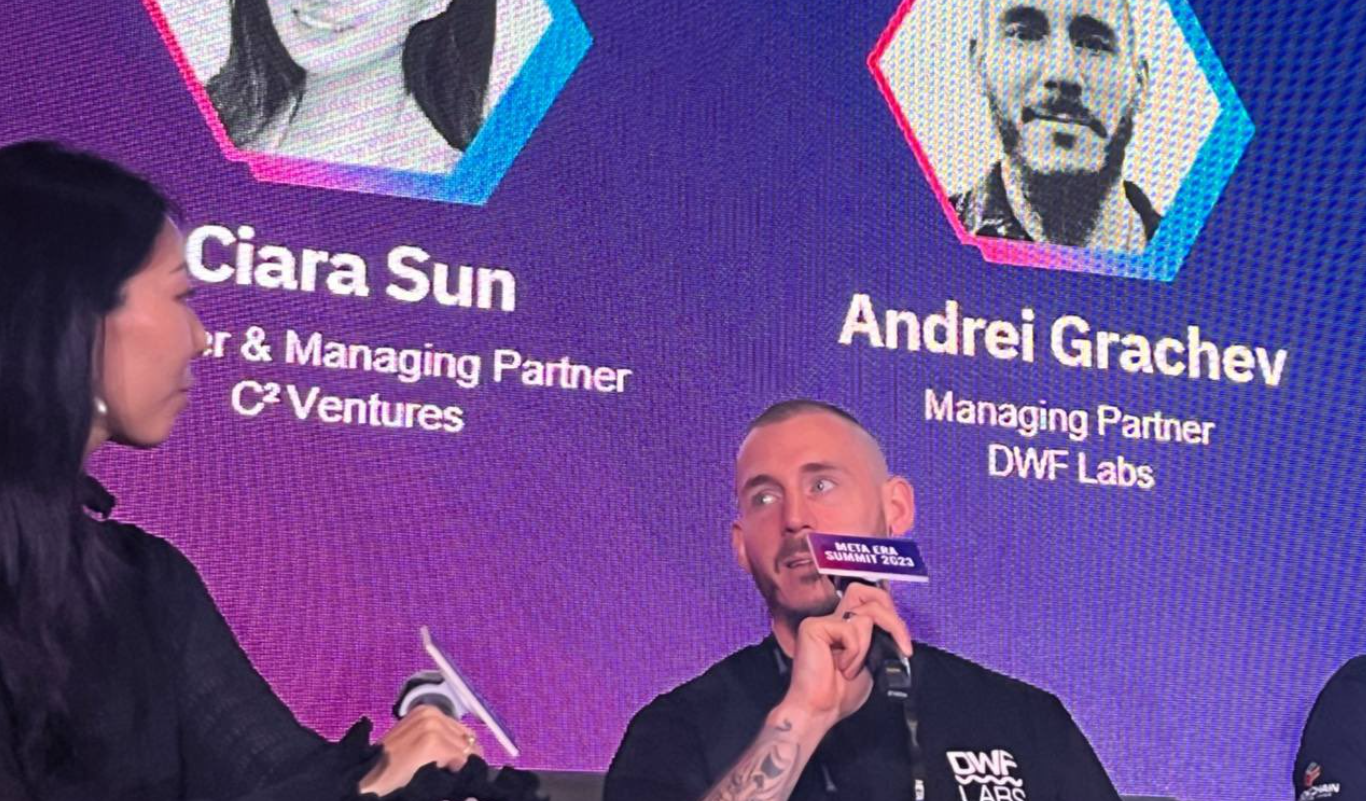

Founded by Andrei Grachev, DWF distributed hundreds of millions of dollars to cryptocurrency companies this year. As the former CEO of Huobi Russia, Grachev found a method to inflate trading volumes and managed to create a daily volume of $10 million with just $50,000. Following this success, the Russian exchange could be launched with a strong trading volume.

Three days after the official launch of Huobi Russia, it was legally registered in Risch, Switzerland, as an HFT firm called Digital Wave Finance. This firm was managed by brothers Marco and Remo Schweizer along with Michael Rendchen. Over the years, Grachev faced tough times. In February 2019, he was revealed to be connected to OneCoin at an event, and in April of the same year, it was discovered that he failed to pay his debts and did not make payments to his investors for a $157,000 ICO project called ExportOnline. He resigned from the CEO position of Huobi Russia in September but continued to work in the same company as a partner and launched an exchange called Jiamix with Zac Zou, whom he met at Huobi Russia, but this project was closed two years later.

Then, in 2020, Digital Wave Finance was established and expanded into the Korean market and Japanese exchanges. The ties between Grachev and Digital Wave Finance grew stronger, and just before the closure of Huobi Russia, Grachev founded a company called VRM Trade in Latvia. From this point on, while the HFT firm was trading tokens on major exchanges, Grachev was responsible for trading on smaller exchanges and interacting with exchanges.

After dozens of events, DWF Labs was officially launched in 2022 and was managed by a team led by Grachev. At this point, Digital Wave Finance, VRM Trade, and Darley Technologies could take more accurate steps thanks to the experiences gained from various firms’ successes. And so they did.

DWF Labs Today

Grachev was heavily criticized this year by a group due to the controversies summarized above. However, this did not hinder his success. Although DWF Labs made a few deals in 2022, it truly shone in 2023. It invested over a hundred million dollars for Conflux, Orbs, Synthetix, Radix, and Fetch.

Afterwards, it spent $45 million to buy EOS tokens from the EOS Network Foundation and $50 million to purchase ALGO from the Algorand Foundation. The Algorand Foundation had previously stated that there was no mention of market stimulation or providing artificial volume in the deals made with DWF Labs.

According to BlockBeats, the company applied for a virtual asset service provider license in the British Virgin Islands and is generally in the process of obtaining multiple licenses. As recently announced by Grachev, the company is also undergoing an audit by a Big Four accounting firm.

Throughout the year, we saw abnormal price movements in tokens that made deals with DWF. However, the founder’s past keeps suspicions alive. Could it go bankrupt in the future like 3AC or others if it doesn’t adjust its risks properly? This would be a bad presumption, but investors need to carefully examine DWF Labs and the projects with which it has commercial relations, considering the risks they may face in a collapse similar to Alameda, FTX, 3AC. Indeed, SOL Coin and other “Sam Coins” have not fully recovered after the 2022 crash.

Türkçe

Türkçe Español

Español