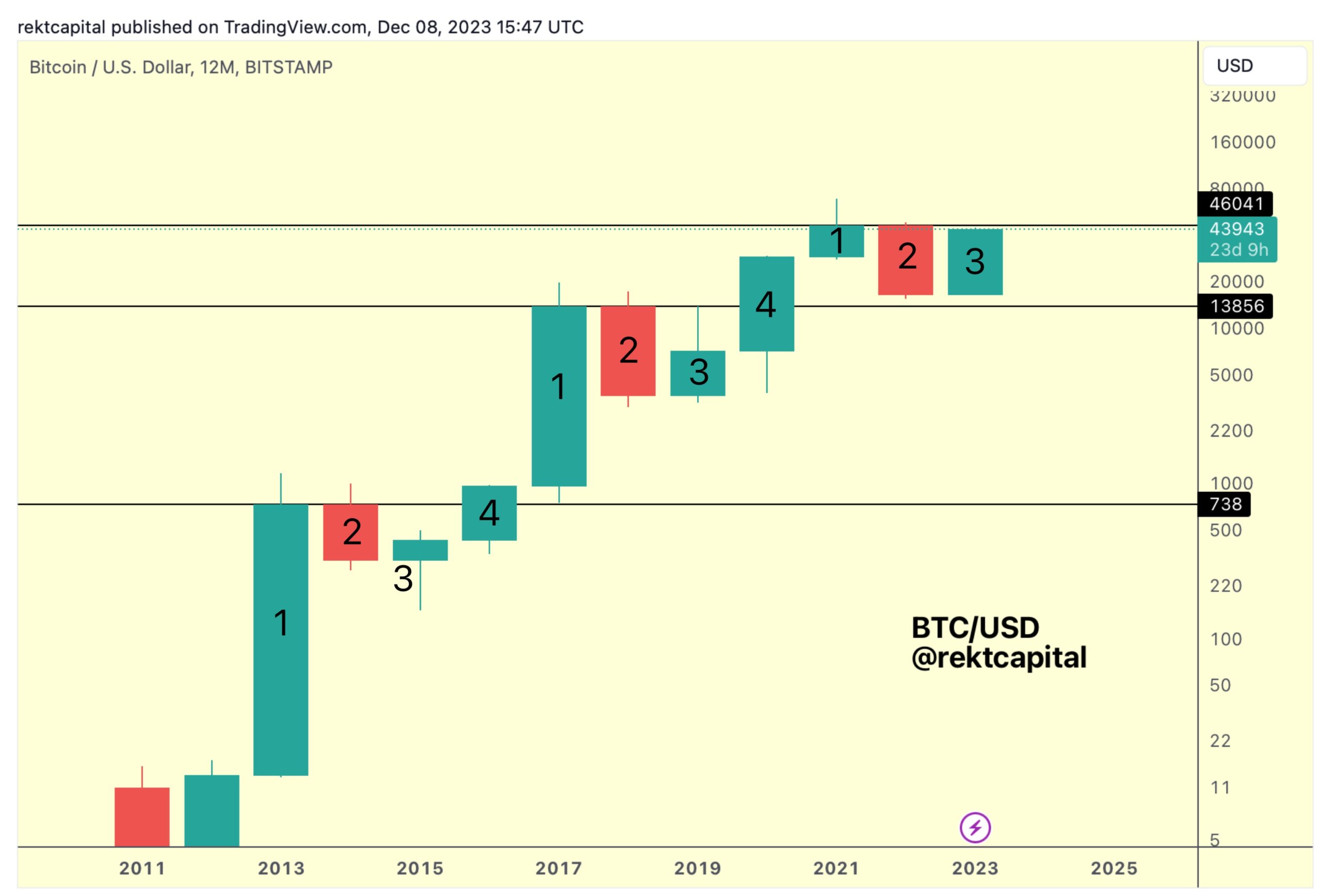

In the fast-paced world of cryptocurrencies, strategic analysis plays a very important role in forecasting future trends. Rekt Capital’s latest views offer a roadmap for both investors and enthusiasts by examining the intriguing dynamics of Bitcoin‘s four-year cycle. As Bitcoin bids farewell to its third highest levels, the approach of the fourth candle in 2024 promises both challenges and opportunities.

Historical Perspectives: Explaining Bitcoin’s Four-Year Cycle

To understand Bitcoin’s potential trajectory, it is mandatory to explore the historical context of its four-year cycles. Each candle in this cycle represents a significant year in Bitcoin’s price movement. Candle 1 witnesses the peak of the bull market, while Candle 2 marks the beginning of the bear market. Now, as Candle 3 ends, attention shifts to the unexplored territory of Candle 4.

Rekt Capital’s predictions for the upcoming 4th Candle leverage time-tested principles that accurately predicted the last bear market bottom and a subsequent rise to around $45,000 with a 180% increase. Analysts are using these principles to unravel the mysteries that 2024 holds for Bitcoin.

Key Predictions: Navigating the Landscape of Candle 4

As Candle 3 extinguishes, attention turns to the potential scenarios that Candle 4 could reveal. Historically, the four-year cycle resistance level around $46,000 has acted as a tough rejection point for three consecutive years. However, the emergence of the 4th Candle in 2024 is expected to break this resistance and carry Bitcoin beyond $46,000 post-halving.

At the beginning of 2024, the start of Candle 4 is expected to include a short downward wick, signaling one of the last buying opportunities before Bitcoin’s post-Halving rally. This downward wick is creating high peaks that could indicate a potential pullback, causing panic and pessimism among investors.

Deeper Retracement: Unraveling Potential Scenarios

Considering historical precedents, a deeper retracement similar to the 18% pullback seen in early 2016 could see Bitcoin drop to around $35,000 at the beginning of 2024. While a 45% pullback like the one seen in 2020 does not seem likely, potential downsides remain a critical issue to monitor.

As the curtain falls on Candle 3 and heralds the arrival of Candle 4 in 2024, Rekt Capital’s analysis provides a compass for navigating the unpredictable terrain of Bitcoin’s four-year cycle. A green candle could signal levels above $100,000 for Bitcoin.

Türkçe

Türkçe Español

Español