Efforts towards legal regulations in the cryptocurrency market continue to increase day by day. Accordingly, stablecoin issuer Paxos announced that it has received regulatory approval from the New York Department of Financial Services (DFS) to offer its services in the Solana ecosystem. Until now, the company was only authorized to issue its Pax Dollar (USDP) stablecoin product on the Ethereum network due to regulations imposed by the DFS.

Paxos’s Critical Step

With this regulatory approval, Paxos plans to launch its first product in the Solana ecosystem on January 17, 2024. Pax Dollar will be offered to users as a US-backed stablecoin product. As reported by Fortune, Paxos strategy director Walter Hessert announced that after a comprehensive and detailed review, Paxos decided not to object to expanding USDP from Ethereum to Solana. The institution’s review focused on the internal risk framework of the Solana ecosystem.

Hessert, referring to competitors behind Tether and USD Coin, which are stablecoin projects not regulated by DFS, claims that Paxos is the most regulated stablecoin issuer in the world. Hessert made a notable statement on the matter:

“We are the only company that issues regulated stablecoins on a large scale.”

Hessert noted that Solana’s higher transaction speeds and lower costs compared to the Ethereum ecosystem could make it a more attractive option for Paxos’s partners and suggested that PayPal’s stablecoin project, PayPal USD, could also be integrated into Solana.

Noteworthy Details About the Solana Network

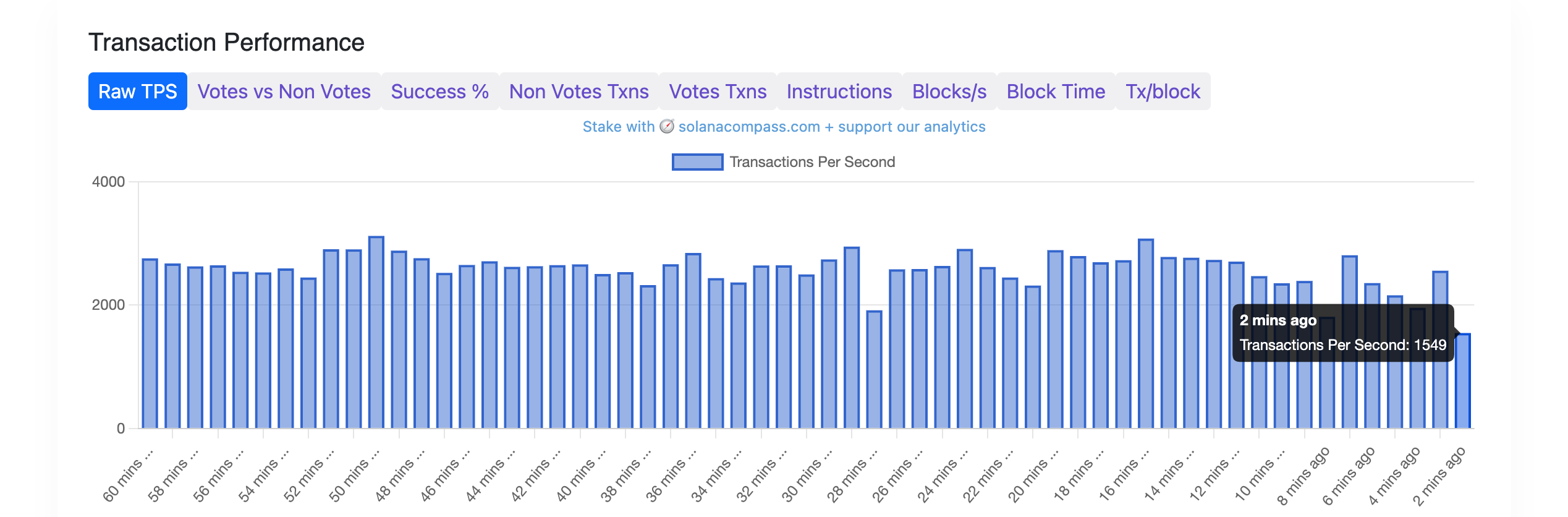

Solana continues to be a popular Layer-1 protocol known for its high transaction speed and low costs. The ecosystem can handle approximately 50,000 to 65,000 transactions per second (TPS) and can create a significant difference compared to Ethereum’s current capacity of about 30 TPS. The ecosystem faced several outages in 2022 but has been operating without interruptions for the past few months.

According to the strategy director, Paxos is seeking regulatory approval for other Layer-1 and Layer-2 ecosystems and has been expanding its international operations in recent months. The company announced on November 16 that it received preliminary approval from Singapore’s regulatory authority for a new establishment aimed at launching a US dollar-backed stablecoin. Paxos also received approval from Abu Dhabi’s regulatory authority to issue stablecoins and conduct crypto asset services.

Türkçe

Türkçe Español

Español