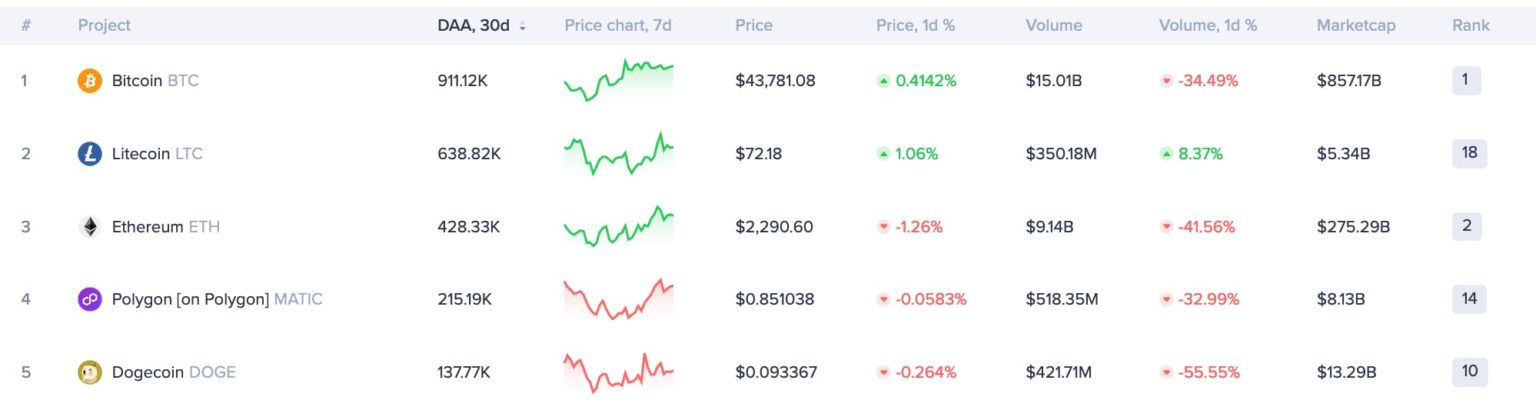

Cryptocurrency units are witnessing an increase in demand and price formation with benefits measured by various criteria such as network activity and Daily Active Addresses (DAA). A new study on Santiment’s crypto dashboard on December 23 revealed the top five cryptocurrencies leading in network activity. This result also indicates that these cryptocurrencies could be invested in January.

Litecoin Leads! Ethereum Remains Strong

The top of the list is not surprising, of course. Bitcoin (BTC) reached 911,120 daily active addresses in the last 30 days, securing the top spot. Accordingly, with an impressive market value of 857 billion 170 million dollars, it proved to be a testament to its market dominance.

Unexpectedly, Litecoin (LTC) took second place in daily active addresses, leaving behind giants like Ethereum. Ranked 18th in terms of market value, Litecoin displayed 70% of Bitcoin’s network activity with 638,820 daily active addresses, while commanding only 0.62% of BTC’s capital with 5 billion 340 million dollars.

Ethereum (ETH) confirmed its position as the second-largest cryptocurrency by market value, taking third place with 428,330 daily active addresses. The fourth and fifth places were claimed by altcoins Polygon (MATIC) and Dogecoin (DOGE), which recorded 217,190 and 137,770 daily active addresses last month, respectively.

Litecoin’s Asymmetry and Price Dynamics

Interestingly, the cryptocurrency Litecoin stands out among the top five cryptocurrencies in valuation with the highest asymmetry according to network activity. This situation leads to speculation about the role of network activities in price increases and the potential opportunities they can create.

Currently trading at $72.08 per coin, Litecoin has recorded a modest increase of 3% since the beginning of the year. In contrast, many cryptocurrencies with lower network activity have achieved significant gains exceeding 100% in 2023.

Additionally, the cryptocurrency Litecoin’s daily address activity tends to rise during increases in Bitcoin transaction fees. Despite Bitcoin’s transaction costs exceeding the global daily average income of $26 per person, maintaining its superiority in network activity underscores its resilience and leadership in the crypto space.

Türkçe

Türkçe Español

Español