Following the announcement of interest rate decisions in the US and growing expectations for a Bitcoin spot ETF, there has been a notable increase in the number of addresses holding Bitcoin (BTC) over the past ten days.

Increasing Bitcoin Investors

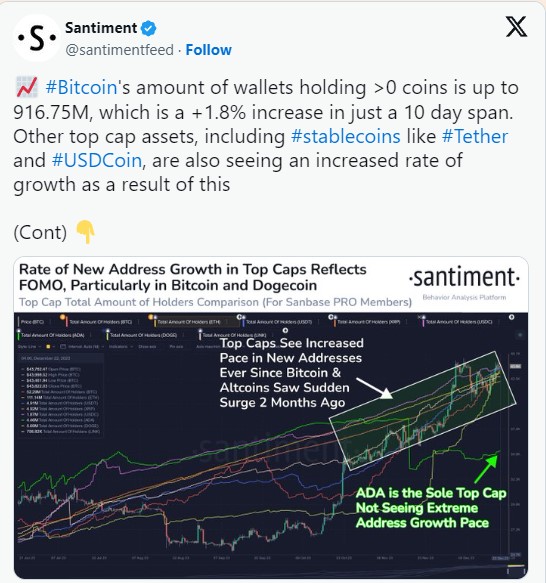

Santiment, a leading cryptocurrency analysis firm, shared a post via X (formerly known as Twitter), indicating that the total number of cryptocurrency wallet addresses with more than zero BTC balance has increased by 2% in the last two weeks, surpassing 910 million.

More importantly, according to another set of data shared by Santiment, the total number of BTC holders has increased by 8% since the market rally that began in October, exceeding 50 million.

In the last ten days, the demand for BTC among wallet addresses that previously held no Bitcoin suggests an increase in early adoption in the market, yet Santiment continues to issue warnings to be cautious.

The company’s statement was as follows:

While network growth is a great sign for the long term, this rapidly increasing rate of new wallets is a sign of FOMO that warrants caution.

Current Bitcoin Status

According to data from 21milyon.com, at the time of writing, Bitcoin was trading at $43,750, reflecting a 5% increase compared to last week’s price.

In addition to the new demand for Bitcoin, there was also a clear increase in the total number of unique active addresses where BTC transactions occurred last week.

According to data provided by CryptoQuant, as of December 22, the daily active address count for BTC reached 1.23 million, indicating a 10% increase over the past seven days.

During the same period, the BTC price also rose above the $44,000 level again. The last time BTC reached this price level was on December 5th. Due to the price movement, there was a slight increase in the amount of BTC sent to exchanges for sale on the mentioned day.

While some traders were selling their coins to benefit from the rally, BTC’s exchange reserves also showed an increase of 0.01%. As of writing time, crypto exchanges hold 2.02 million BTC, which can be interpreted as an indication that they are always ready to be sold.

Interestingly, despite the recent price increase and accompanying cryptocurrency distribution, there is also a visible decrease in the volatile structure of the BTC market.

As understood from the cryptocurrency’s Bollinger Bands (BB), the area between the upper and lower bands of the indicator is narrowing, which could be interpreted as a decrease in volatility.

Türkçe

Türkçe Español

Español