Institutional investors made a $103 million inflow into digital asset investment products last week. This is an indicator of the continued corporate interest in Bitcoin and altcoin-focused digital asset investment products. It is recalled that institutional investors had ended an 11-week inflow process the previous week, and there had been outflows from digital asset investment products. The inflow last week showed that optimism among institutional investors is ongoing.

Institutional Investors Buy Bitcoin and Ethereum

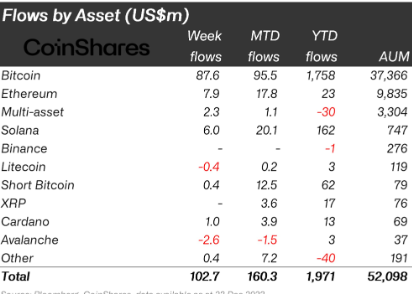

Institutional investors made an inflow of $87.6 million into Bitcoin-focused digital asset investment products this week. While there were inflows of $7.9 million into Ethereum, the recently surging cryptocurrency Solana also saw an inflow of $6 million.

Institutional investors made an inflow of $1 million into Cardano, while outflows were observed from two altcoins. Accordingly, institutional investors sold Avalanche and Litecoin. There was an outflow of $2.6 million from Avalanche and an outflow of $400,000 from Litecoin.

Highest Inflows from Germany and Canada

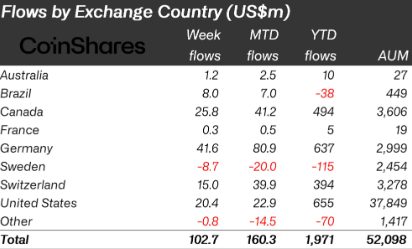

Looking at the countries where institutional investors made inflows, Germany is leading. There was an inflow of $41.6 million from Germany. On the other hand, Canada is in second place with an institutional investor inflow of $25.8 million. The United States is in third place with an inflow of $20.4 million.

The only country that experienced an outflow was Sweden. Accordingly, institutional investors in Sweden made an outflow of $8.7 million from digital asset investment products.

The interest of institutional investors indicates that cryptocurrencies are maturing and integrating into mainstream finance. It also points to the broader adoption and legitimacy of digital assets in the global financial environment.