Spot Bitcoin exchange-traded fund (ETF) applicants have only a few days left to complete their applications to meet the deadline set by the United States Securities and Exchange Commission (SEC). According to a report published by Reuters based on public documents and two people familiar with the discussions, the SEC has set a deadline for spot Bitcoin ETF applicants to submit their final S-1 amendments by December 29.

SEC Warns Institutions of December 29 Deadline

According to the report, SEC officials met on December 21 with representatives of at least seven firms hoping to launch spot Bitcoin ETF funds in early 2024. The meetings included representatives from BlackRock, Grayscale Investments, ARK Investments, and 21 Shares.

The meetings also included representatives from exchanges that could potentially list the new products, such as Nasdaq and the Chicago Board Options Exchange, as well as lawyers and investment firm officials. It was reported that the regulatory body told participants in the meetings that any investment firm not complying with the December 29 deadline would not be part of the initial process of potential spot Bitcoin ETF approvals at the beginning of January.

Fox Business reporter Eleanor Terrett was one of the first to report on the deadline. Terrett later confirmed the date for the final amendments to all S-1s to be made by December 29. Journalist X shared developments on the matter:

“The SEC told investment firms that applications fully completed and filed by December 29 will be considered in the initial process.”

Noteworthy Comments on Applications

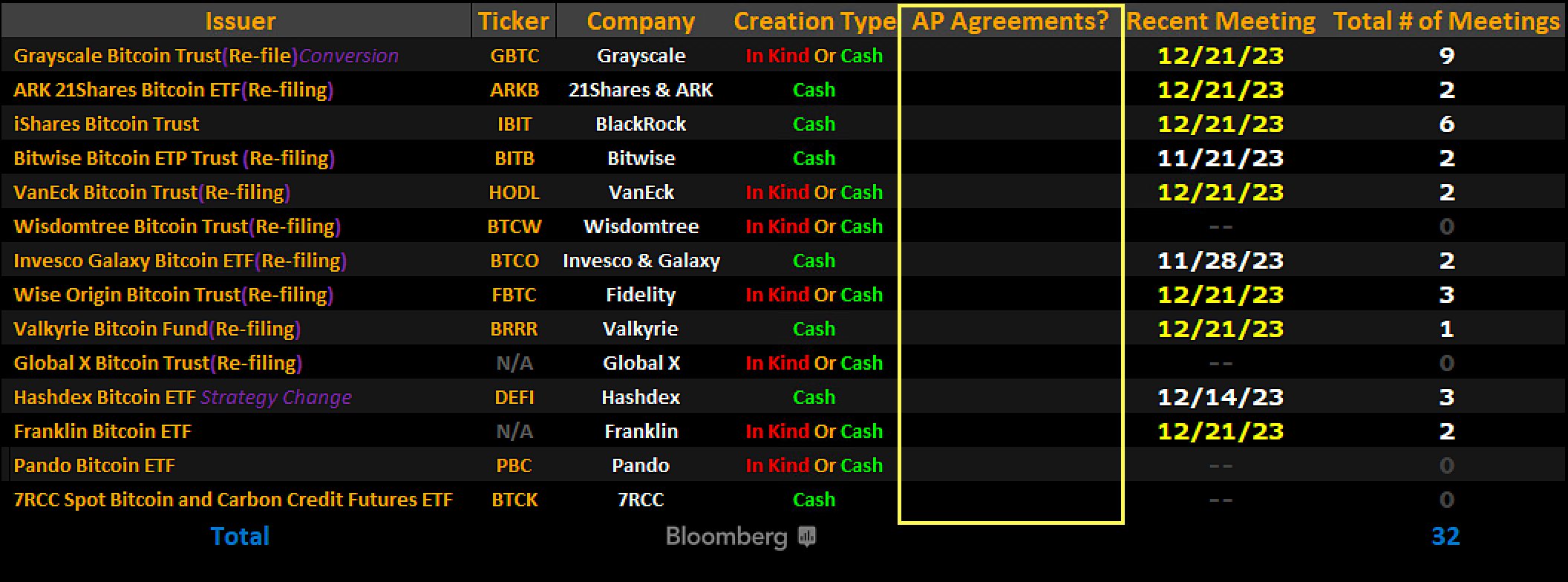

As previously reported, many spot Bitcoin ETF applicants are rushing to update their S-1 applications with a cash redemption model instead of in-kind redemptions, which means non-monetary payments such as Bitcoin. In addition to the cash requirement, the SEC is also reported to require Bitcoin ETF application filings to specify authorized participants (APs). According to Bloomberg ETF analyst Eric Balchunas, the AP agreement will be the final hurdle in identifying Bitcoin ETF applications:

“This is not an easy final step and could keep some from the starting gate. AP agreement + cash creation = approval.”

As of December 22, according to Balchunas, none of the spot Bitcoin ETF applications had an AP agreement, while he believes that seven firms have definitely converted their redemption model to cash. Despite last-minute updates to many firms’ spot Bitcoin ETF applications, Bloomberg analysts are still confident that the SEC will approve the first spot Bitcoin ETF applications by January 10.

Türkçe

Türkçe Español

Español