The funding rate of Bitcoin (BTC), the largest cryptocurrency by market value, has begun to return to normal levels after the recent rally that pushed many traders to pay higher than usual fees to maintain long positions. This has led to speculation that the cryptocurrency market as a whole may be poised for a resurgence under Bitcoin’s leadership.

Bitcoin and Altcoins’ Funding Rates Drop

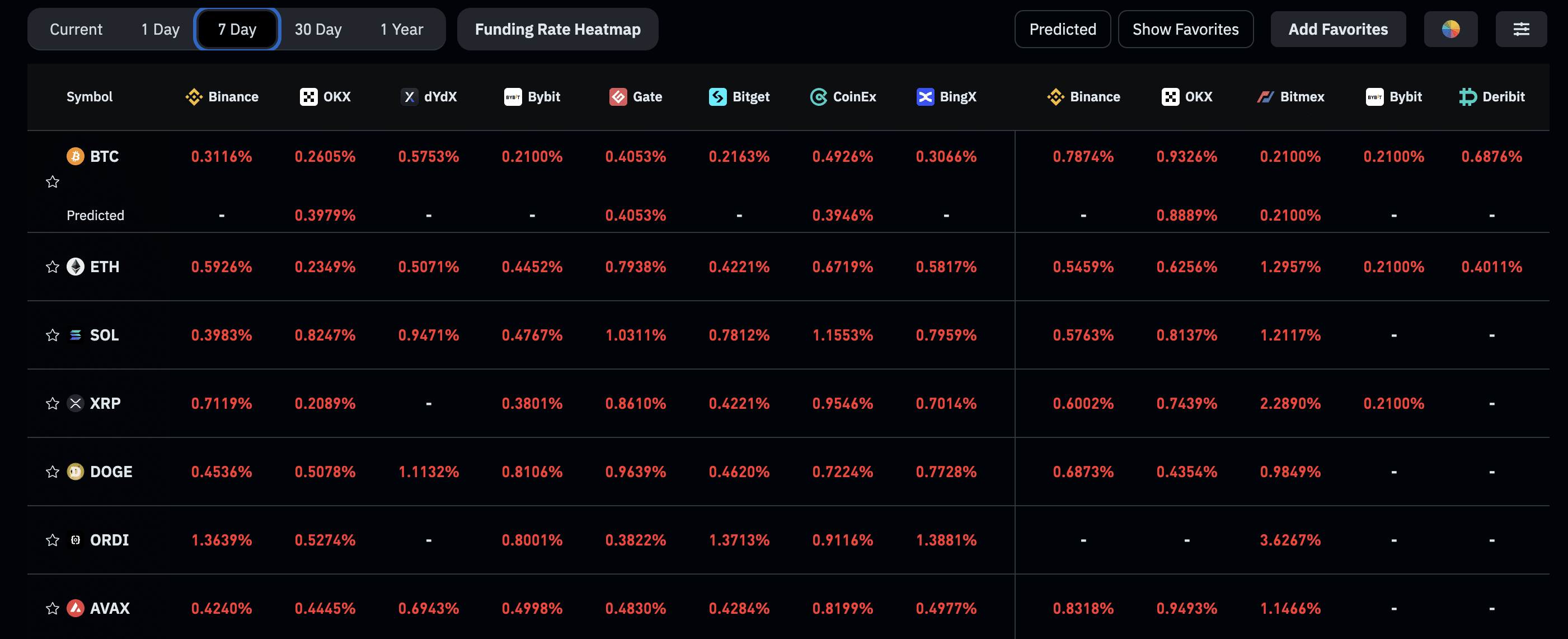

Data from Coinglass shows that traders have paid a funding rate equivalent to between 0.19% and 0.93% to stay long on Bitcoin over the past seven days. Moreover, the data reveals that the funding rate for altcoins like ORDI (ORDI) has reached as high as 4.6%. The funding rates for other major altcoins, including Ethereum (ETH), Solana (SOL), and XRP (XRP), have also returned to normal levels.

This situation indicates that many market participants are starting to take positions in anticipation of a price drop rather than a rise. According to the data, funding rates in the crypto futures side have zeroed out, and approximately 24 million in cumulative liquidations have been recorded in the last 138 hours.

As is known, the funding rate is a periodic payment between short and long positions intended to keep the future price of an asset close to its spot price. A perpetual futures contract is an agreement to buy or sell an asset at a predetermined price, and the contract has no expiration date.

Fundamentally, the funding rate is very important as it reflects the overall sentiment of traders and projects future market trends. A negative funding rate indicates that traders are predominantly in short positions, expecting the market to fall, while a positive funding rate shows that traders are mainly in long positions, anticipating a market rise.

Continuation of Bitcoin’s Rally Expected

Current data shows that funding rates below zero suggest most traders expect the price of Bitcoin to fall. However, analysts point out that despite the recent decline, the largest cryptocurrency is expected to continue its upward trend.

Well-followed cryptocurrency analyst Credible Crypto recently stated in a post, “Bids filled, all metrics still look great, let it go.” Another cryptocurrency analyst, Crypto Ed, the creator of the CryptoTA trading team, also shared a similar expectation.

Türkçe

Türkçe Español

Español