This year has seen a much better crypto market environment than the previous year, with the cumulative value doubling. Major FUDs have decreased. Setting aside the Binance and Coinbase cases, we are fortunate not to have seen a chain of bankruptcies throughout the year as we did in 2022.

Crypto Currency Price Performance

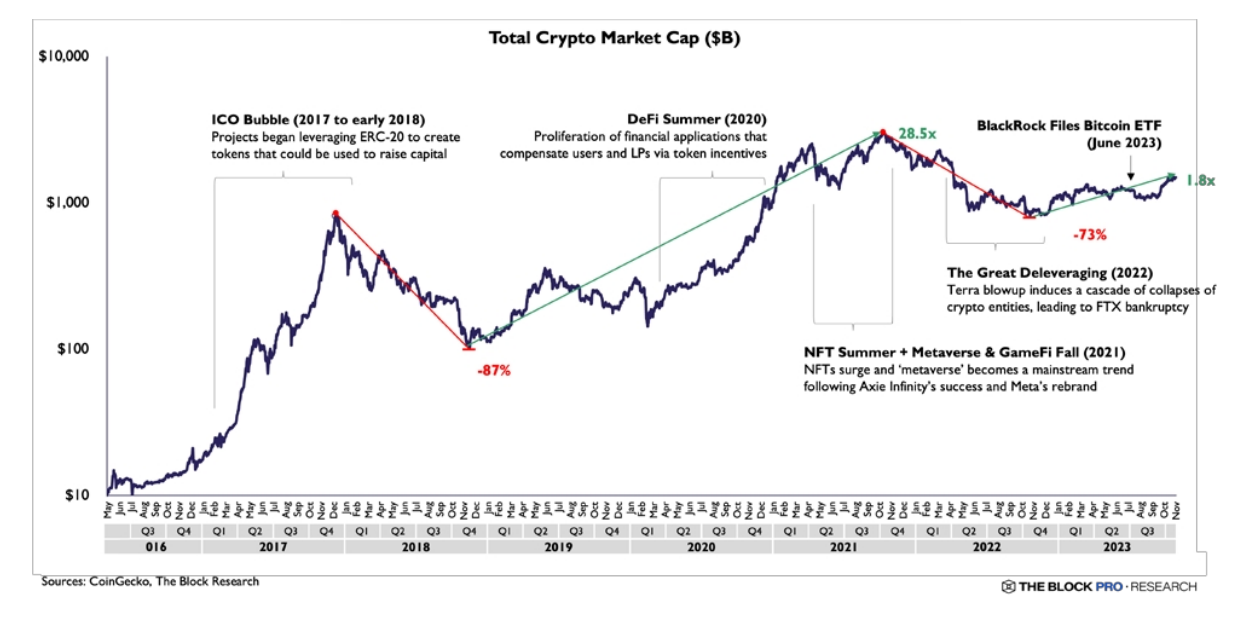

We are not experiencing a different process from previous cycles, and this is definitely good news. In the graph below, you can see the last cycle, which we will refer to as the ICO period rise, the DeFi summer, and BlackRock’s entry into crypto. When we first announced the application in June, we said nothing would be the same again. And it wasn’t, as BTC and altcoins experienced massive increases.

The crypto market is accustomed to periods of intense speculative frenzy followed by 70-90% declines. It is also familiar with the rapid increases that follow these declines. From January to today, the cumulative value of cryptocurrencies has risen from 840 billion dollars to over 1.6 trillion dollars.

Most of these gains occurred in the first and last quarters of the year. In January, the crypto market began its rise with the weakening of the effects of centralized crypto lenders and trading firms that characterized 2022. The FTX collapse was the last straw, and about two months later, the fear in the market began to weaken while the appetite increased.

Top Cryptocurrencies

In March, for the first time since the Terra collapse, we saw BTC reach $30,000 at a time when the banking crisis erupted. At that time, five banks went bankrupt due to rapid interest rate hikes, selling their long-term bonds at a discount to meet customer withdrawals. By mid-year, BTC was moving sideways around $25,000 – $30,000, while a summer rally for new memecoins began.

Later, at the end of October, the market gained more serious momentum, and we all experienced what has happened so far. Below, you can see the price performance of popular altcoins during the relevant periods.

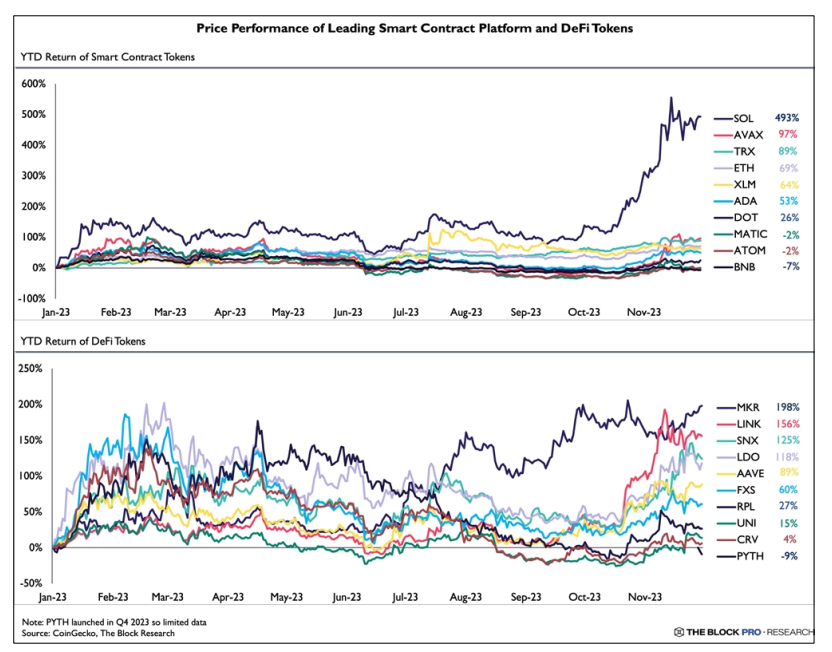

Here is a graph reflecting the year-long competition between smart contract networks and DeFi coins.

SOL Coin definitely made its mark in the last quarter, and this movement related to the GSOL premium was speculative.

Türkçe

Türkçe Español

Español