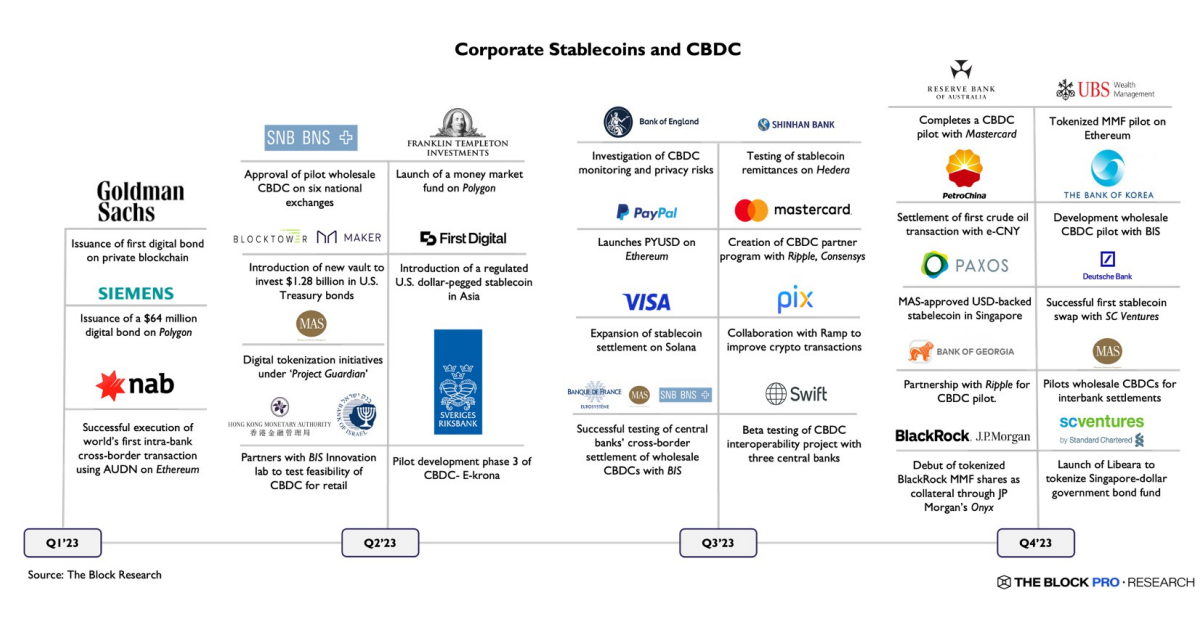

The corporate appetite in the crypto space is not just about large funds and accredited investors’ interest in ETFs and ETF investments. Major companies, banks, and even governments have worked hard this year to build their own digital currencies and we have seen significant steps. Spending the last days of the year remembering what we have experienced in this regard for 12 months is a good idea.

Corporate Stablecoins

One of the great enthusiasms of 2023 was the eagerness to launch corporate stablecoins. Investing non-interest-bearing deposits in highly liquid short-term strategies makes the stablecoin business model extremely profitable. The highest-profile corporate stablecoin launched in 2023 was PYUSD, released by PayPal in partnership with Paxos on August 7th.

Despite not following an aggressive marketing strategy, PayPal’s PYUSD has entered the top 20 with a market value of over $150 million. In September, PayPal announced the integration of PYUSD with Venmo. We may hear more about this new stablecoin in the future, which will help its massive user base become more familiar with crypto.

2023 CBDC Efforts

Turkey had announced that it started tests a while ago, but concrete steps or test results are expected to be announced in the coming year. On the other hand, Project mBridge, a joint initiative conducted by central banks such as the BIS Innovation Hub, Hong Kong Monetary Authority, Central Bank of the UAE, Digital Currency Institute of the People’s Bank of China, and the Bank of Thailand, has made significant efforts on multi-CBDC.

In 2023, China’s digital yuan (e-CNY) made notable progress and saw increased adoption. Key developments include enhanced accessibility allowing foreigners to open e-CNY wallets using international phone numbers, innovative payment solutions that enable transactions without the internet, and the integration of e-CNY into the mBridge project for international settlements.

The UAE continues to work on integrating the Digital Dirham into the global financial system. The Central Bank of Brazil announced it would initiate the first phase for DREX (Digital Real) in May 2024. The Digital Euro project continued throughout the year, and the EU will decide whether to launch it after fully establishing the legal framework.

And yes, the latest development came from the Asian market. The Monetary Authority of Singapore (MAS) announced plans to issue a wholesale CBDC for payment settlements.