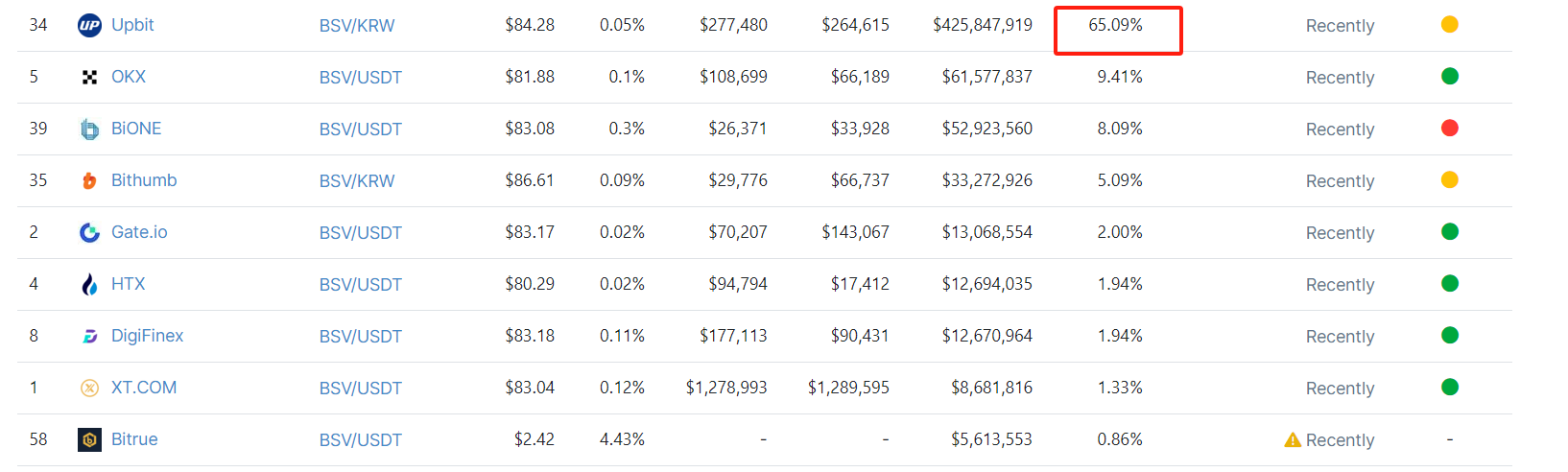

Bitcoin, a fork of Bitcoin SV (BSV), has experienced a significant 65% increase in the last 24 hours. A large part of this increase originates from the South Korean market, with 65% of the trading volume concentrated on Upbit, South Korea’s largest exchange. This surge is an indicator of the significant influence and interest of Korean investors in BSV’s recent price movement.

Sharp Rise in Bitcoin SV

The increasing interest and trading activity of Bitcoin SV in the South Korean market highlights the country’s active participation in the cryptocurrency world. Upbit, the main player in this fluctuation, played a significant role in facilitating the increased trading volume and directing the notable price increase of BSV.

It is very important to note that the increase in Bitcoin SV’s price comes amid an announcement from Coinbase. The popular cryptocurrency exchange has declared its intention to discontinue support for BSV from January 9, 2024. Coinbase’s decision to delist BSV could potentially affect trading dynamics and overall market performance.

Coinbase’s upcoming delisting decision adds an element of uncertainty to the future of BSV. Investors are closely monitoring the situation, assessing the potential impact of Coinbase’s withdrawal of support for BSV. As market participants react to the news and adjust their positions accordingly, such developments often lead to increased volatility and rapid price movements.

Analysis of the Fluctuations and Future Outlook

The increase in Bitcoin SV’s price highlights the dynamic nature of the cryptocurrency market, where factors such as exchange support, regulatory developments, and market sentiment can significantly affect the value of digital assets. In this case, the concentration of trading activities in South Korea, especially on Upbit, emphasizes the regional nuances that play a very important role in the crypto environment.

As the market responds to Coinbase’s decision and the broader regulatory environment, it will be interesting to observe how Bitcoin SV’s price continues to develop. The influence of South Korean investors, combined with the global effects of Coinbase’s delisting, creates a complex and multifaceted scenario for BSV.

In the coming days, investors and analysts will likely closely monitor fundamental levels and indicators to measure the sustainability of the recent surge. The interaction between market forces, investor sentiment, and regulatory developments will contribute to shaping the future trajectory of Bitcoin SV.