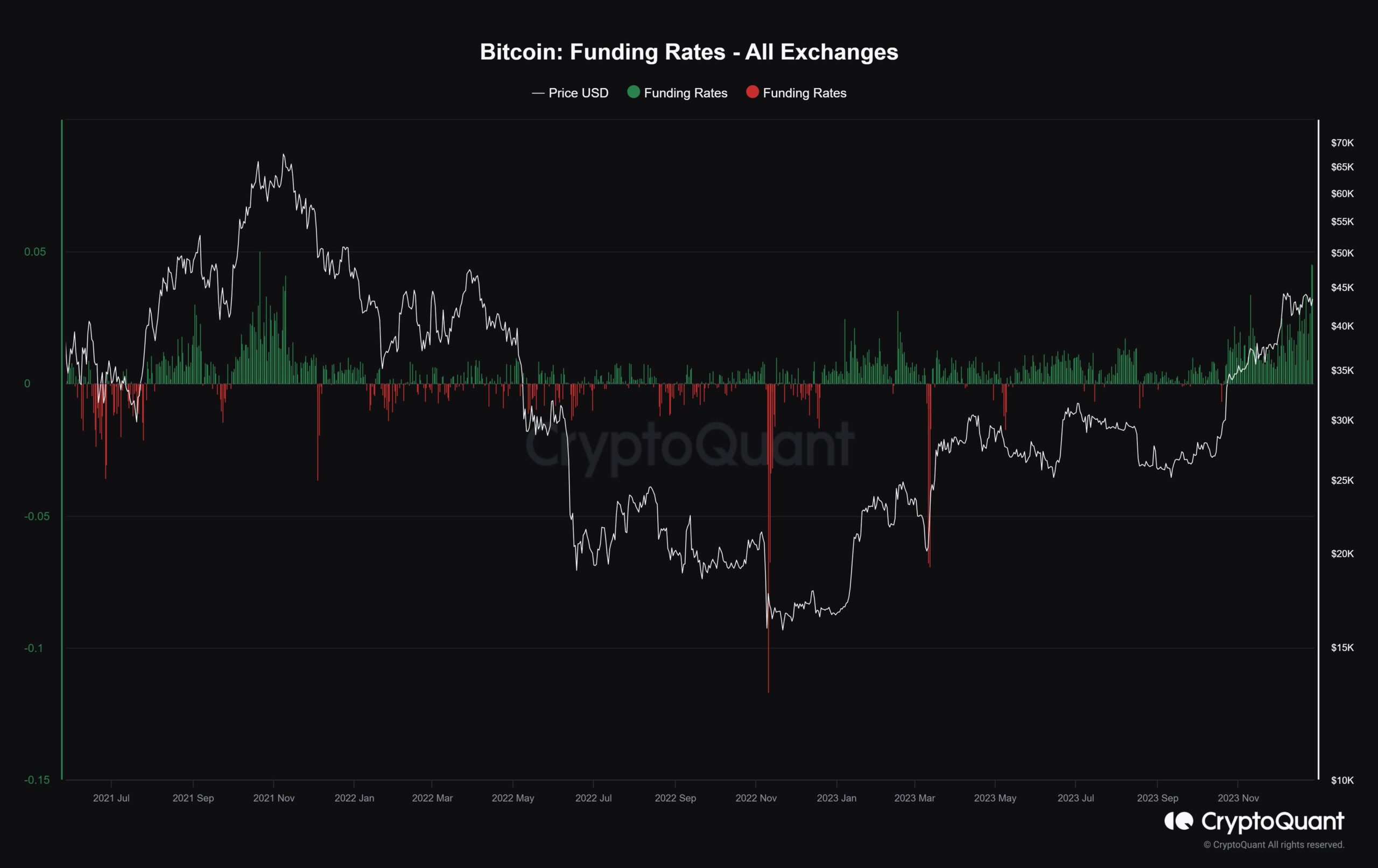

Bitcoin‘s funding rates have reached levels not seen in the last 25 months, causing a stir in the cryptocurrency trading community. The increase in funding rates reflects the growing speculation among investors positioning themselves for potential upward price movements. However, this fluctuation could bring a series of effects, especially if the market makes an unexpected turn against these speculative positions.

Analysis of the Increase in Bitcoin Funding Rates

The funding rate in the Bitcoin market is a very important metric showing the cost of holding a long or short position in a perpetual futures contract. It is a mechanism designed to encourage investors to take the opposite side of the majority, maintaining balance in the market.

When the funding rate is positive, long positions pay short positions. When it is negative, the opposite occurs. Recently, Bitcoin’s funding rates have reached the highest level in 25 months, reflecting a significant change in market sentiment.

This increase in funding rates is an indicator of rising speculation among investors. Accordingly, a significant portion of investors are taking positions in anticipation of higher prices. Investors generally use funding rates as an indicator of market sentiment and potential price trends. Although a positive funding rate indicates a bullish trend, it can also be interpreted as a sign of overleveraging and overcrowded long positions, so investors should be careful.

Potential Impacts for Investors

For investors actively involved in the cryptocurrency market, the increase in Bitcoin funding rates requires careful consideration of potential outcomes. The primary concern arises when the market does not align with speculative high price expectations. In such scenarios, investors with leveraged long positions can face significant losses.

Since the cryptocurrency market is known for its volatility, it is a fact that sudden price changes occur frequently. Investors relying heavily on bullish narratives must be prepared for adverse movements. While the increase in funding rates points to optimism, it emphasizes the importance of risk management strategies, increasing risks for investors.

Managing the Possibility of a Market Reversal

Although the increase in Bitcoin funding rates indicates a prevailing bullish trend, investors should be on alert for the potential of a market reversal. In such cases, risk management becomes very important, and investors should set clear stop-loss levels to limit potential losses. Diversifying trading strategies and avoiding excessive leverage are fundamental practices to survive possible market downturns.

In conclusion, as Bitcoin funding rates reach the highest levels in the last 25 months, investors find themselves in a dynamic and potentially profitable environment. However, a balanced perspective should be taken towards the increase in rates. While optimism prevails, being cautious is equally vital.

Türkçe

Türkçe Español

Español