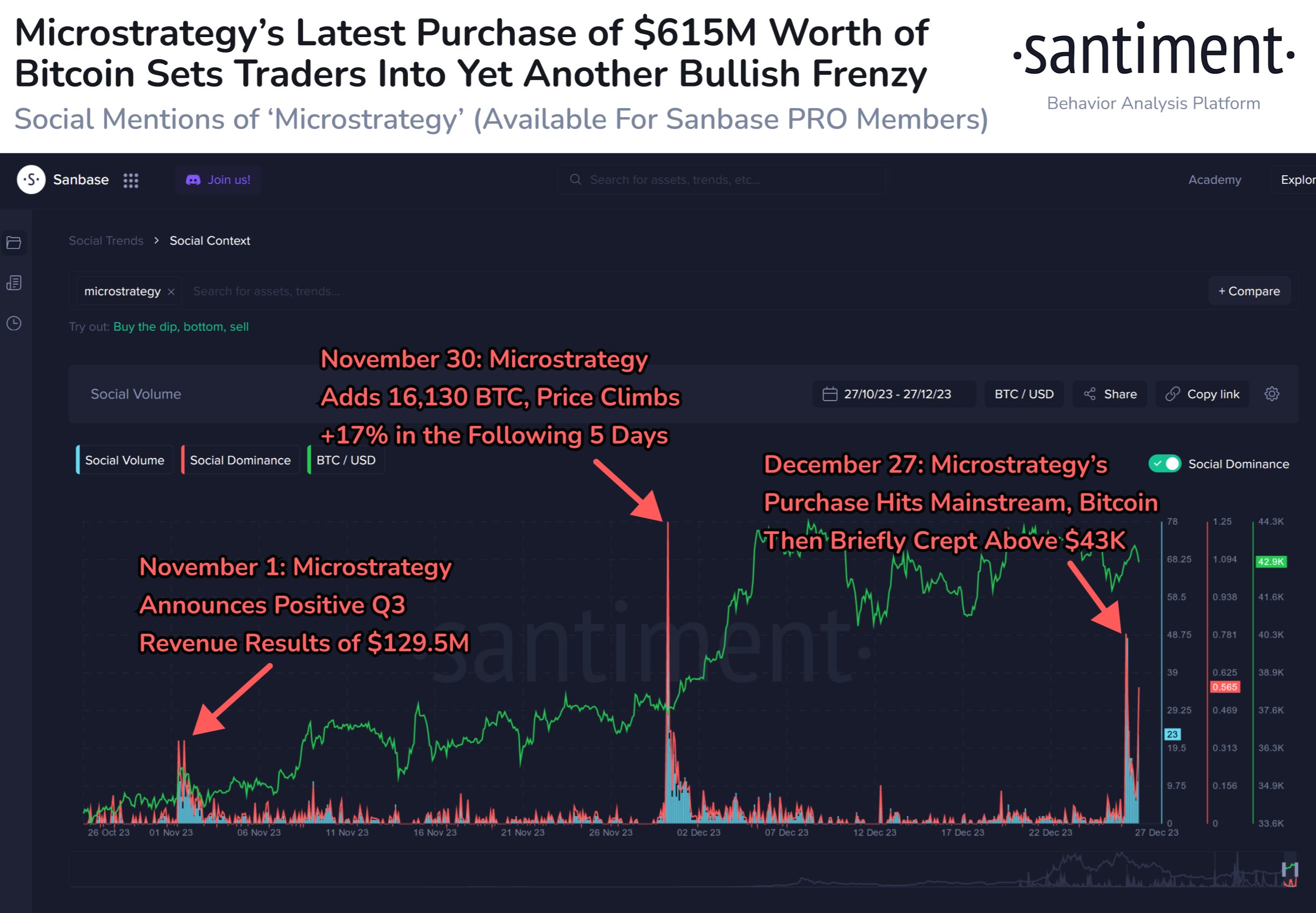

MicroStrategy’s recent purchase of $615 million worth of Bitcoin has created waves of enthusiasm in the crypto community. The company, now possessing a significant crypto portfolio exceeding $8 billion, has strategic moves and positive developments contributing to the rising market sentiment.

MicroStrategy’s Strategic Bitcoin Accumulation

MicroStrategy, a business intelligence firm led by CEO Michael Saylor, has become a leading player in the cryptocurrency space, consistently making headlines with its significant Bitcoin holdings. The recent purchase of $615 million in Bitcoin further solidifies the company’s commitment to cryptocurrencies as a key component of its treasury strategy.

The announcement of MicroStrategy’s latest Bitcoin purchase has triggered a wave of excitement and optimism among investors. The company’s strategic approach to accumulating Bitcoin as a treasury asset has become a focal point for those closely watching the crypto market.

MicroStrategy’s move to diversify its assets with significant Bitcoin purchases positions the firm as an important factor in broader market dynamics. The $615 million investment not only strengthens MicroStrategy’s position as a major Bitcoin holder but also serves as a sign of confidence in the long-term value and potential of the leading cryptocurrency.

Positive Impact on Market Sentiment

According to Santiment, the positive news surrounding MicroStrategy, combined with its continuous Bitcoin accumulation, has created a tangible impact on overall market sentiment. The bullish momentum generated by the company’s actions is clearly seen in the reactions from investors and the wider crypto community.

As MicroStrategy’s crypto portfolio exceeds $8 billion, the firm’s influence on market dynamics becomes increasingly evident. Positive developments related to the company, including strategic Bitcoin purchases and proactive treasury management, contribute to a favorable outlook for Bitcoin and the broader crypto market.

Strategic Moves Support Bullish Trends

MicroStrategy’s strategic moves go beyond its recent BTC purchase. The company’s proactive involvement in the crypto market and commitment to holding a significant portion of its treasury in Bitcoin position it as a major player shaping the future of the industry.

The $615 million investment is just the latest chapter in MicroStrategy’s ongoing crypto journey. Focused on using Bitcoin as a treasury reserve asset, the company continues to play a significant role in influencing market dynamics and contributing to the wider adoption of cryptocurrencies.

Türkçe

Türkçe Español

Español