Solana, in December, experienced an incredible surge with an increase of over 100%. It now appears to be undergoing a price correction. The decline in SOL’s price seems to be a result of investors taking profits and capital moving towards the Ethereum token.

Overbought Correction

On December 28, the price of SOL reached $126.50, the highest level since April 2022, and then fell to $101.50 over three days. Following the recent price rally in Solana, traders seem to have started selling to take profits. This is indicated by the daily Relative Strength Index (RSI) in SOL, which rose above 70 in early December, signaling overbought conditions.

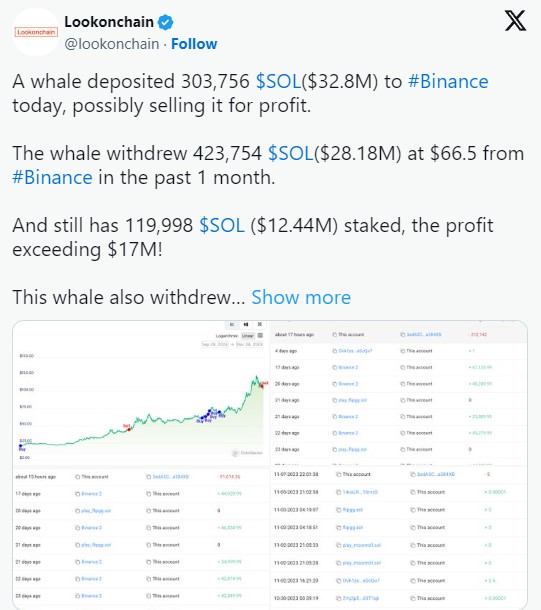

In recent days, it appeared that even Solana’s wealthiest investors, including Arthus Hayes, began selling their SOL holdings. Following a daily 5% drop in Solana, a significant transfer of 303,756 SOL, worth $32.8 million, was made to Binance on December 28, increasing the selling pressure on other investors.

Solana’s Biggest Rival

Today’s decline in Solana’s price coincided with gains in Ethereum, a leading Altcoin. Particularly, during SOL’s decline, ETH’s price saw a clear increase of 12.35%, reaching up to $2,450. Meanwhile, the SOL/ETH trading pair experienced a 23.75% decrease this week, indicating a cash flow from SOL to ETH.

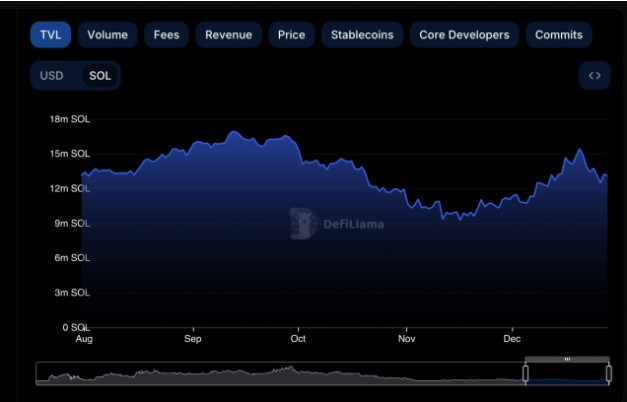

The price drop in SOL on December 28 also paralleled a decrease in the total value locked (TVL) within the Solana dapp ecosystem. According to data from DeFi Llama, Solana’s TVL has fallen by 2 million SOL (approximately $200 million) since December 20. A decrease in SOL locked in applications on the Solana network could mean more supply is available elsewhere, including on cryptocurrency exchanges, which could trigger increased selling pressure in the market.

Solana Price Analysis and Future

An analyst performing a price analysis of Solana pointed out that even on wider time frame charts, SOL/USD appeared overbought, increasing the likelihood of a correction or consolidation period in January.

A potential bearish move could see the price fall below the 0.382 Fibonacci line support near $100, leading to a 35% drop to the 0.236 Fibonacci line ($68.5) and visiting the next major support level.

Conversely, the bulls could aim for a decisive weekly (and yearly) close by maintaining above the 0.5 Fib line around $130. If the $130 level turns into support, SOL’s price could rise to $150 by February.

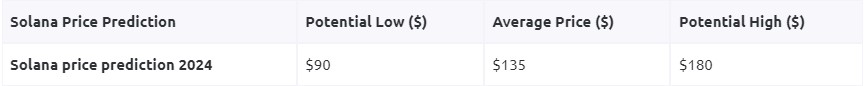

Additionally, projections for 2024 suggest that Solana (SOL) could trade between $90 and $180, although this is subject to change in the volatile crypto market. Positive events such as halving and ETF approvals could drive prices much higher, while incidents like the past FTX issue could lead to much lower prices.

Türkçe

Türkçe Español

Español