Solana’s price experienced an impressive 120% increase in December, but began to decline in the days following Christmas, even surpassing the market value of Binance‘s BNB token and attracting the crypto community’s attention. What were the factors that highlighted Solana during this period and attracted investors’ interest? Let’s take a look.

Pressure on Solana Sales

SOL faced selling pressure, causing Solana’s price to drop below $100 before stabilizing just above $101. According to TradingView data at the time of writing, SOL is trading above $106, approximately 11% below its annual high of $123 seen on December 26th.

During this period, a 9% increase in BNB price allowed the Binance-linked token to regain its position as the fourth-largest cryptocurrency by market value. At the time of writing, BNB is trading at $319, just a few steps ahead of Solana in terms of market value.

The most significant factor igniting the rally on the Solana front was the incredible surges in Solana-based memecoin projects. Between November 22 and December 22, BONK price increased by 650%, while Dogwifhat (WIF) price soared by 123,000%, capturing everyone’s attention.

During this period, both memecoin projects saw a pullback of more than 50% after reaching all-time highs, starting their decline three days before Solana reached its annual high on December 26th.

Solana and Ethereum Competition

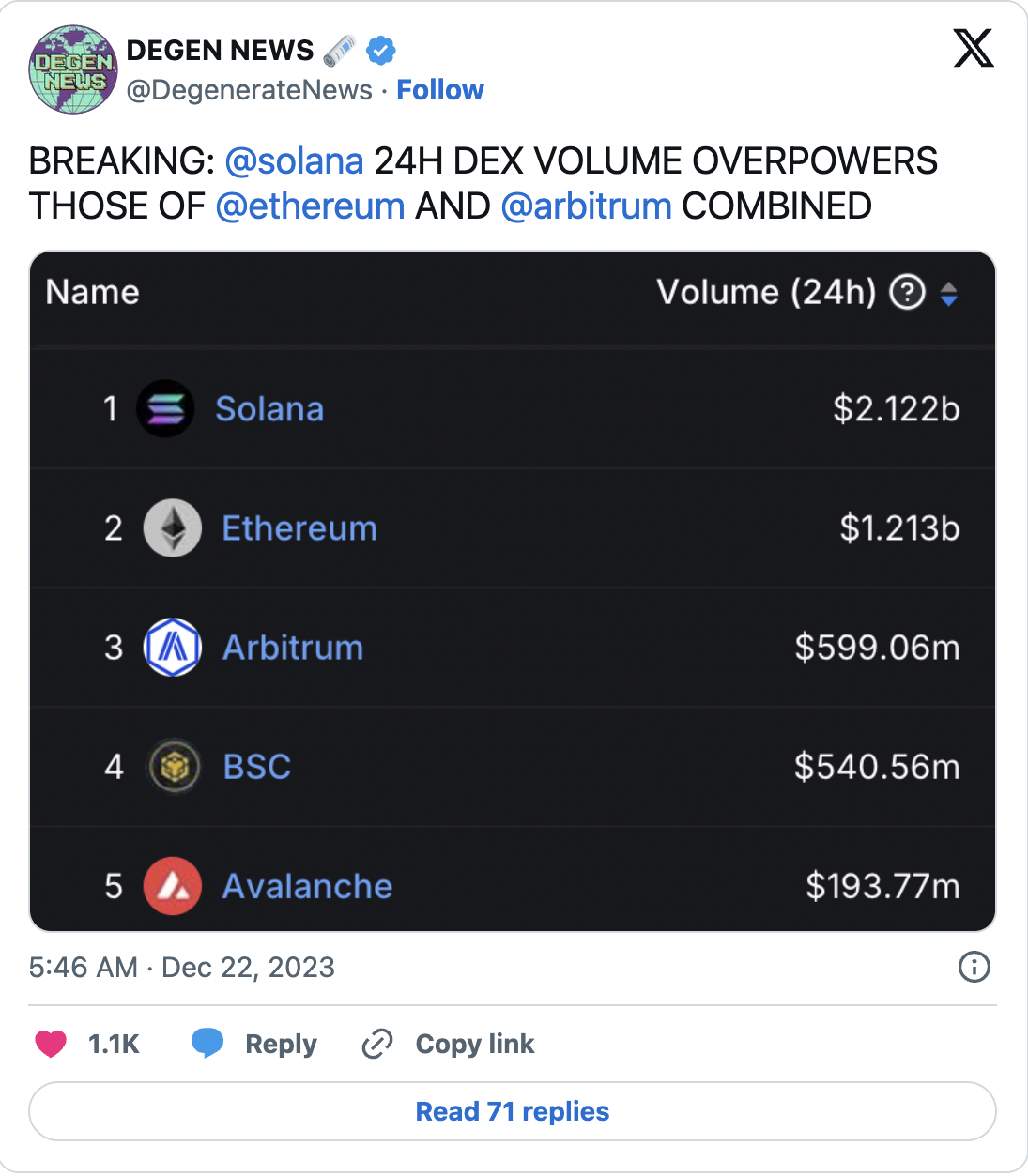

Parallel to the significant increases in Solana’s price, there was also an uptick in trading activities within the Solana ecosystem, and for the first time, the trading volumes on SOL-based decentralized exchanges (DEXs) surpassed those of the Ethereum ecosystem. According to blockchain data analytics platform DefiLlama, Solana DEX volume continues to retract after the record, with volume dropping to $1.1 billion in the last 24 hours. During this time, Ethereum ecosystem’s DEX volume reached $2 billion.

These developments led to a short-term 5% gain for Ethereum, prompting many investors and analysts to speculate that Ethereum may soon outperform its rivals.

Türkçe

Türkçe Español

Español