With only a few days left until 2024, the rise of cryptocurrencies continues at a dazzling pace. Bitcoin (BTC), the pioneer of this digital revolution, frequently makes headlines with the revolutionary changes it brings to financial systems. Especially in recent years, economic fluctuations and various challenges in traditional finance have steered investors towards digital assets, with Bitcoin’s price continuing to climb. This ascent in Bitcoin’s price has also reflected on the shares of BTC mining companies and firms that invest in and hold BTC.

Shares of Bitcoin Mining Companies and Related Firms Skyrocket

The year 2023 has been quite productive for the cryptocurrency market. Starting the year at around $16,500, Bitcoin has since seen an increase of over 150%, bringing joy to its investors. This rise in Bitcoin has also impacted the shares of BTC mining companies traded on exchanges, such as Core Scientific, and companies that invest in and hold BTC, like MicroStrategy.

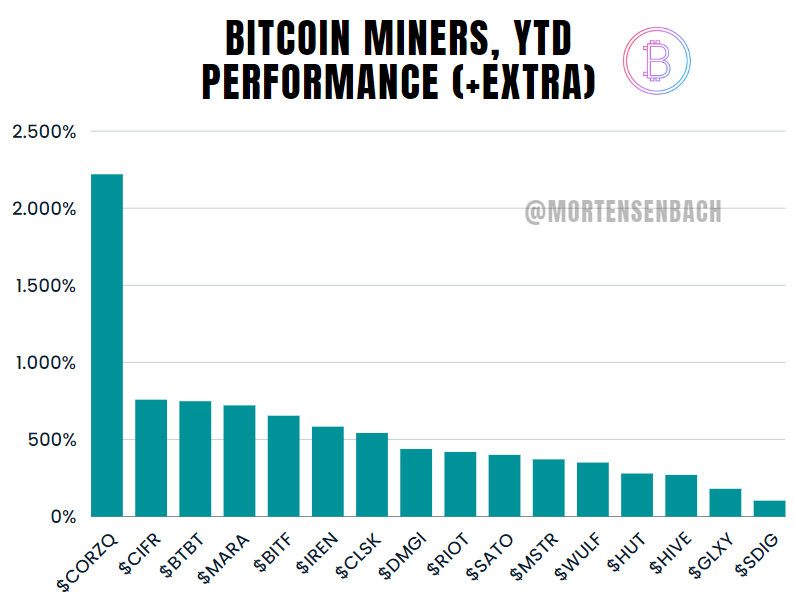

Shares of the Bitcoin mining company Core Scientific (CORZQ) have risen by 2,220 percent since the first day of the year. Shares of another Bitcoin mining company, Cipher Mining (CIFR), have seen an increase of 758 percent in the same period.

The significant rise in the shares of Core Scientific and Cipher Mining has been echoed in the shares of other BTC mining companies and firms that invest in and hold BTC. According to current data, since the beginning of the year, shares of Bit Digital (BTBT) have risen by 748%, Marathon Digital Holdings (MARA) by 721%, Bitfarms (BITF) by 654%, Iris Energy (IREN) by 583%, CleanSpark (CLSK) by 542%, DMG Blockchain Solutions (DMGI) by 438%, Riot Platforms (RIOT) by 419%, SATO Technologies (SATO) by 400%, MicroStrategy (MSTR) by 371%, TeraWulf (WULF) by 350%, Hut 8 (HUT) by 279%, HIVE Digital Technologies (HIVE) by 270%, Galaxy Digital Holdings (GLXY) by 180%, and Stronghold Digital Mining (SDIG) by 103%.

Bitcoin Mining Companies

Bitcoin mining companies are firms that solve mathematical problems using computer power to confirm transactions on the Bitcoin network. This process, known as mining, is typically carried out through the Proof of Work (PoW) consensus mechanism.

Bitcoin mining companies often set up large data centers and use high-performance computer hardware. This hardware usually consists of ASIC (Application-Specific Integrated Circuit) devices, which are specifically designed for Bitcoin mining and can operate more effectively than general computer hardware. These companies record the rewards and transaction fees they earn in BTC as income. Nowadays, many of these companies are publicly traded.

Mining also plays a crucial role in securing the Bitcoin network and verifying transactions. Due to the intense energy required for mining activities and their environmental impacts, this issue has been subject to some criticism. Concerns about energy consumption are part of a broader discussion about the sustainability and environmental effects of Bitcoin and other cryptocurrencies.

Türkçe

Türkçe Español

Español