Crypto Con, focusing on the phenomenon known as the “Blue Years,” examines the complex models of Bitcoin‘s halving cycles. Drawing parallels between historical cycles and the current market landscape, Crypto Con offers insights into the cyclical nature of Bitcoin’s price movements and sheds light on the significance of the anticipated ETF approval.

Bitcoin’s Historical Patterns: Unveiling Symmetry

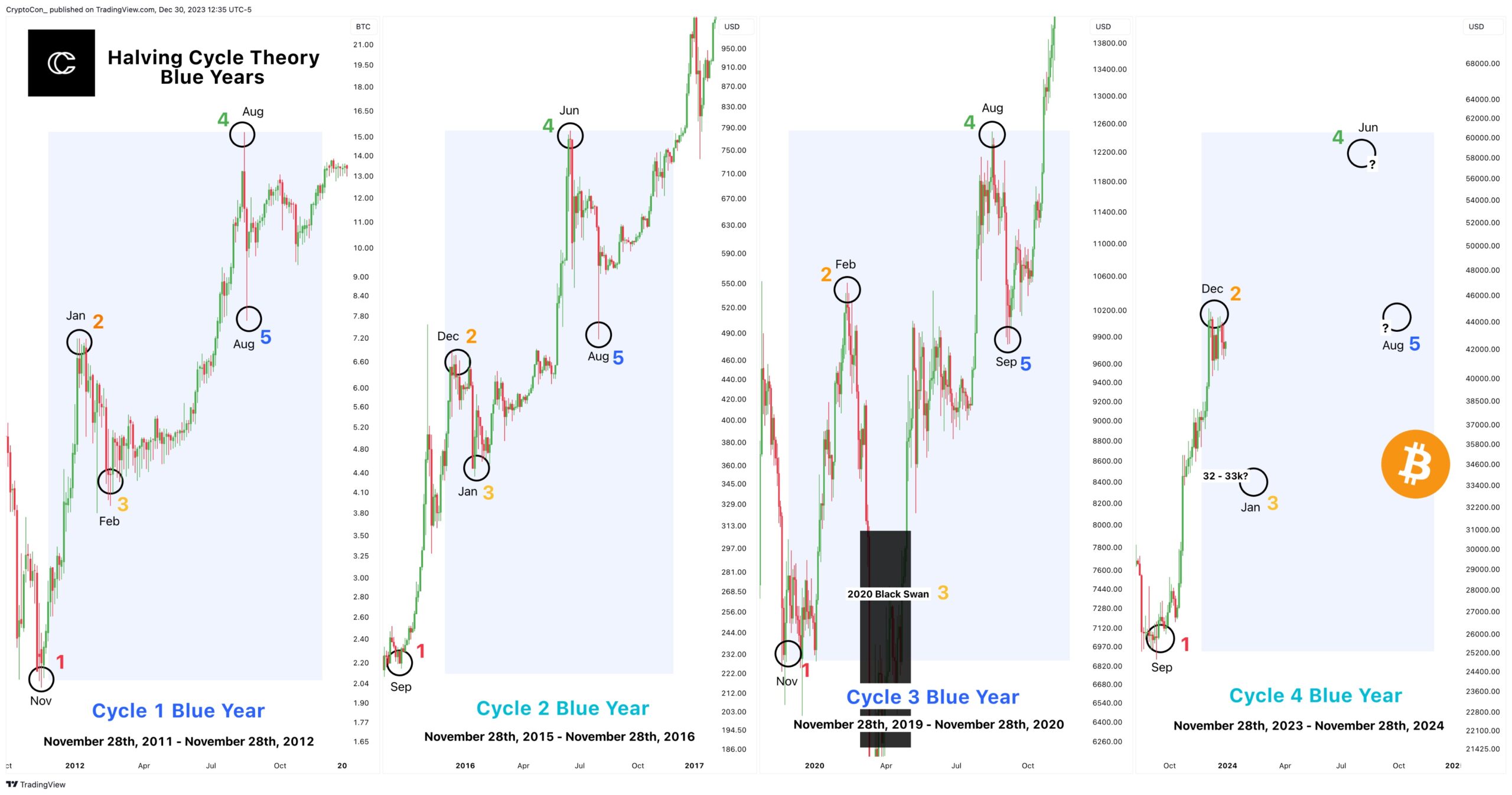

A meticulous examination of the Bitcoin Halving Cycle Blue Years reveals striking similarities between different cycles. Crypto Con highlights mysterious resemblances, particularly when comparing alternating cycles. Notably, the 1st and 3rd cycles initiated strong rallies at the beginning of the Blue Year in November, while the ongoing cycle and the 2nd cycle began their upward trajectories in September.

Drawing a parallel with Cycle 2, Crypto Con suggests that Bitcoin could potentially reach its peak in December. This observation contributes to the narrative of cycles that provide a roadmap for Bitcoin’s price movements, in line with historical patterns. According to the analyst, BTC could drop to $33,000 levels in January, with signs pointing to $60,000 levels in July.

However, amidst expectations of ETF approval, Crypto Con emphasizes the speculative nature of such events, underlining the unpredictability that covers the crypto market.

Bitcoin ETF Approval: Unprecedented Expectation and Speculation

The impending ETF approval stands as one of the most eagerly anticipated events in Bitcoin’s history. Reports circulating in the crypto space suggest that this significant development could be on the horizon. However, Crypto Con adds a note of caution by emphasizing the speculative nature surrounding news of the ETF. The lack of certainty regarding the outcome underscores the unpredictability that characterizes the crypto market.

Crypto Con examines current market dynamics, pointing out that data and timeframes have become excessively broad in the short term. This analysis reflects on the speculative nature of market analyses, calling for investors to be cautious.

The acceptance that no one can definitively predict the outcomes related to ETFs adds another layer of complexity to the already intricate web of crypto market speculations.

Deciphering the Mysterious Terrain of Bitcoin Cycles

As Crypto Con navigates the historical intricacies of Bitcoin’s Halving Cycle Blue Years, the analysis provides valuable information on the cyclical nature of the cryptocurrency. The parallels drawn between cycles offer a lens through which market observers can interpret and predict price movements.

Nevertheless, the cautious tone regarding ETF approval and the acceptance of speculative elements underscore the mysterious and unpredictable terrain that characterizes Bitcoin’s journey.

Türkçe

Türkçe Español

Español