Tellor’s (TRB) price experienced a dramatic increase today amidst a whirlwind of market activity, soaring from $200 to over $600, reaching an impressive peak. However, the excitement was short-lived as the cryptocurrency quickly underwent a significant drop, retreating to $155. This volatile price movement has attracted the attention of both investors and enthusiasts, making TRB the focal point of the latest surge in the crypto market.

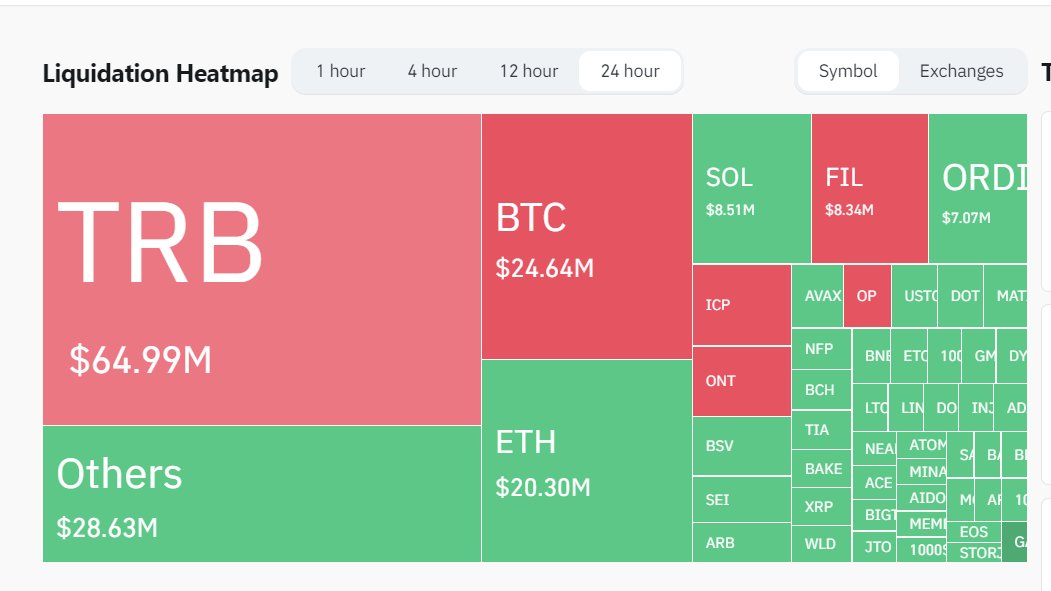

Liquidation Frenzy: TRB Tops the Charts with $60 Million in 12 and 24 Hours

In the midst of intense price fluctuations, TRB emerged as the cryptocurrency with the largest amount of liquidation both in the last 12 hours and over a 24-hour period. The liquidation of TRB contracts surpassed a staggering figure of $60 million, creating a significant impact on market participants.

This significant amount of liquidation underscores the increased activity and trading volume surrounding TRB during this period of price fluctuation.

Unraveling TRB’s Price Trajectory

The rise from $200 to over $600 showcases the potential for rapid and significant gains in the cryptocurrency market. TRB’s ascent to these levels likely attracted both long and short positions, contributing to increased trading activity.

However, the sharp pullback towards $155 highlights the volatility and risk inherent in crypto investments. At the time of writing, as seen in the graph above, TRB is trading around $139.

Factors Influencing TRB’s Price Movements

Various factors could have contributed to TRB’s tumultuous price action. Cryptocurrency markets are influenced by numerous elements, including market sentiment, macroeconomic trends, regulatory developments, and specific news or developments related to the project, as in the case of TRB. Investors carefully monitor these factors to make informed decisions in the dynamic crypto environment.

The significant amount of liquidation associated with TRB’s price fluctuation emphasizes the importance of effective risk management strategies in crypto trading. Considering the inherent volatility of crypto assets, investors must stay alert and implement risk mitigation measures such as setting stop-loss orders and diversifying their portfolios.

Understanding the unique dynamics of each cryptocurrency is crucial for navigating the complexities of the market. TRB’s recent price trajectory reinforces the unpredictable nature of crypto markets, providing a valuable lesson for market participants. As the crypto community reflects on the events surrounding TRB, a broader discussion on risk tolerance, investment strategies, and the need for continual market awareness is sparked.

Türkçe

Türkçe Español

Español