As the U.S. Securities and Exchange Commission (SEC) is expected to approve at least one spot Bitcoin ETF soon, the largest cryptocurrency Bitcoin (BTC) saw its price rise over 7%, surpassing the $45,000 level. Ethereum (ETH), the king of altcoins, also saw its price increase by 5% once again, approaching $2,400. Currently, on-chain data indicates a strong rally signal for ETH.

On-Chain Data Indicating a Rise in Ethereum (ETH)

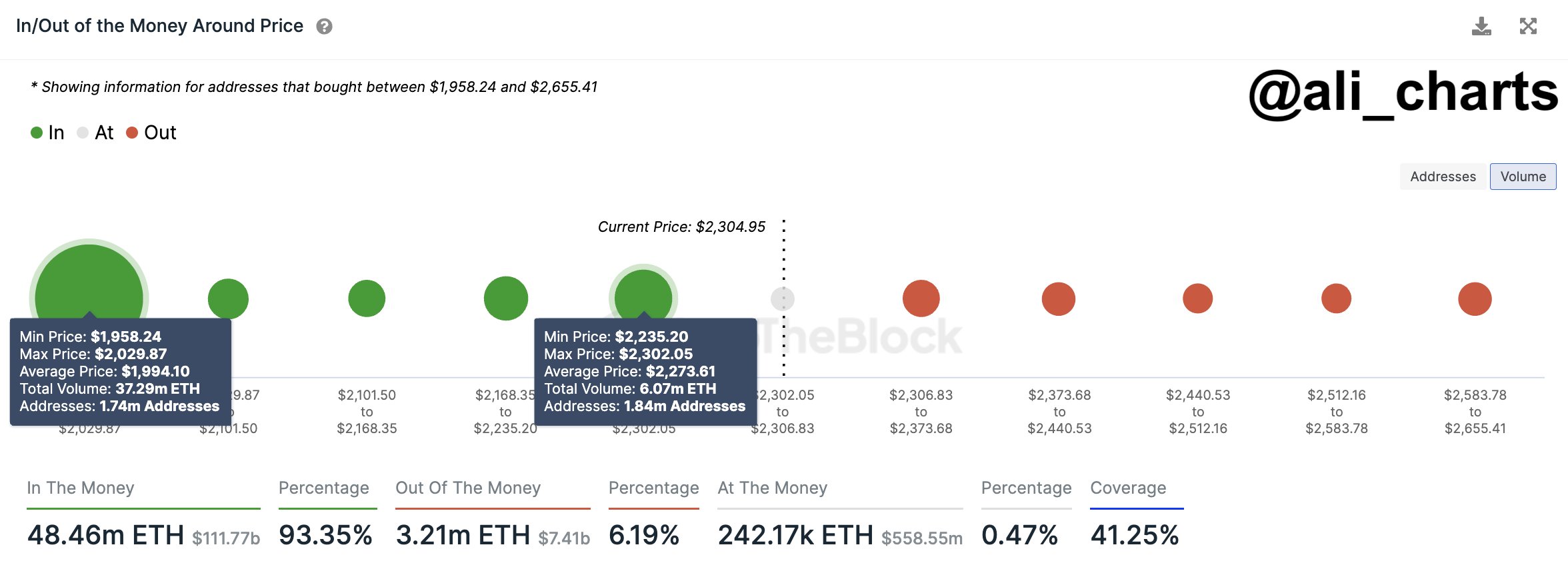

Prominent cryptocurrency analyst Ali Martinez, in a recent market analysis, stated that the bullish outlook for Ethereum is now clearer. Martinez highlighted that there are no significant supply barriers that could prevent potential rises to $2,700 or higher levels for Ethereum.

Additionally, Martinez’s analysis indicates that the $2,000 level is a strong demand wall, suggesting that it could act as a cushion in the event of corrections, serving as important support. The analyst’s positive forecast reflects current market dynamics that parallel Ethereum’s optimistic short-term price trajectory.

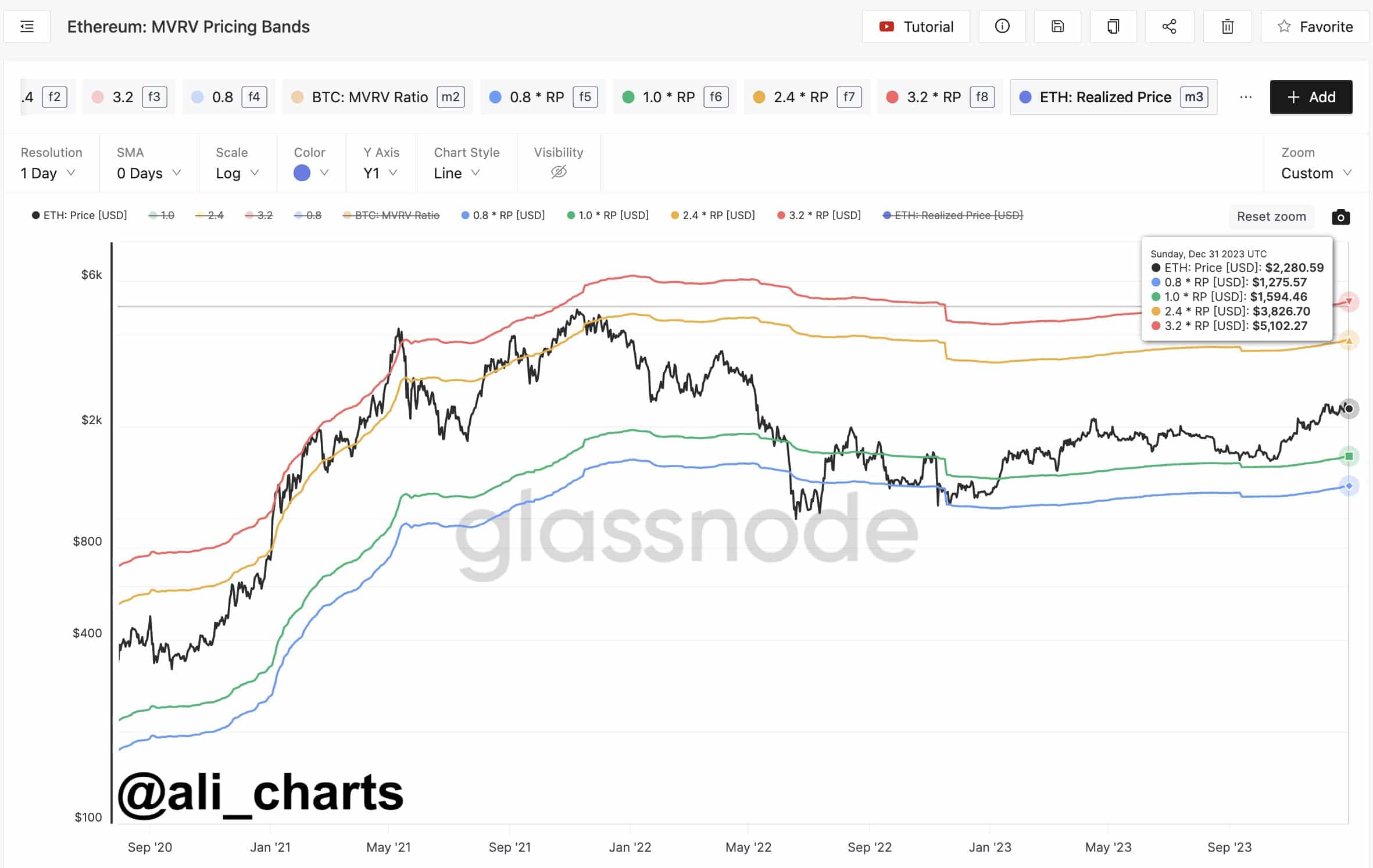

According to on-chain data compiled by Martinez, Ethereum’s MVRV Pricing Bands indicate significant price targets for the altcoin king. Martinez pointed out that the next significant price targets for ETH, according to the data, are $3,830 and $5,100. This analysis provides valuable guidance by shedding light on potential future price movements in the Ethereum market for investors and market participants.

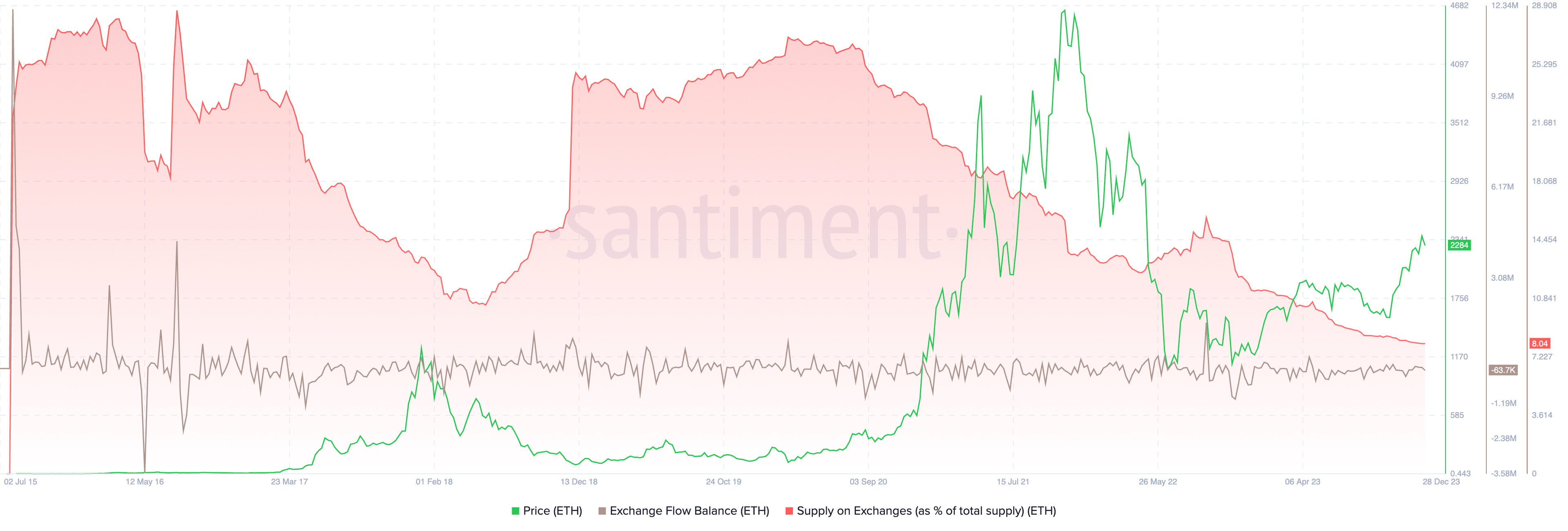

ETH Supply on Exchanges Plummets Sharply

Another positive indicator for Ethereum is the sharp decline in ETH supply on cryptocurrency exchanges. Data from the on-chain data platform Santiment reveals that the supply of ETH on exchanges has dropped to the lowest level ever seen since Ethereum was launched.

Current data shows that the supply of Ethereum on cryptocurrency exchanges corresponds to only 8.04% of the total ETH supply. This is the lowest level recorded since the launch of ETH. The supply of an altcoin like ETH on cryptocurrency exchanges usually plays a very important role in influencing market price. A decrease in supply on exchanges is often considered a bullish signal, and in the case of ETH, this suggests a decrease in selling pressure.

Türkçe

Türkçe Español

Español