As the first spot Bitcoin ETF in the USA is thought to be nearing approval, almost all market participants are curious about where the price of Bitcoin will go next. At the beginning of the week, Bitcoin’s price made a strong move above $45,000 and continues to stay above this level.

Is Bitcoin Price Aiming for Over $50,000?

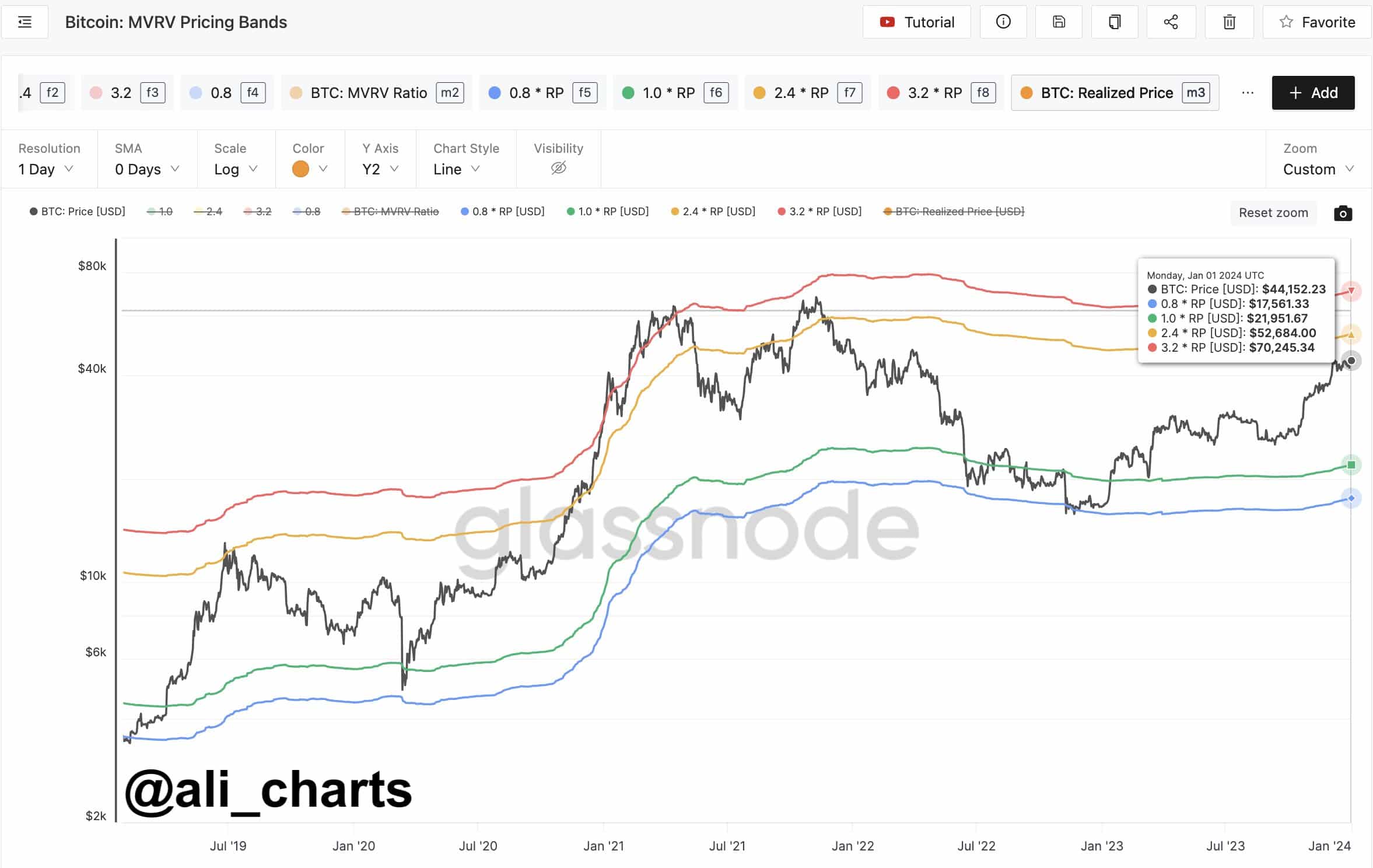

Some on-chain metrics indicate that Bitcoin is currently facing some buying pressure at existing levels. Crypto analyst Ali Martinez pointed out the Bitcoin MVRV Pricing Bands, a metric that shows potential price targets for Bitcoin. The MVRV ratio, or Market Value to Realized Value ratio, is a measure used to assess the average profit or loss of all Bitcoin transactions. According to Martinez, the MVRV Pricing Bands show sequential price targets for Bitcoin at $52,680 and $70,250.

According to a recent report by the crypto company Matrixport, the funding rate of the largest cryptocurrency has reached a new peak, hitting 66%. Consequently, there is an expectation that this dynamic could push Bitcoin beyond the forecasted target level of $50,000 for January 2024, which now seems to be a reasonable milestone within reach.

Last Rally Before a Correction?

On the other hand, popular crypto analyst Michael van de Poppe highlighted an important issue by underlining a historical trend that suggests Bitcoin dominance tends to peak during periods leading up to the four-year cycle’s block reward halving. Van de Poppe suggested that the current fluctuation in Bitcoin dominance could be largely influenced by the expectation of a spot ETF approval and could be indicative of one last upward surge. However, he warned altcoin investors that this peak could be followed by a correction, which could lead to an increase in Bitcoin’s market dominance.

Analysts Anders Helseth and Vetle Lunde from K33 Research recently noted in an investor memo that the approval of spot Bitcoin ETFs might not immediately result in significant inflows and could potentially lead to a ‘buy the rumor, sell the news‘ scenario. However, the analysts emphasized the importance of such investment products, indicating a longer-term structural change in buyer interest. K33 Research assesses the probability of the Securities and Exchange Commission (SEC) rejecting investment products that invest directly in Bitcoin at 5%. They see the likelihood of a ‘buy the rumor, sell the news’ scenario at 75% and the possibility of a potential price increase in Bitcoin due to ETF inflows at 20%.

Türkçe

Türkçe Español

Español