Bitcoin (BTC) has created widespread anticipation with the possibility of exchange-traded funds (ETFs) being approved, which many are eagerly awaiting a decision on. However, recent data suggests that the approval could trigger a sell-the-news event, potentially overshadowing the initial excitement.

Bitcoin’s K33 Report

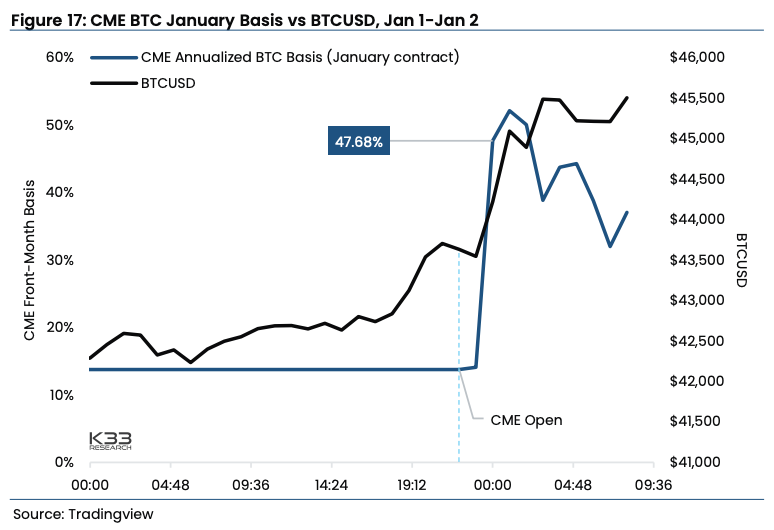

According to K33 Research, a decision regarding Bitcoin spot ETFs is expected between January 8 and 10, with the possibility of market-moving news emerging earlier. It was also noted that traders have been heavily exposed prior to the decision, and derivative products have shown significant increases following Bitcoin’s consistent upward momentum in recent months.

This event is becoming a primary target for profit-taking, potentially leading to a self-fulfilling prophecy of sales. Despite recent meetings and updated S-1 filings suggesting imminent approval, data indicates a 5% chance of ETF rejection. Potential sales following the ETF approval could affect Bitcoin’s price dynamics. Short-term investors seeking profit could contribute to a temporary decline, but the long-term outcomes remain uncertain and depend on the balance between profit-taking and sustainable institutional interest.

Bitcoin Mining Activities

In the midst of this uncertainty, optimism has surrounded Bitcoin mining. Notably, Canadian miner Bitfarms (BITF) saw its stock price double last month without any change in revenue, highlighting a positive market sentiment towards Bitcoin-related stocks. Another positive indicator for Bitcoin is the increase in fees collected by miners. The leading cryptocurrency has been at the top in terms of fees among block rewards over the last 30 days.

This upward trend, with annual fees for miners exceeding $4 billion, indicates strong network activity and reinforces Bitcoin’s attractiveness for miners. Despite these positive aspects, the immediate market sentiment reflected a decline in Bitcoin’s price. At the time of reporting, Bitcoin had experienced a 1.13% decrease over the last 24 hours, pricing at $42,544.09.

Türkçe

Türkçe Español

Español