Cryptocurrencies made a fast entry into the new year. Following the first day of the new year, the price of BTC rose to $45,950, fueled by ETF expectations. Subsequently, Bitcoin’s price fell after the Maxiport announcement, dragging down altcoins with it. During these events, it was suggested that whales were at the center of these market activities.

Bitcoin and Whales

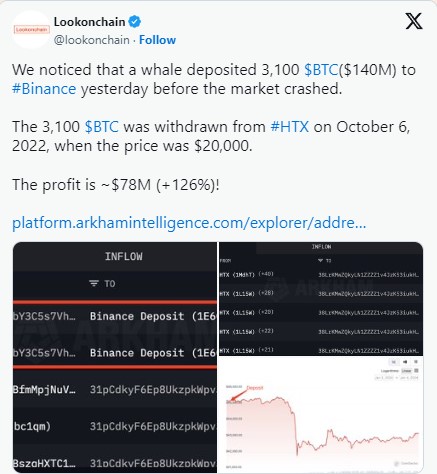

The stance of whales following the news played a significant role in the decline of cryptocurrencies. Particularly, one whale’s transaction did not go unnoticed. Just before the notable market drop, a transfer of 3,100 Bitcoin (BTC) worth $140 million was made to Binance.

Initially detected on the HTX exchange, the BTCs were withdrawn on October 6, 2022, for $20,000, and the 3,100 BTC generated a surprising profit of $78 million for the investor.

However, not all whales were as fortunate as this one. According to data provided by Coinglass, a long position worth $14.26 million was liquidated on Huobi.

Profit and Loss in Cryptocurrencies

Despite the challenging situation, some whales turned the downturn into an opportunity. Following the drop in the BTC/ETH ratio, two whale wallets made purchases of Wrapped Bitcoin (WBTC) and Ethereum (ETH) at levels indicating the market’s temporary bottom.

For example, wallet 0x8B20 spent 1.5 million USD Coin (USDC) to buy 35.18 WBTC at $42,641. On the other hand, it spent another 1.5 million in USDC to purchase 674.18 ETH at $2,225.

The independent actions of these whales unsettled investors regarding the impact on both BTC and ETH. The whales’ objectives and unpredictability can influence market sentiment and potentially lead to more price volatility.

Interestingly, despite the price drop thought to be caused by whales, there was an increase in individual investor interest in BTC. However, if whales continue to sell their BTC following an ETF decision, larger price drops could occur, which could negatively affect individual investors.

While the growing interest in Bitcoin is notable, in contrast, there has been a decline in individual investor interest in ETH in recent weeks.

As of the time of writing, BTC has started to rise again and is trading at the $44,100 level. Concurrently, there has been an increase in the price of ETH, trading at $2,283 with a 2.31% increase.

Türkçe

Türkçe Español

Español