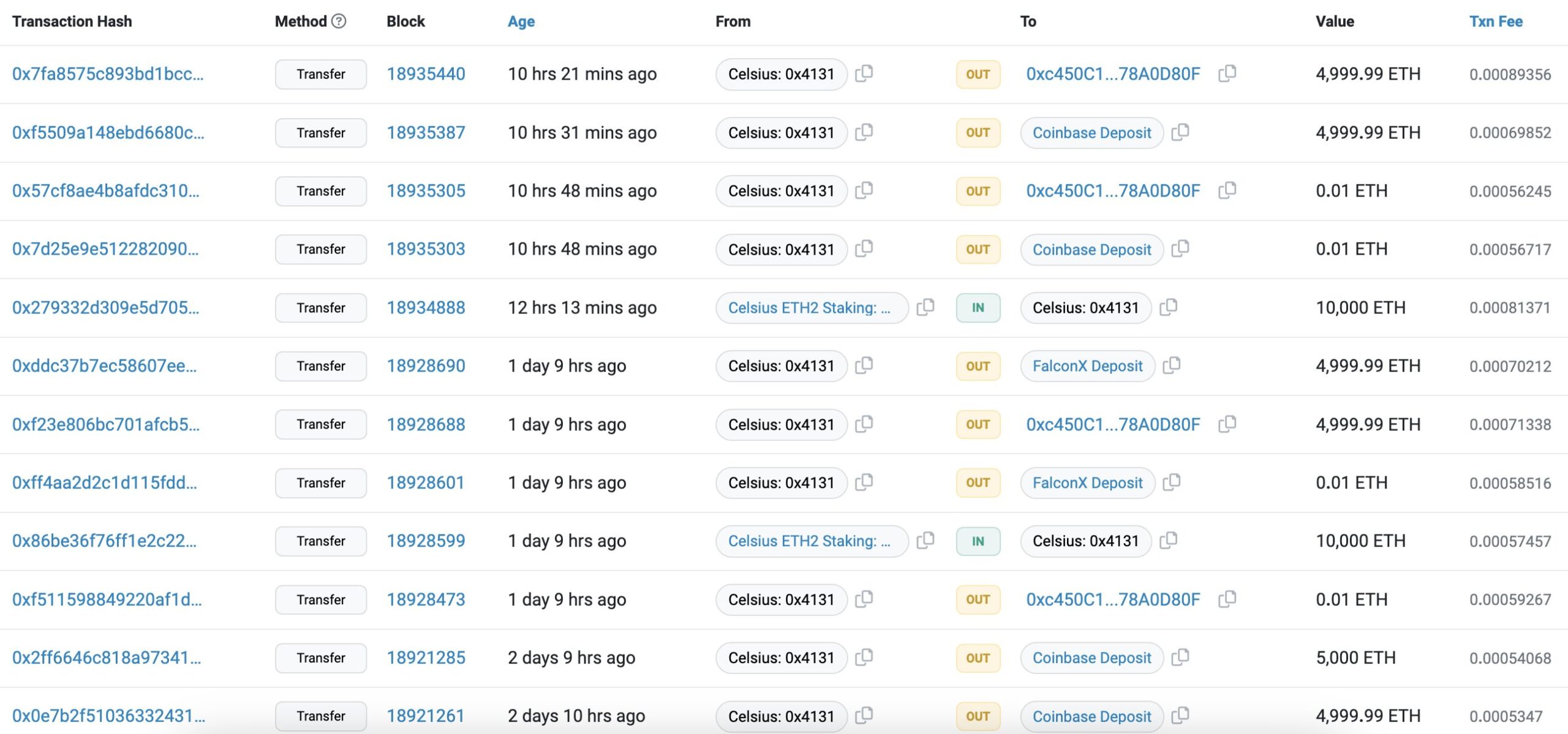

Celsius wallet recently made a significant deposit transaction to Coinbase worth $22.4 million, amounting to 10,000 ETH. This strategic move occurred just 10 hours after a previous deposit transaction, demonstrating dynamic activity within the Celsius ecosystem. Notably, since November 13, Celsius has received a total of 184,000 ETH worth $413 million from stake wallets. These funds were strategically transferred to leading platforms such as Coinbase, FalconX, and OKX.

Tracking ETH Movements

The tracking of Ethereum movements showcases proactive interaction with various platforms for optimized asset management. The recent deposit transactions to Coinbase, combined with previous transfers to FalconX and OKX, underline Celsius’s strategic approach to leveraging various platforms for liquidity and investment purposes.

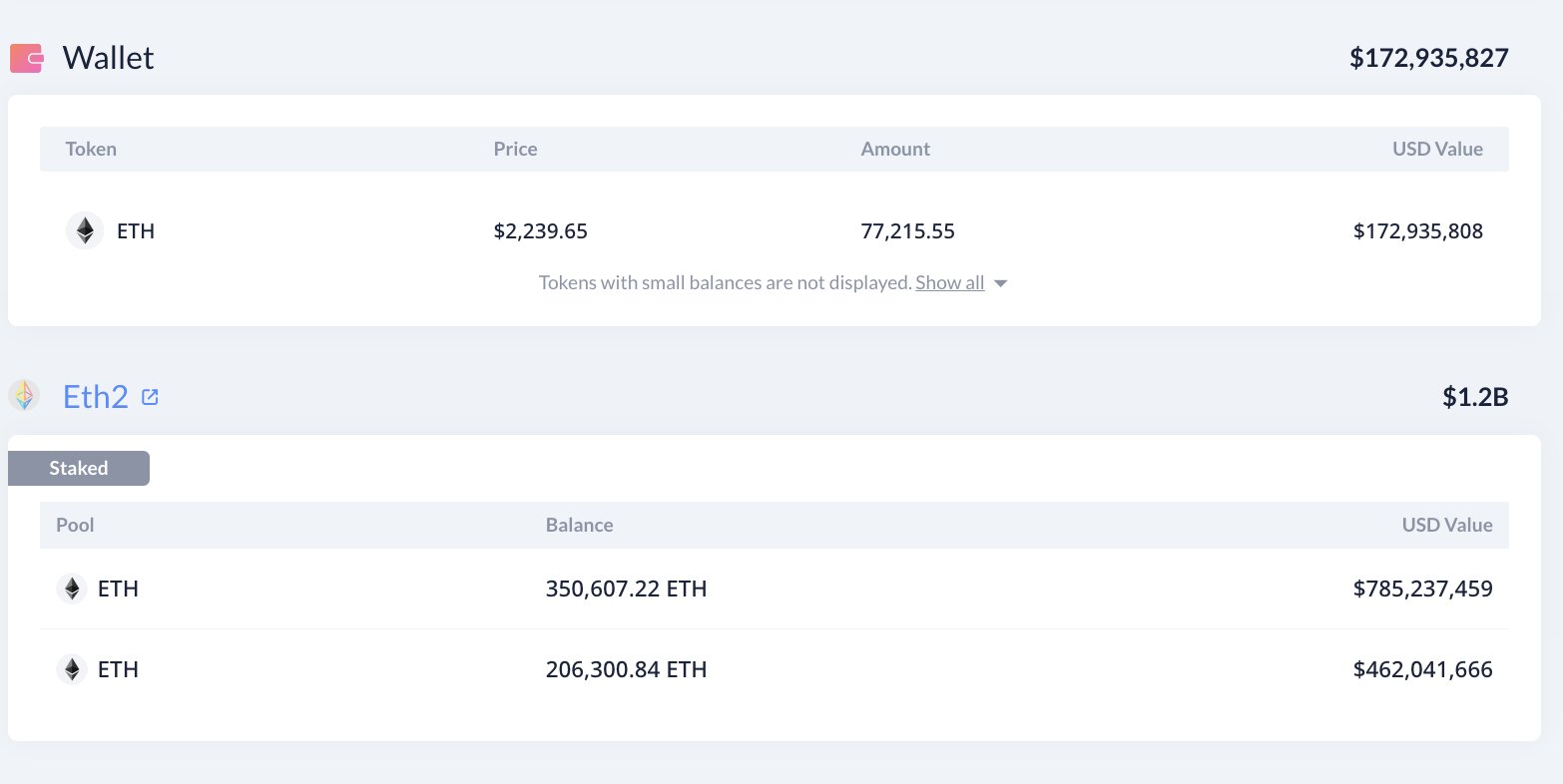

Currently, two stake wallets associated with Celsius collectively hold a significant amount of Ethereum, equivalent to $1.42 billion with 634,000 ETH. This substantial ETH ownership positions Celsius as an important player in the crypto field, with a strategy to manage and distribute assets across different platforms.

Decoding Celsius Strategy: Insights and Implications

Celsius’s recurring ETH deposits and transfers highlight a strategic initiative aimed at optimizing liquidity and investment opportunities. The decision to deposit significant amounts into Coinbase reflects confidence in the platform’s capabilities and potential benefits for Celsius’s overall portfolio.

The transfer of 184,000 ETH from staking wallets since November 13 indicates a continued commitment to active asset management. By strategically allocating funds to platforms like Coinbase, FalconX, and OKX, Celsius navigates the evolving crypto landscape with a dynamic approach. It’s also worth noting that Celsius previously obtained court permission to liquidate altcoin assets.

The Significance of Celsius’s ETH Assets

Celsius’s impressive Ethereum holdings, now reaching 634,000 ETH, reflect the platform’s significant impact in the cryptocurrency space. Celsius may have taken this step to capitalize on market opportunities.

Celsius, which is in a controversial situation in the crypto world, may have broader implications for the crypto universe with its large ETH movements. Celsius’s strategic decisions could influence market dynamics and potentially lead to a significant sell-off wave.

Türkçe

Türkçe Español

Español