The crypto market continues to demonstrate strength ahead of the anticipated historic announcement from the United States. Amid speculations that the Securities and Exchange Commission (SEC) will approve 12 spot Bitcoin ETFs, institutional investors seem to be aggressively accumulating Bitcoin (BTC) before the expected date of January 10, 2024.

US Institutional Investors Aggressively Accumulating Bitcoin

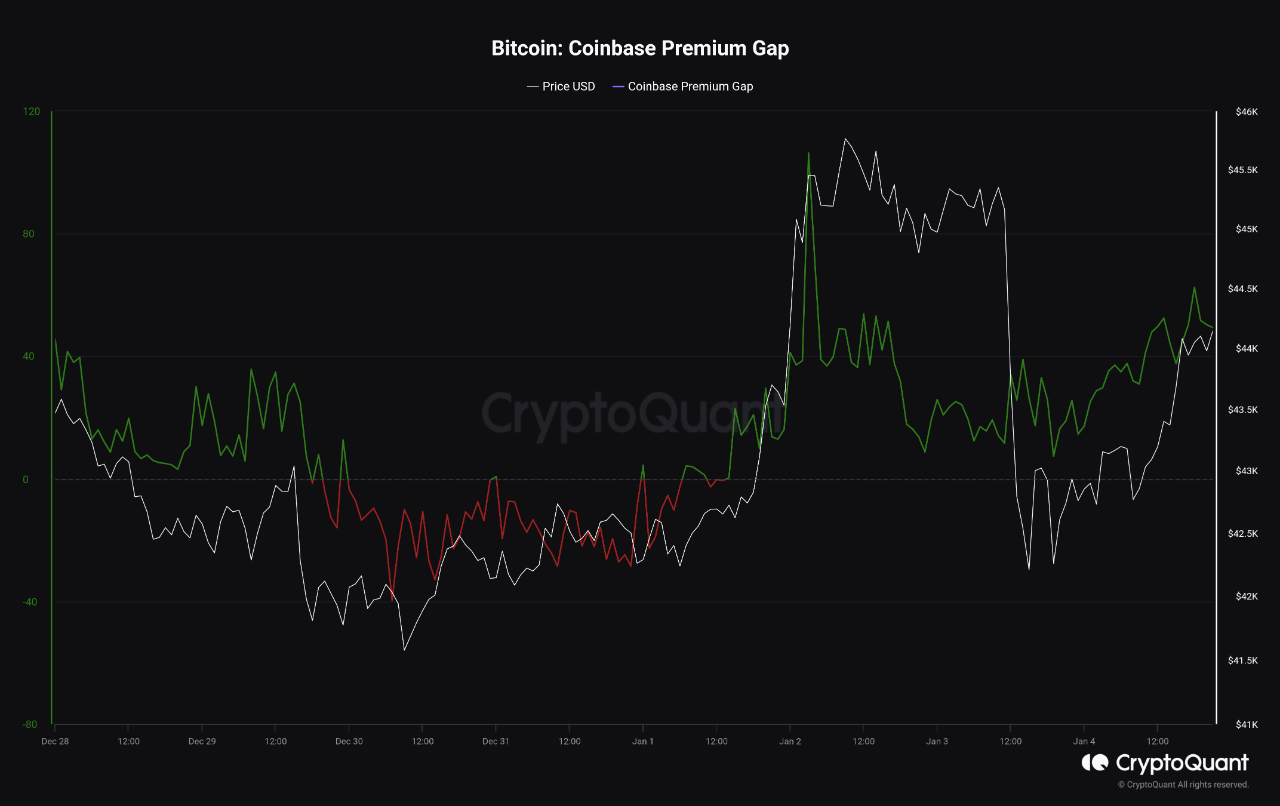

When looking at the price difference of BTC on leading crypto exchanges Binance and Coinbase, a growing gap is observed recently. Market observers suggest that this indicates a clear sign of aggressive buying interest from US investors.

Chain data provider CryptoQuant analysts have pointed out that the gap has increased from a few dollars to over $50, indicating a strong buying interest in the US. There is great curiosity as to whether the Bitcoin purchasing activity of US investors will increase until the approval of a spot Bitcoin ETF.

On the other hand, MicroStrategy, currently the world’s largest corporate Bitcoin investor, continues to accumulate BTC amid growing excitement about the approval of the US’s first spot Bitcoin ETF. The company recently purchased Bitcoin worth $615 million and now holds approximately $6 billion in BTC, with control over 189,150 BTC.

Current State of Bitcoin

According to figures provided by the crypto data and price platform CoinMarketCap, BTC has risen by 1.57% in the last 24 hours, trading at $43,847. The data shows that the largest cryptocurrency has increased by 2.98% over the past 7 days and by 5.35% over the past 30 days.

After a speculative report published by crypto firm Matrixport on January 3, Bitcoin had dropped to $40,800, and leveraged positions worth tens of millions of dollars were liquidated. Matrixport analysts had suggested in their report that the SEC would not approve the spot Bitcoin ETF and that the final approval would come in the second quarter of the year.

Türkçe

Türkçe Español

Español