Crypto communities continue to eagerly await the decision of the United States Securities and Exchange Commission (SEC) regarding spot Bitcoin ETF applications. Meanwhile, some investors are using this uncertain time to speculate whether the applications will be approved or not by January 15th. Let’s examine investor behaviors related to the ETF process.

What are the Predictions Regarding the SEC Decision?

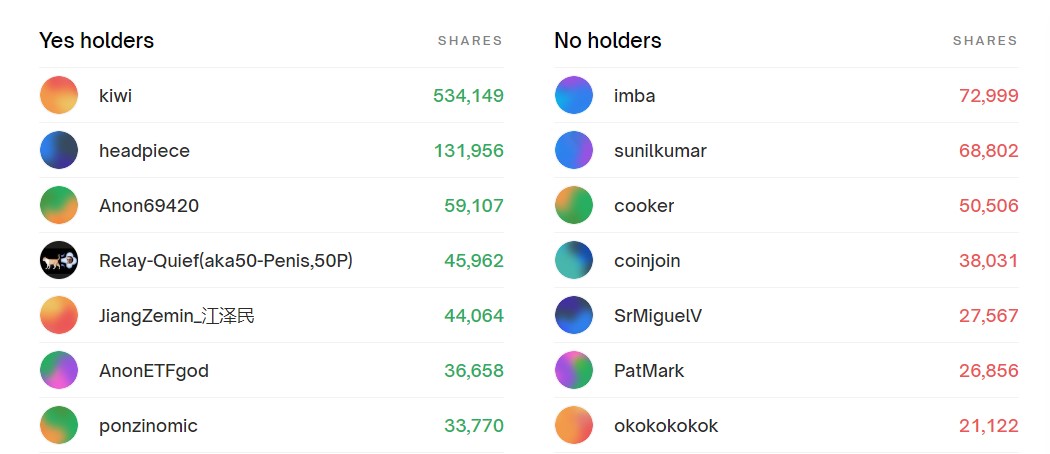

On the Polymarket platform based on Polygon, investors continue to make predictions about whether Bitcoin ETF applications will be approved or not, with options to bet on “Yes” or “No”. At the time of writing, approximately 1.5 million dollars worth of predictions have been made on the platform, and most investors purchased “Yes” shares.

In the process ending on January 15th, the value of a share representing the likelihood of either “Yes” or “No” winning is priced similarly to the crypto market. Currently, the cost of a “Yes” share is 0.79 dollars, while a “No” share is 0.21 dollars. An investor with the pseudonym “Kiwi,” one of the largest shareholders, owns approximately 421,000 dollars in “Yes” shares. On the other hand, the largest holder of “No” shares has only about 15,000 dollars worth of “No” shares.

Noteworthy Details About the Process

According to Polymarket, if any spot Bitcoin ETF application receives approval from the SEC by January 15th, the process will be decided as “Yes”. Otherwise, the decision will result in a “No”. This means that both groups of speculators will see their gains or losses by the specified deadline.

The site explained that the primary source of resolution for the market will be information from the SEC. They also added that a reliable reporting consensus could be used to decipher the market.

Meanwhile, some Reddit users criticized this process, while others were creative with their jokes on the subject. In the Cryptocurrency subreddit, one user described the bet as foolish and likened it to depositing a dollar to win ten cents. Another community member wrote about risking their child’s college fund, and another apologized to their grandchildren for what they were about to do.

Türkçe

Türkçe Español

Español