Investors who had previously earned significant returns from their investments in DOGE, SHIB, and PEPE had turned their attention to SOL’s newest meme coin. The meme coin of Solana, Bonk (BONK), which saw an incredible increase in value last year, has now entered a challenging period. Most recently, despite experiencing a double-digit rise on January 1st, Bonk has unsettled its investors with a 25% drop over the last seven days.

Will the Price Decline Continue?

As of the time of writing, BONK is trading at $0.00001042. Considering the 6% decline in price movement, it appears that the altcoin’s value may continue to decrease in the short term unless new market news emerges.

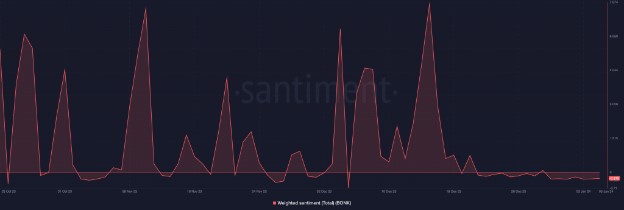

According to Santiment data, the weighted sentiment of the token, which was positive during the weeks of BONK’s rise, turned negative on December 29th and has remained in the negative zone since then.

As market sentiment changed, there was also an increase in token sales. It can be understood from BONK’s fundamental momentum that investors have preferred to sell rather than accumulate tokens since the beginning of the year.

BONK Charts and Price Analysis

BONK’s Money Flow Index (MFI) rose from a low of 17.77 to a nearly neutral level of 46.88, while the Relative Strength Index (RSI) remained at 36.34.

These values suggest that there is an air of uncertainty among market participants, and despite the selling pressure, it is possible that demand in the market may begin to increase again. If there is another downturn, a pullback in price could potentially begin anew.

Additionally, BONK’s Chaikin Money Flow (CMF) was at a positive value of 0.15 at the time of writing. A cryptocurrency’s CMF above the zero line indicates an increase in liquidity inflow.

This could mean that investors are watching for opportunities to enter the market and exert upward pressure on the price of a cryptocurrency.

Interestingly, despite all the price declines, market investors in futures trading continue to open LONG positions, seemingly supporting a new price increase.

According to data provided by Coinglass, there was a 32% increase in open interest for BONK over the past five days. Funding rates on exchanges also appeared to be significantly positive during the same period.

Türkçe

Türkçe Español

Español