Polygon’s native token MATIC continues to face selling pressure around the psychological resistance level of $0.8300. Last week, MATIC’s market value dropped by 14%, and the selling momentum applied downward pressure on the price. The decline in MATIC’s price has revealed the possibility of a break below the lower support trend line of the rising wedge formation, which indicates a risk of further correction in the MATIC price.

MATIC Chart Analysis

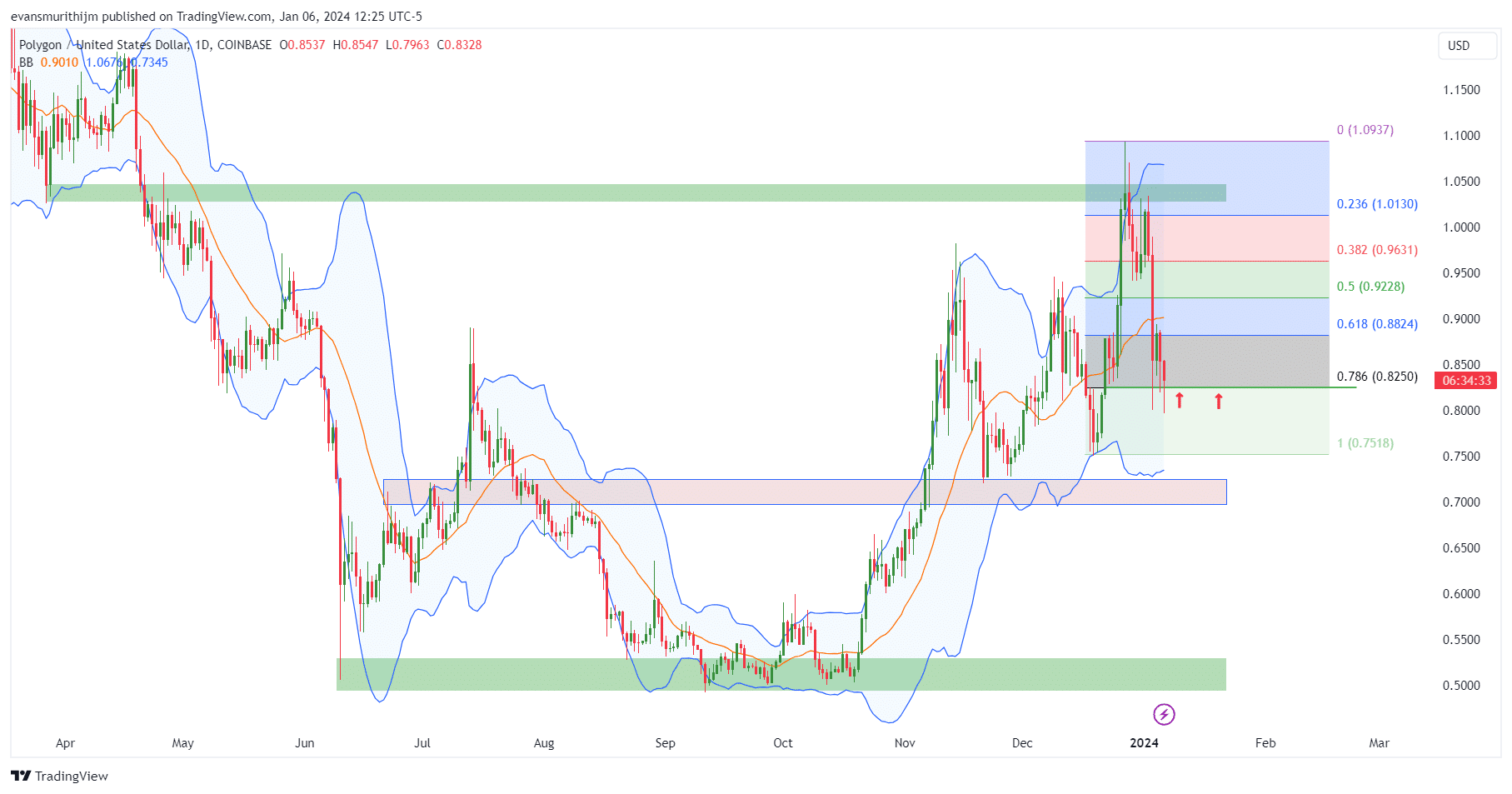

In the past few days, the Polygon price has been trading between $0.80 and $0.90, with declining and rising trends contradicting each other. This tug-of-war resulted in a narrow trading range with the price balancing both upwards and downwards. At the time of writing, MATIC is trading at $0.8402, indicating a potential short-term downtrend. Despite experiencing a drop of over 2.5% in the last 48 hours, MATIC continues to show an overall recovery from its recent lowest level, maintaining a positive outlook for the short term.

Famous crypto analyst Ali shared his optimism with his followers that Polygon could revisit the $0.96 level by the end of January 2024. The increase in buying pressure at current levels could potentially push MATIC to $0.88 and even $0.96. MATIC is particularly regaining interest due to the transition to Polygon 2.0.

Noteworthy Data for MATIC

MATIC’s price, if it stays above the $0.0800 support level, has the potential to rise to the resistance level of $0.9600. Maintaining this level could lead to the price surpassing $1 in the future. However, if the downward trends continue, the current support level could be broken, and short-term selling pressure could emerge.

Technical indicators from the last 24 hours, with most moving averages and key data giving buy signals, point to the potential for a bull run. The MACD indicates a downturn in momentum as the blue MACD line crosses above the red signal line. The Relative Strength Index (RSI) is at a neutral level of 44.17, indicating market equilibrium. The converging Bollinger Bands suggest a high probability of increased volatility in the coming days.

Türkçe

Türkçe Español

Español