While expectations for a Bitcoin ETF continue, analysts’ price predictions are not limited to this alone. On the other hand, analysts targeting the upcoming halving are not shy about expressing their views on where the cryptocurrency could reach by the year 2024.

Analyst’s Bitcoin Commentary

Famous analyst PlanB, while drawing attention to the rise in many of its fundamental indicators, mentioned that a tenfold price increase for Bitcoin (BTC) is within the realm of possibility.

In recent days, through a Youtube video, the analyst informed crypto followers that BTC adoption is still in the early stages and does not believe that the upcoming halving, which will cut miner yields in half, will provide less profit than the previous cycle.

(Bitcoin’s growth) was 100-fold in the first few bull markets, but it has slowed down recently and dropped to 10-fold, just under 10-fold. I do not expect diminishing returns because we have a 2% or 3% adoption rate and if we follow the logistic S-curve and Metcalfe’s law, we cannot have diminishing returns under 50% adoption, so we will experience exponential growth for a few more years. I expect it to reach somewhere between $100,000 and $1 million, a tenfold increase.

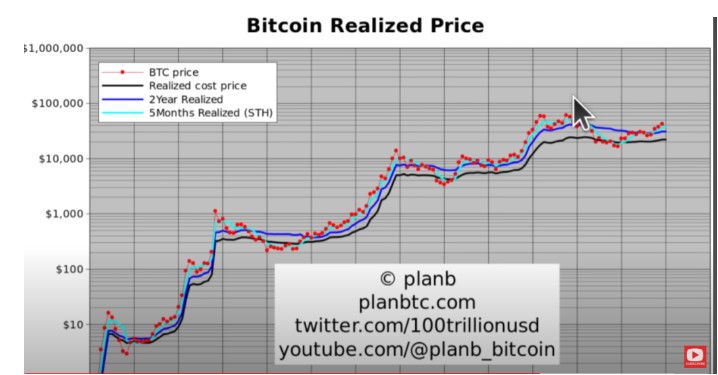

PlanB also analyzed the cost basis of the majority of BTC in circulation and reviewed the model that aims to determine the stages of Bitcoin’s market cycles. According to the analyst, Bitcoin is currently trading above the average cost basis of cryptocurrencies, which is considered a distinct signal of a bull run.

Right now, we’ve left the 2022 bear market behind, Bitcoin’s price has surpassed all cost prices, so many people are in profit and Bitcoin is above the cost prices and the cost prices are rising, especially the resurging actual price, which is a distinctive signal of an emerging bull market. Where will this take us? If history is a guide, probably to an area between $100,000 and $1 million.

When analyzing the chart above, Bitcoin’s price is positioned above the actual cost price, the two-year actual cost price, and the five-month actual cost price. To briefly summarize what the actual price is, it can be said to be the average price calculated based on the last transaction price of all Bitcoins in circulation.

How Much is Bitcoin?

There is anxiety due to the ETF expectations for Bitcoin, and at the time of writing, it is trading at $43,790. In addition, there are bigger concerns in the altcoin market.

When we examine the altcoins within the top 5 by market cap (excluding Tether due to being a stablecoin), the price of ETH has dropped by 1% and is trading at $2,214. The price of BNB has fallen by 3% to $297, which seems to have lost the $300 support level.

On the other hand, SOL has experienced a 4.31% decrease and has fallen below the $90 level. Lastly, XRP, closely monitored by investors, is finding buyers in the $0.55 region after a 2.27% drop.

Türkçe

Türkçe Español

Español