The anticipated profit-taking downturn in altcoins has begun. BTC is attracting more attention with the upcoming ETF approval, and altcoins are melting. We may see altcoins, pulled back to support regions, fall even further due to a possible “sell the news” event. On the other hand, institutional investors’ interest is growing exponentially. The GBTC case has become a turning point.

Institutions and Cryptocurrency

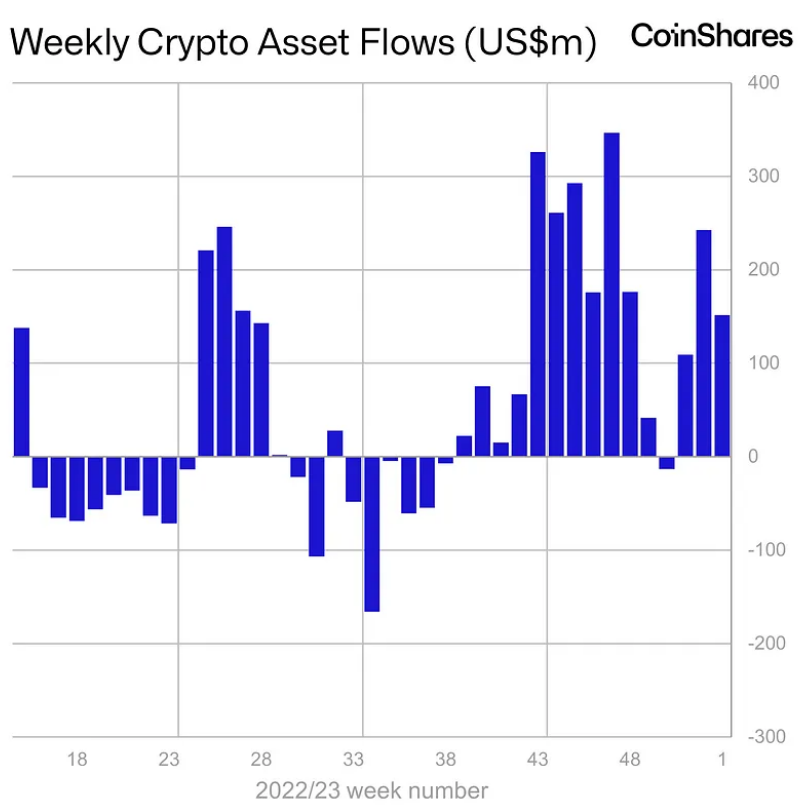

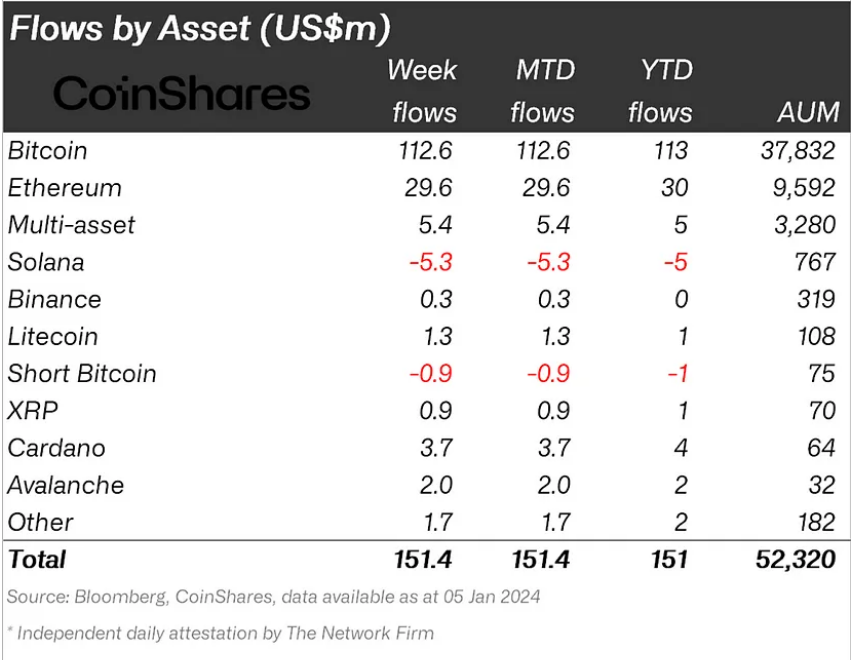

We share with you every Monday the CoinShares report that measures institutional interest in cryptocurrencies. Just now, we received data for the past week. According to this, in the first week of 2024, there was a total inflow of 151 million dollars into cryptocurrency investment funds. Following Grayscale’s legal victory against the SEC, total inflows reached 2.3 billion dollars.

BTC saw the largest inflow with 113 million dollars. However, we saw an outflow of 1 million dollars from the ShortBTC fund, which is used to short Bitcoin, during the same period. Despite the spot-based ETF not yet being launched in the USA, 55% of the inflows came from the USA. Germany and Switzerland accounted for 21% and 17% of the inflows, respectively.

While Ethereum saw a total inflow of 215 million dollars over the last 9 weeks, Solana experienced an outflow of 9 million dollars in the first week of the year. Cardano, Avalanche, and Litecoin saw inflows ranging between 3.7 million and 1.4 million dollars.

Türkçe

Türkçe Español

Español