Bitcoin‘s price has been surpassing seemingly insurmountable resistances for months, stronger than expected, largely due to the Spot Bitcoin ETF catalyst. Investors are excited about the potential end of the road on Wednesday. Everyone is nearly certain that the ETF approval will come with a 99% probability. However, there is something you might be missing.

Spot ETH ETF

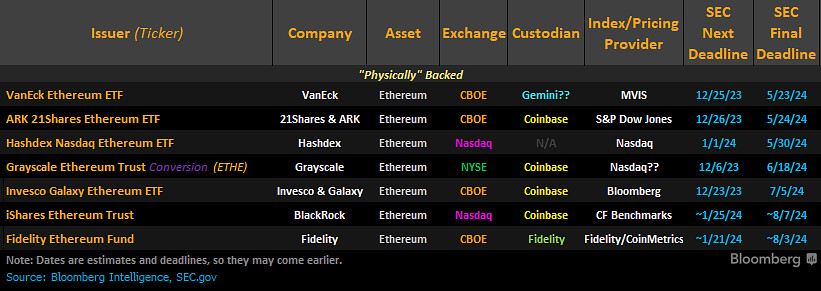

While everyone’s focus is on the spot BTC ETF, and altcoins including ETH continue to melt away, after Wednesday, all eyes will turn to Ethereum. Giants like Fidelity and BlackRock have ongoing ETF processes. That is the spot ETH ETF. They are not alone in this battle, as Grayscale is also trying to convert its trust into an ETF, just like it did with GBTC.

This month, on the 21st and 25th, the SEC will decide on the ETF applications of the two giants. The final decision dates are in May, June, July, and August. Below is a table with the final decision dates.

If ETH starts to rise with the ETF story, investors will have plenty of time to buy into the expectation, especially from February onwards. During this period, we might hear good things about Ethereum and that the next big battle for these trillion-dollar giants could be ETH. For altcoins, an increase in ETH price carries significant implications.

If ETH’s price rallies with the expected ETF, Bitcoin Dominance (BTCD) may loosen, and more altcoins may see an increase. The truth is, in this scenario, many altcoins could perform better (percentage-wise) than ETH due to their market cap-limited upside ceiling.

Here’s a small detail for you. While the SEC initiated the last comment period for the Spot ETH ETF, it mentioned the possibility of the asset being considered a security following the PoS transition, risks of staker centralization, among other things. This means that approval may not be as straightforward as BTC, and if there is something that could suppress the rise, it could be these details.

Should You Buy Ethereum?

While the current BTC price is racing back to the levels of the early 2022 rise and will likely soon target the 2021 peaks, ETH is at the bottom. Yes, at the bottom, and what you need to look at to see this is its performance against BTC. Most altcoins are making huge gains while ETH is performing worse than BTC today.

The graph above shows ETH’s price at the April 2021 bottom against BTC. This suggests that if we don’t see a catastrophic drop to 0.03 BTC, the price should climb to the 0.07 and 0.082 BTC region. If BTC is at $47,000, then ETH should reach $3,760 if it hits the 0.082 BTC region.

The second important thing to know is that the ATH in the ETHBTC pair was made at 0.155 BTC in June 2017. If the old peak is matched, ETH should exceed $7,000 against the current BTC price.

Türkçe

Türkçe Español

Español