Bitcoin price today suddenly dropped to $45,500, and market volatility continues. Everyone is on edge. The number of investors hoping to profit from high volatility is not negligible. So what does this mean? Certainly, the reality that we may see larger fluctuations with the slightest FUD, misinformation, or rumor. Especially since tomorrow is the most important day of the year, and any unannounced SEC approval/rejection decisions should definitely be approached with skepticism.

Will the Spot Bitcoin ETF Be Rejected?

Eric and James have been closely monitoring the spot Bitcoin ETF process for months. Bloomberg ETF experts were saying last month that there was a 90% chance of approval. Now this has risen to 95%. However, there are still skeptics and comments circulating on social media that suggest we might surprisingly see an ETF rejection.

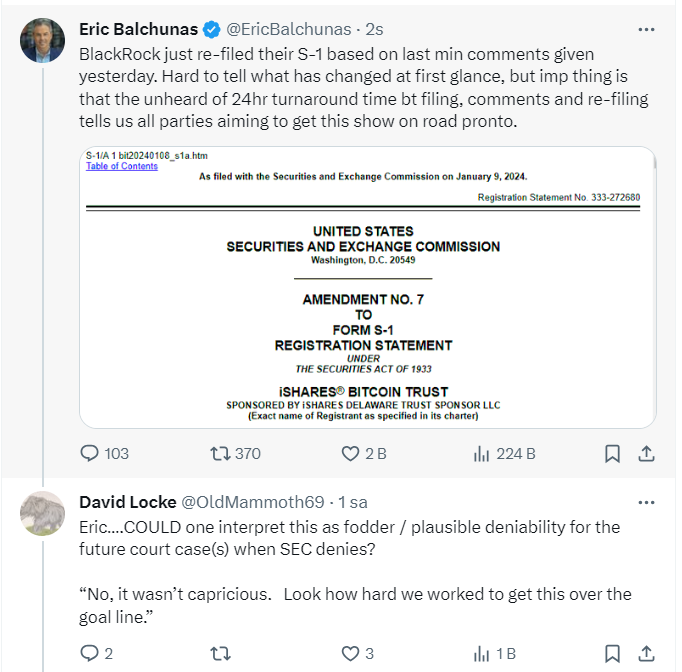

The latest of these comments came under a message shared by Eric;

“BlackRock refiled the S-1 based on last-minute comments made yesterday. At first glance, it’s hard to say what changed, but what’s important is that the filing, comments, and refiling all happened within an unheard-of 24-hour turnaround time, telling us that all parties are aiming to get this show on the road as soon as possible.”

A user named David wrote;

“Eric… Could we interpret this as bait/reasonable denial for future court cases when the SEC rejects it? They will say, ‘no, we weren’t capricious, we worked hard to get them on track’.”

Spot Bitcoin ETF Rumors

The point that investors like David are missing is that the SEC no longer has any room to maneuver. Futures BTC ETFs are already trading and it’s not possible for them to issue contradictory rejection decisions. Could they reject Coinbase for custody services? No, the current lawsuit between the SEC and Coinbase is about unregistered securities sales and other issues, not the reliability of its custody services.

Eric also wrote in response to those expecting an ETF rejection;

“The idea of Gary’s staff working countless hours over the holiday on two dozen massive documents, each over 100 pages long and filled with technical jargon, with 11(!) different issuers seems like a tin foil hat thing to me. But look, we still have a 5% chance of delay/rejection. Here’s my answer to people worried about approval turning into last-minute disaster. I completely understand the fear, but I think there’s too much going against that (rejection) idea.”

Türkçe

Türkçe Español

Español