While everyone is eagerly awaiting the approval of a Bitcoin ETF, Michael Saylor seems disheartened despite the significant news. Currently, there is no spot Bitcoin ETF in the US stock markets, but there are stocks through which you can indirectly invest in BTC, with MSTR being a prime example. Let’s take a closer look at what’s happening.

MicroStrategy and Bitcoin

As of its latest purchase on December 27, 2023, MicroStrategy holds 189,150 BTC, bought at an average price of $31,168 each. The technology company, managed by Michael Saylor, a major player from the dotcom bubble era, holds the most BTC on its balance sheet, yet its core business has nothing to do with Bitcoin, providing software and licensing services.

In fact, what Saylor has been doing for years is managing an unofficial spot Bitcoin ETF. While filling his company’s reserves with billions of dollars in Bitcoin, investors bought shares of his MSTR stock. There are two ways to invest in Bitcoin through the stock market indirectly.

You either buy MSTR stock or you accumulate shares of Coinbase and mining companies. However, MSTR, with its massive BTC accumulation, has been the preferred choice for investors due to its clear commitment to Bitcoin.

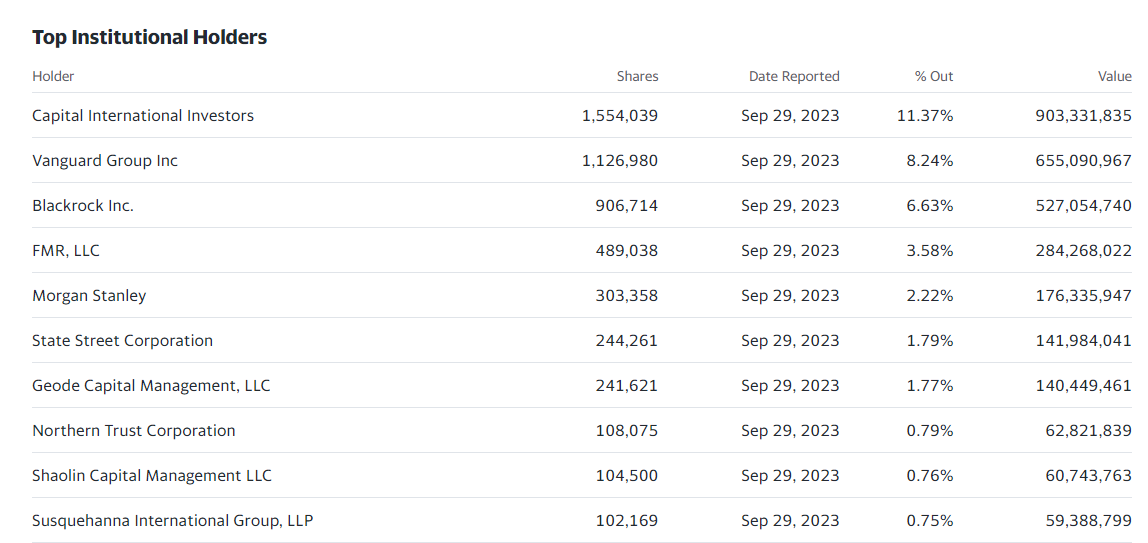

The image above shows the intense interest of large asset management firms. These firms hold MSTR shares on behalf of their clients.

The Future of MSTR Stock

MicroStrategy being listed on Nasdaq, traditional investors preferred it for indirect Bitcoin investment. The chart above clearly reflects this interest. A principal analyst at Blockchain Capital, a crypto venture capital firm, stated the obvious, saying that an ETF approval could start a challenging period for Saylor.

If an ETF approval comes, why would people take the extra risk with MSTR shares instead of directly buying an ETF? According to Bogart, an approval could benefit MicroStrategy by increasing its stock price due to its heavy Bitcoin exposure. However, when sales begin for a transition to ETFs, the stock prices will need to drop.

Bogart assesses MicroStrategy’s real premium at 30%. When comparing the amount of BTC the company holds to its current stock price, those holding MSTR shares for BTC investment are exposed to Bitcoin at a 30% higher cost. Such large price differences would not exist in ETFs, leading people to sell MSTR and buy Bitcoin ETFs like IBIT instead.

In the long run, this situation could trigger a process where Saylor starts selling BTC. On this matter, Michael Saylor had previously stated;

“ETFs are unleveraged and charge a fee. We provide you with leverage, but we do not charge a fee. We offer a high-performance tool for people who are long-term Bitcoin investors.”

Türkçe

Türkçe Español

Español