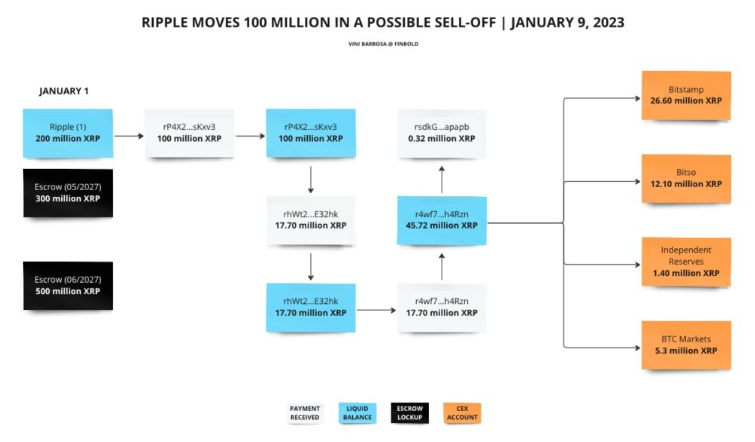

Ripple, after unlocking 1 billion tokens in January, allocated 200 million XRP ($112 million) for its treasury. According to onchain data, the company first acted on January 7th to sell half of this month’s supply inflation.

Current Status of XRP

Considering the sales that took place, a structure similar to the movements that emerged last year attracted attention. The transactions sent to the exchanges pointed to a community of transactions worth $56 million, equivalent to 100 million XRP tokens.

One of the wallets known to belong to Ripple, ‘Ripple (1)’, carried out the transfer of tokens to the account named ‘rP4X2…sKxv3’.

Moreover, this address starting with ‘rp4X2’ preferred to hold 82.3 million XRP, while 17.70 million XRP were sent to the address named ‘rhWt2…E32hk’. The mentioned first address currently has a balance worth more than $52 million.

Afterward, the address named ‘rhWt2’ sent the 17.7 million XRP it received to the address ‘r4wf7…h4Rzn’. What is noteworthy is that the last address to which the 17.7 million XRP were sent previously served as the address for transactions to central exchange accounts.

45 Million XRP Sent to Exchanges

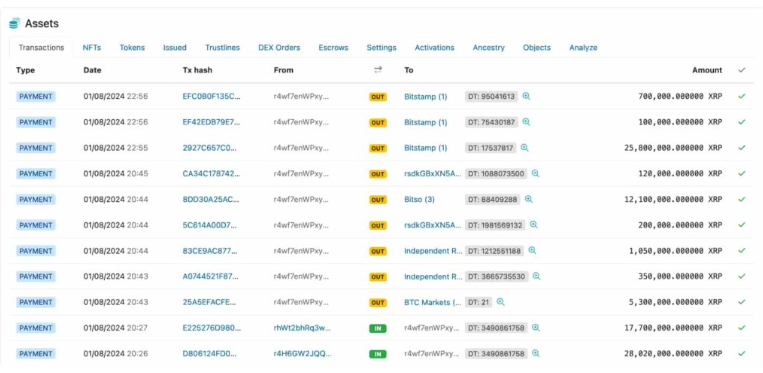

On January 8th, the address ‘r4wf7’ sent a total of 45.72 million XRP to four identified exchange addresses.

Of these XRPs, 26.6 million went to Bitstamp, 12.10 million to Bitso, 1.4 million to Independent Reserves, and finally, 5.3 million to BTC Markets. Notably, an unknown address received a transfer of 320,000 tokens during these transactions.

More importantly, before the transaction of 17.7 million XRP carried out by Ripple, a transfer of 28.02 million XRP was made from the address named ‘r4H6G…QXNMT’.

In addition to all these, Ripple’s wallets still hold 100 million liquid XRP, and there are currently 82.3 million XRP in circulation. The presence of these tokens creates a selling pressure on the market due to the fear that they can be sold at any moment, which also affects the price of XRP.

It is a known fact in the market that Ripple usually carries out asset sales for strategic applications. Potential sales of XRP of this magnitude can have a clear impact on the token’s 24-hour trading volume and shape short-term price movements.

Especially today (January 10), as investors await the SEC’s decision on the Bitcoin spot ETF, leading cryptocurrencies like Ripple may experience extra volatility for whales. Such situations generally bring risks and opportunities together.

Türkçe

Türkçe Español

Español