While the crypto world is focused on the US Securities and Exchange Commission’s (SEC) anticipated announcement of a spot Bitcoin ETF decision, another institution has been identified as entering the game before the ETF decision. A wallet address suspected to belong to the venture capital firm Bitscale Capital purchased $7.94 million worth of Wrapped Bitcoin (BTC), indirectly investing in Bitcoin (BTC).

Bitscale Capital’s $7.94 Million WBTC Purchase

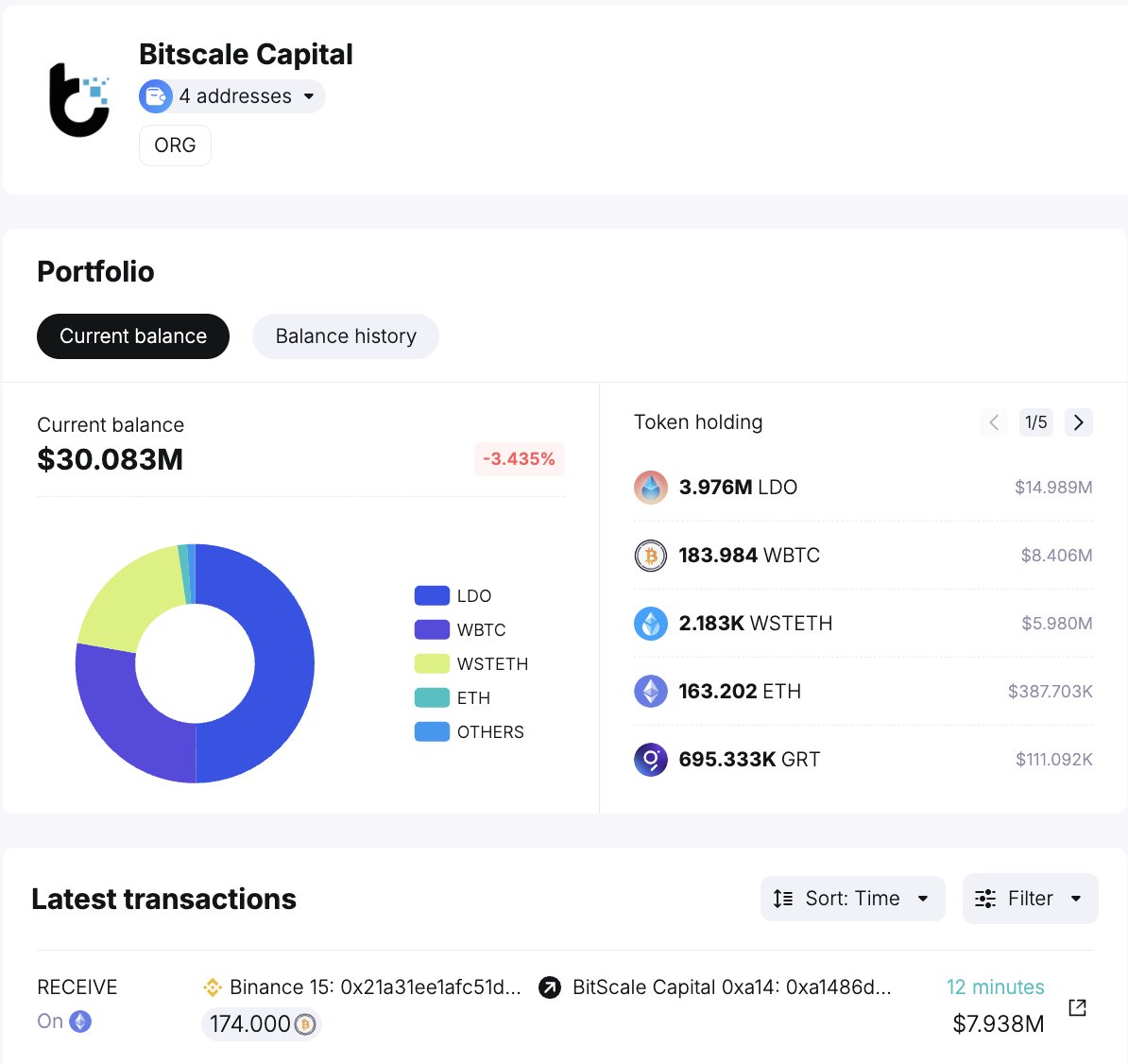

On-chain data provider Spot On Chain reported that another institution has joined the game before the spot Bitcoin ETF decision. The data provider identified a wallet address, suspected to belong to Bitscale Capital, that purchased 174 units of WBTC worth $7.94 million from Binance at an average price of $45,655 each.

According to on-chain data, the second-largest asset in the wallet address is WBTC, with Lido DAO (LDO) in the first place. The data shows that the wallet address currently holds 3.97 million LDO tokens worth $14.98 million.

Wrapped Bitcoin vs Bitcoin

The fundamental difference between Wrapped Bitcoin and Bitcoin is where they reside on the blockchain and their purposes. While Bitcoin operates on its own native blockchain, Wrapped Bitcoin is a token that operates on the Ethereum blockchain. WBTC represents the value of Bitcoin “wrapped” into the Ethereum network, allowing it to interact with Ethereum-based smart contracts.

Bitcoin is typically used as a store of value and a medium of transfer. Its primary purpose is to provide a secure, decentralized digital asset. Wrapped Bitcoin, on the other hand, is designed for use within the Ethereum ecosystem. It serves as a token that can be used in Decentralized Finance (DeFi) applications, smart contracts, and other Ethereum-based projects.

In summary, while Bitcoin operates directly on its own blockchain, Wrapped Bitcoin is built on the Ethereum blockchain and represents the value of Bitcoin within the Ethereum ecosystem. Wrapped Bitcoin emerged as a token created to increase Bitcoin’s liquidity and availability for use.

Türkçe

Türkçe Español

Español