The king cryptocurrency finds buyers above $47,000 with the announcement of the third and final form of ETF approval. The rise in altcoins surpassed BTC‘s gains, with double-digit gains seen as BTCD loosens. The ETH price exceeding $2,600 with the excitement of the spot ETH ETF supported the rise in altcoins. ETH continues the day with a 10% gain.

US Inflation Data Announced

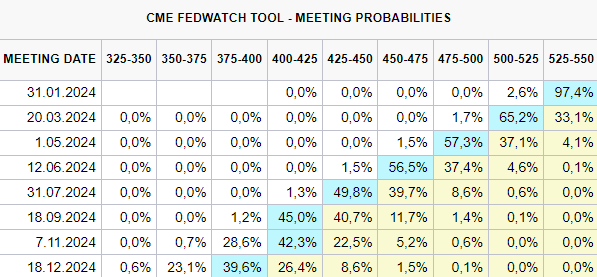

At the end of January, the Fed will announce its first interest rate decision of the year. No rate cut or increase is expected at this meeting. However, the tone used by Powell is of critical importance. Since the last employment data was quite poor, the inflation data announced today was of critical importance. Although the markets expect a 150bp rate cut this year, members are firm about a 75bp cut.

The faster and earlier the interest rate cuts, the greater the rise for risk markets. The continuation of the decline in inflation is also critical for the optimistic scenario to materialize. The expectation for December inflation was a slight increase from the previous 3.1% to 3.2% annually. A monthly increase of 0.2% is also forecasted.

The real decrease was expected for Core Inflation, with a critical announcement of 3.8% against the expected 4%. The announced data is as follows;

- US Inflation Announced: 3.4% (Expectation: 3.2%, Previous: 3.1%)

- US Core Inflation Announced: 3.9% (Expectation: 3.8%, Previous: 4%)

The released data, although weak against cryptocurrencies, suggests a drop in core inflation which is optimistic, but the increase in headline inflation could lead to a short-term decline. The tone at the end-of-month meeting could turn hawkish.

Türkçe

Türkçe Español

Español