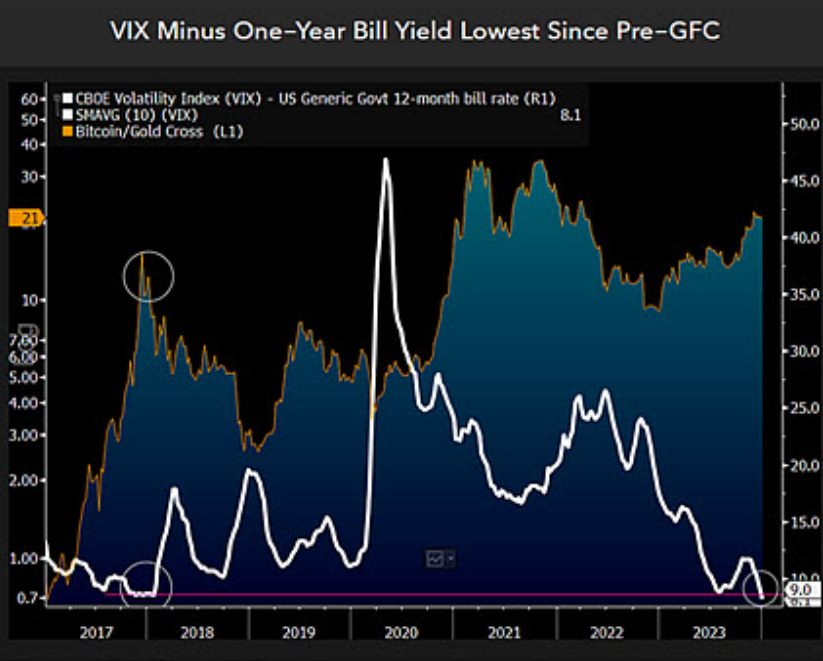

After the Great Financial Crisis, Bitcoin emerged as a disruptive force and entered a financial environment where both gold and the CBOE S&P 500 Volatility Index (VIX) reached record levels. Bloomberg analyst Mike McGlone suggests that there could be a potential volatility shift that could affect the trajectories of both Bitcoin and gold.

Historical Context: Bitcoin’s Rise Amid Financial Chaos

The birth of Bitcoin coincided with a period of increased uncertainty, where gold and the CBOE S&P 500 Volatility Index (VIX) surged to record levels. The cryptocurrency established itself as a decentralized alternative to traditional financial systems. However, as the crypto environment evolves, it may encounter challenges reminiscent of the headwinds faced by gold during its historic rally.

Mike McGlone’s analysis points to a scenario where Bitcoin is facing winds similar to those that propelled gold to unprecedented levels. The possibility of a volatility reversal is becoming a focal point in understanding the potential dynamics between these two assets.

Volatility, a significant driving force in market movements, could play a crucial role in reshaping the narrative for both Bitcoin and gold. According to the analyst, this could signify a rise for both assets, though volatility can bring about rapid declines as well as rapid ascents.

Implications for Bitcoin and Gold Investors

For Bitcoin investors, the potential reversal of volatility could indicate a change in the risk environment. Understanding and navigating this change is becoming increasingly important for informed decision-making.

Gold, with its historical resilience against market turbulence, serves as a benchmark for comparison, offering insights into how Bitcoin might respond to changing volatility dynamics.

McGlone’s Views: An Indicator for Crypto Markets

As a Bloomberg analyst, Mike McGlone’s observations carry weight in the financial world. His focus on a volatility turnaround provides a lens through which investors can assess broader market sentiment.

Whether Bitcoin‘s trajectory will mirror or diverge from gold’s historical patterns is not yet clear, but McGlone’s views serve as a valuable guide for those navigating the evolving crypto landscape.

Looking Forward: Managing Uncertainty in Crypto Markets

In the constantly changing world of cryptocurrencies, predicting market shifts and adapting to them is crucial. As highlighted by McGlone, the potential reversal of volatility introduces a layer of uncertainty that requires investors to be vigilant.

Whether Bitcoin continues on its own path or aligns with gold’s historical trends, being knowledgeable about market dynamics is key to making strategic investment decisions.

As Bitcoin faces potential headwinds similar to those historically challenging gold, the interaction with volatility becomes a critical factor. Mike McGlone’s views offer a perspective on the evolving dynamics of these assets.

Türkçe

Türkçe Español

Español