IntoTheBlock data indicates that about 87% of Lido DAO token (LDO) holders are making a profit. The post shared by the crypto analytics platform also mentioned that the increase is due to LDO’s seven-day performance.

LDO’s Price Performance

In the last seven days, the price of LDO has increased by 18.97%. This performance suggests that the token has outperformed many altcoins, including Solana (SOL) and Ripple (XRP). Despite no recent major developments in Lido, the price increase is thought to be related to Ethereum (ETH).

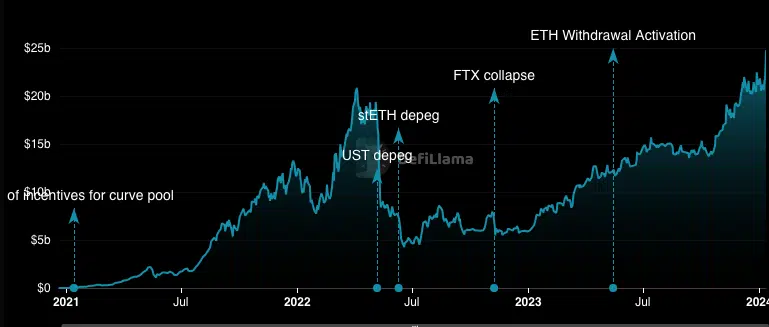

At the time of writing, ETH is trading at $2,653, representing an 18.48% increase, a similar performance to LDO. This movement could be evidence that tokens associated with the Ethereum blockchain are likely to move in the same direction as ETH. However, LDO’s price is not the only metric on the move within the Lido Finance ecosystem. According to data from DeFiLlama, Lido’s Total Value Locked (TVL) is on the rise. At the time of writing, the TVL stands at $24.77 billion, marking a 19.13% increase when the LDO price reached $3.79.

The increase in TVL demonstrates the market relevance of the Lido project. This also indicates increased activity within the Lido protocol, showing market participants’ trust in the ecosystem for higher returns. The mentioned TVL figure is the highest since Lido’s launch. Another metric showing an uptrend in the cryptocurrency is active addresses. According to Santiment, LDO’s 24-hour active addresses reached 1,123 on January 11th.

Current Data on LDO

Active addresses indicate the daily interaction or speculation level around a token. An increase in this metric could mean that many addresses are participating in LDO transactions. This could be considered a bullish signal. Thus, if network activity continues to rise, LDO may move towards $4 in the short term. Similarly, social dominance also rose to 0.40% on the same day.

Social dominance measures the unique social volume related to a project. For Lido, this increase signifies growing interest in the project. However, social dominance fell to 0.25%. This could indicate that LDO is not near its local peak. Therefore, the price movement could maintain its impressive performance moving forward. Regardless of the recent movement, LDO’s price could retract.

Türkçe

Türkçe Español

Español