Friday has arrived, and crypto options are expiring once again. The time is approaching for over $2 billion worth of BTC and ETH options to be paid or rolled over today. Since the beginning of the week, the market has been influenced by the approval of a Bitcoin ETF, but investors are wondering whether this will continue? As of today, January 12, there are 36,000 Bitcoin options contracts expiring. Compared to last week’s $1 billion expiration event, this could have a larger impact on the market.

Current Situation in Bitcoin Option Data

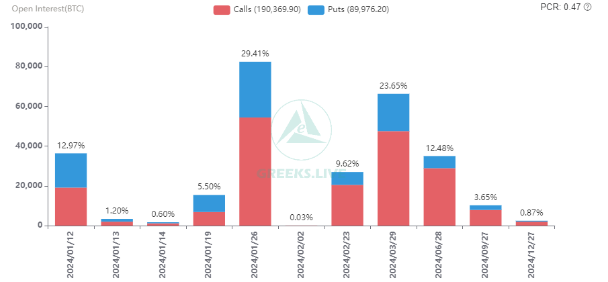

Bitcoin contracts make up a large portion today, with a nominal value of approximately $1.68 billion. Additionally, the put/call ratio for today’s transactions is calculated at 0.9.

To explain the situation, it appears that bulls and bears have distributed long and short contracts equally. On the other hand, the mentioned situation has a minimum level at $45,000.

Data provided by Deribit draws attention to the $50,000 level. The $1.2 billion worth of call options at this level indicates a significant interest gap. Such a concentration of call options has also excited investors.

Derivative investors predict that the BTC price will rise to the mentioned $50,000 level by the end of January.

Other data provided by Greek’s Live focuses on Bitcoin spot ETF approvals, emphasizing that this week has gone exactly as expected. Despite this, a succession of fake news and last-minute reports has led the market into an unstable structure.

Greek’s Live noted that the anticipated rise not occurring has significantly reduced the possibility of volatility.

Greek’s Live revealed that before reaching a definite conclusion, the long-term outlook has been solidified due to capital inflows into the crypto market linked to the ETF:

However, in the short term, there is still significant uncertainty in the market, and sharp fluctuations like those of this week could continue for a few more days.

Expiration of Ethereum Options

The expiring Bitcoin options are not the only ones today. In addition, 262,000 Ethereum contracts are also expiring today. The nominal value resulting from these options is $680 million, and the put/call ratio is at 0.64.

The potential bottom level for Ethereum options is at $2,400. This is slightly below the current spot value at which ETH is trading. According to Deribit data, there is a concentration of open positions at the $2,500 and $3,000 ETH price levels.

Türkçe

Türkçe Español

Español