The US Securities and Exchange Commission (SEC) recently approved 11 Spot Bitcoin ETFs. Following the approval, SEC Chairman Gary Gensler pointed to Grayscale’s past court victory as the main reason for approving the spot Bitcoin ETFs. Subsequently, Grayscale sent Bitcoin to multiple addresses, including crypto exchanges.

Latest on Grayscale and Bitcoin

The first day of the Spot Bitcoin ETF created the expected impact, achieving a total trading volume of $4.6 billion. However, experts believe this was not sufficient.

Experts also think that due to much lower than expected Bitcoin inflows, there was an outflow of $95 million based on GBTC. The total net cash flow for the newly accepted ETFs on the day was reported to be $625.8 million.

According to data provided by BitMEX Research, GBTC outflows were valued at $484 million on the second day following the listing of the spot Bitcoin ETF, with total GBTC outflows reaching $579 million over the previous two days.

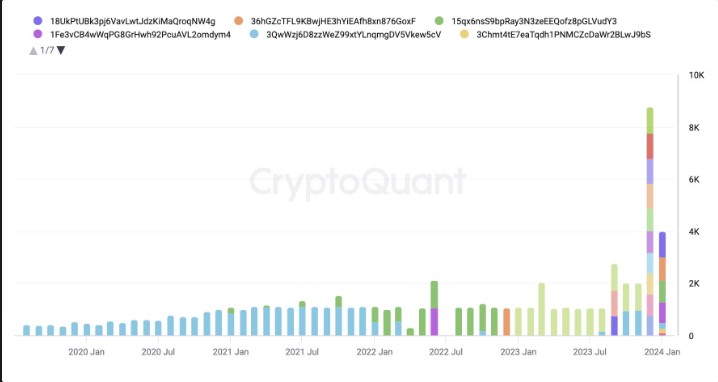

CryptoQuant founder and CEO Ki Young Ju also made a statement on the matter. In a post dated January 13, the CEO mentioned that Grayscale moved over 21,400 BTC valued at over $900 million in a 30-day period.

Grayscale transferred Bitcoin to several addresses, including Coinbase, suggesting that owners might have sold before the spot Bitcoin ETF approval.

Furthermore, an analysis of outflows from Grayscale wallets indicates changes in the balance of the Grayscale BTC reserve wallet.

Grayscale had transferred 4,000 BTC worth $183 million to the Coinbase Prime deposit address. This was attributed to investors moving their assets to other spot Bitcoin ETFs due to the highest fee of 1.5%.

Current Situation of Bitcoin

While all this was happening, the price of BTC continued to fall. In the last 24 hours, the BTC price found buyers at around $42,680, dropping over 6%. The lowest and highest price levels in the last 24 hours were $41,903 and $45,878, respectively.

On the other hand, trading volume increased in the last 24 hours. The transaction volume in the last 24 hours increased by over 6%, exceeding $42 billion. The overall volume lost the $850 billion level, falling to around $830 billion after a drop of over 6%.