While the fluctuation in Bitcoin price continues, it could be useful to take a look at the current situation from an on-chain perspective. BTC is at $42,800 as this article is being prepared. Except for a few exceptions, altcoins have not experienced significant movement in the last 24 hours. So, what does the current outlook for Bitcoin tell us? Will the rise continue?

Bitcoin On-Chain Analysis

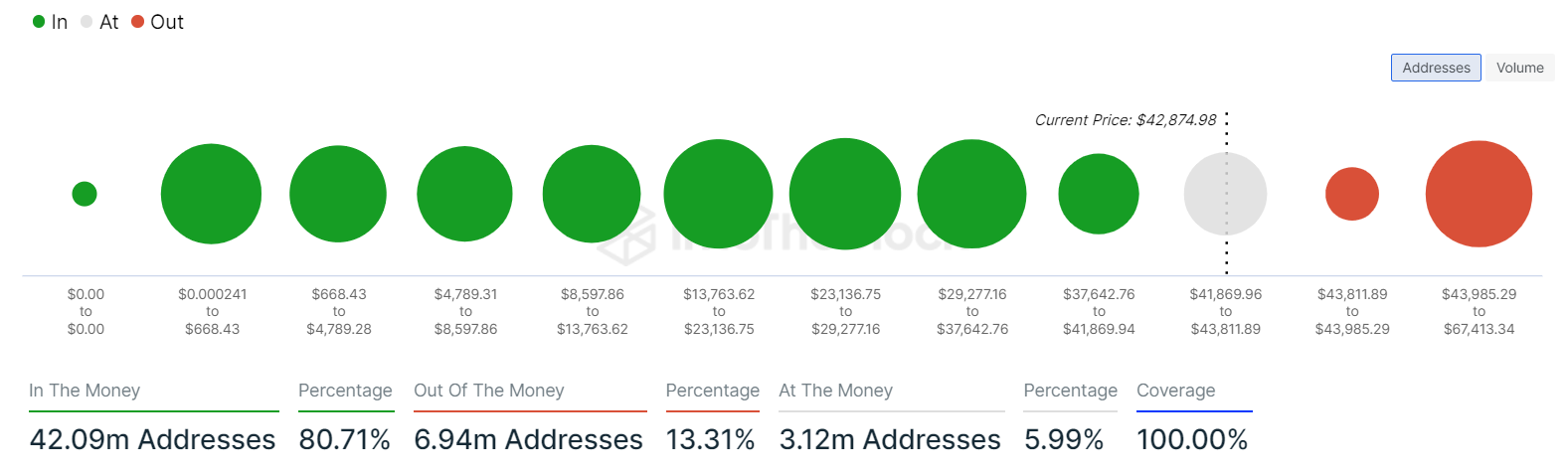

According to the average BTC purchase cost graph, the profitability ratio for the price is still quite high. $41,869 is an important support level and there is no massive resistance up to $44,000. This indicates that if BTC can find some strength at its current level, it could quickly target higher levels.

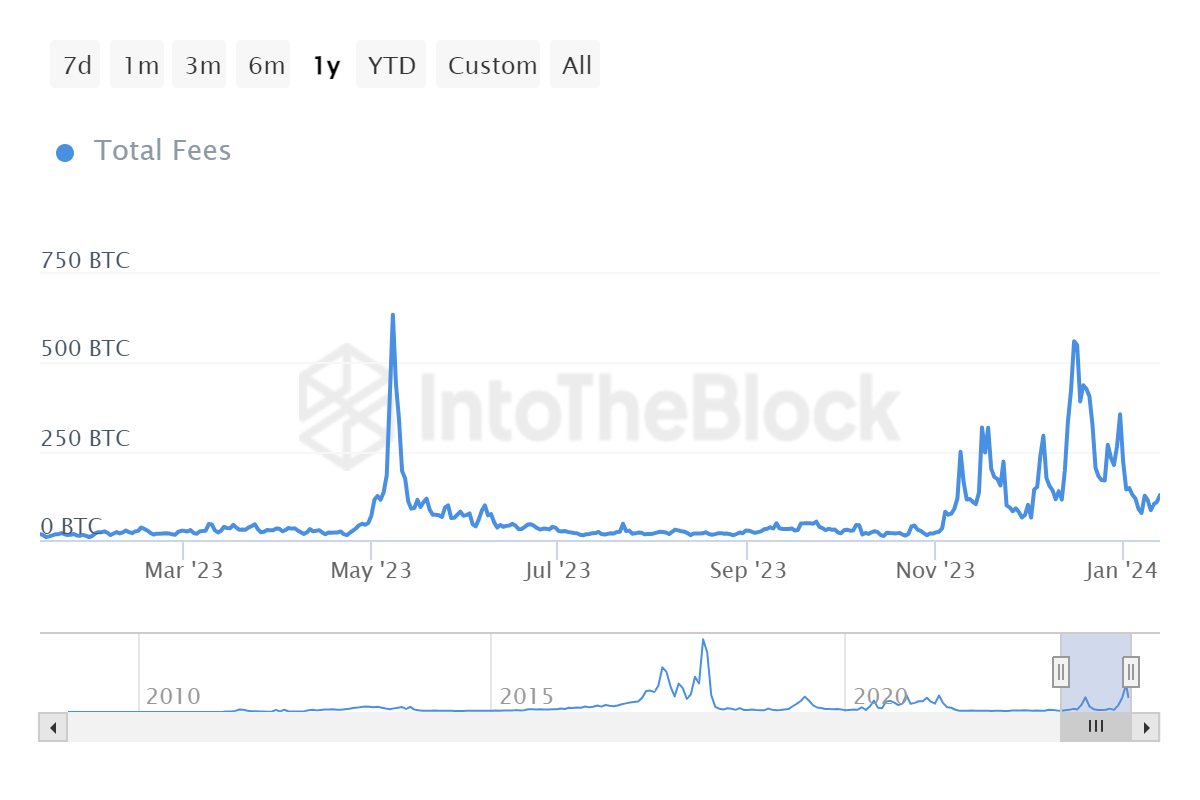

Network fee revenues are not far from the period of the ordinals fomo at the beginning of May 2023. This shows that miners are supported by fees in addition to BTC rewards and have reached high profitability. This was the main reason for the rise in miner shares in the US stock markets.

The data on daily active addresses is well below the 2021 bull period. This confirms that there is more room for the market’s rise to continue. More importantly, it is necessary to ensure the flow of more new investors into the market. The ETF and halving story will be particularly important for attracting more US-based investors to this field.

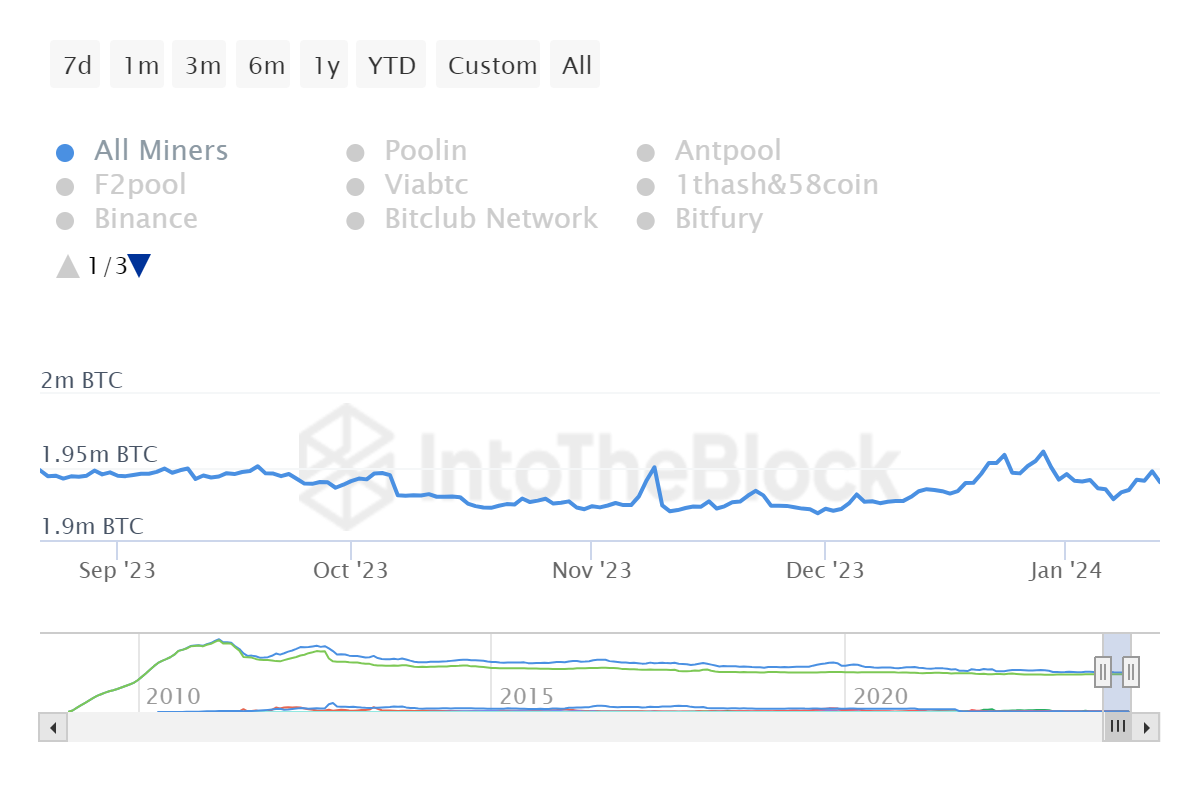

Bitcoin Miners

High profitability, the upcoming halving, interest rate cuts, and ETF approval seem to be deterring miners from selling. Miners with high profitability have probably started selling again in the last few days to update their cash reserves for a rainy day. However, there is still a reserve far from last year’s low levels.

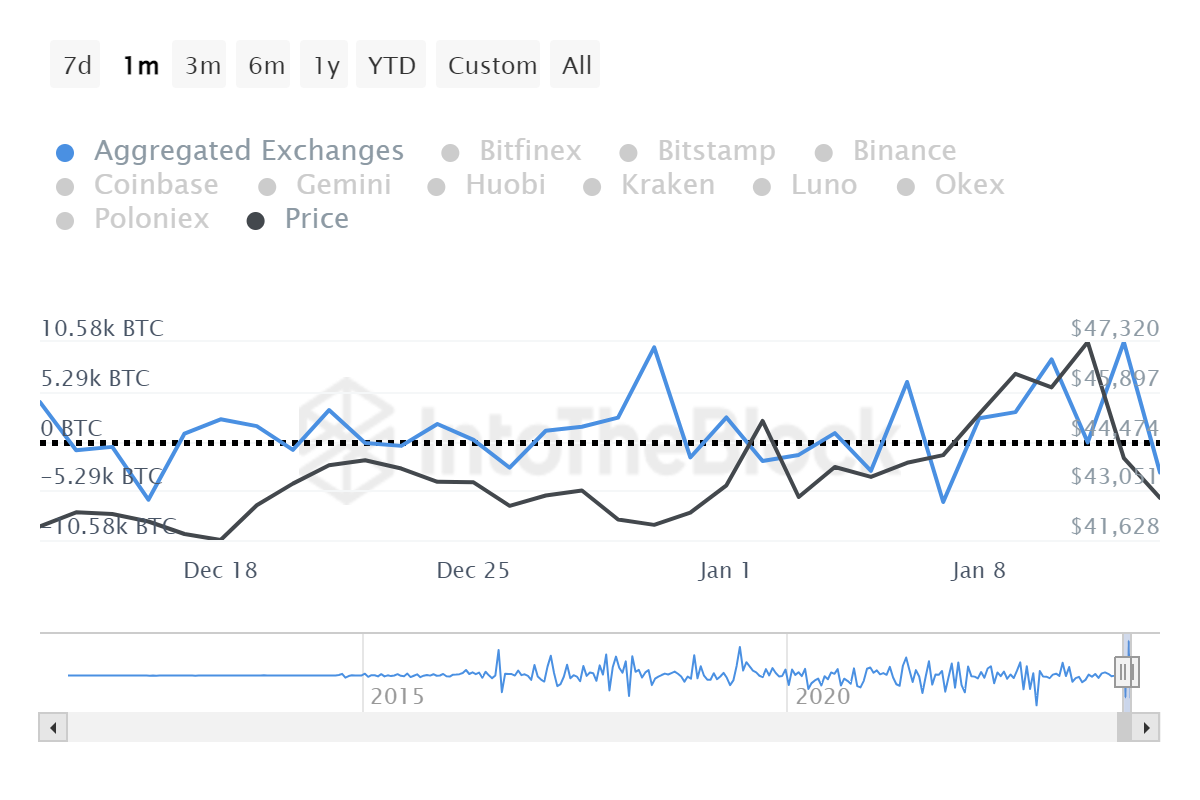

Those preparing for the Spot Bitcoin ETF news were making net entries to exchanges. However, net entries have fallen back into the negative, meaning outflows from exchanges are dominant. There has been a net outflow of 2,360 BTC from exchanges over a 30-day period, with about 13,930 BTC outflow in the last 24 hours. This seems positive as the decline supports exchange outflows, increasing hopes for an accumulation trend.

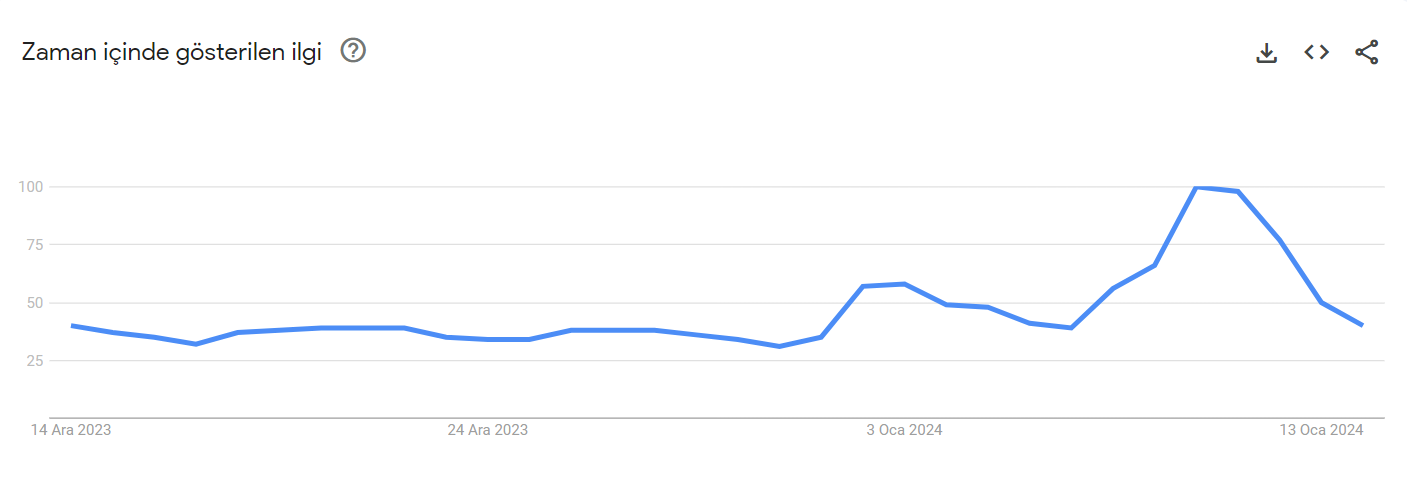

Lastly, Google search data shows that intense searches for the spot Bitcoin ETF approval have weakened, indicating a return to the old days.

In the next phase, it is expected that the expansion of ETF entry channels and the easy accessibility of these ETFs for individual investors will support a shortage of supply. With many positive developments affecting sentiment in the coming months, it is important that short-term negative movements do not lead to excessive pessimism.

Türkçe

Türkçe Español

Español