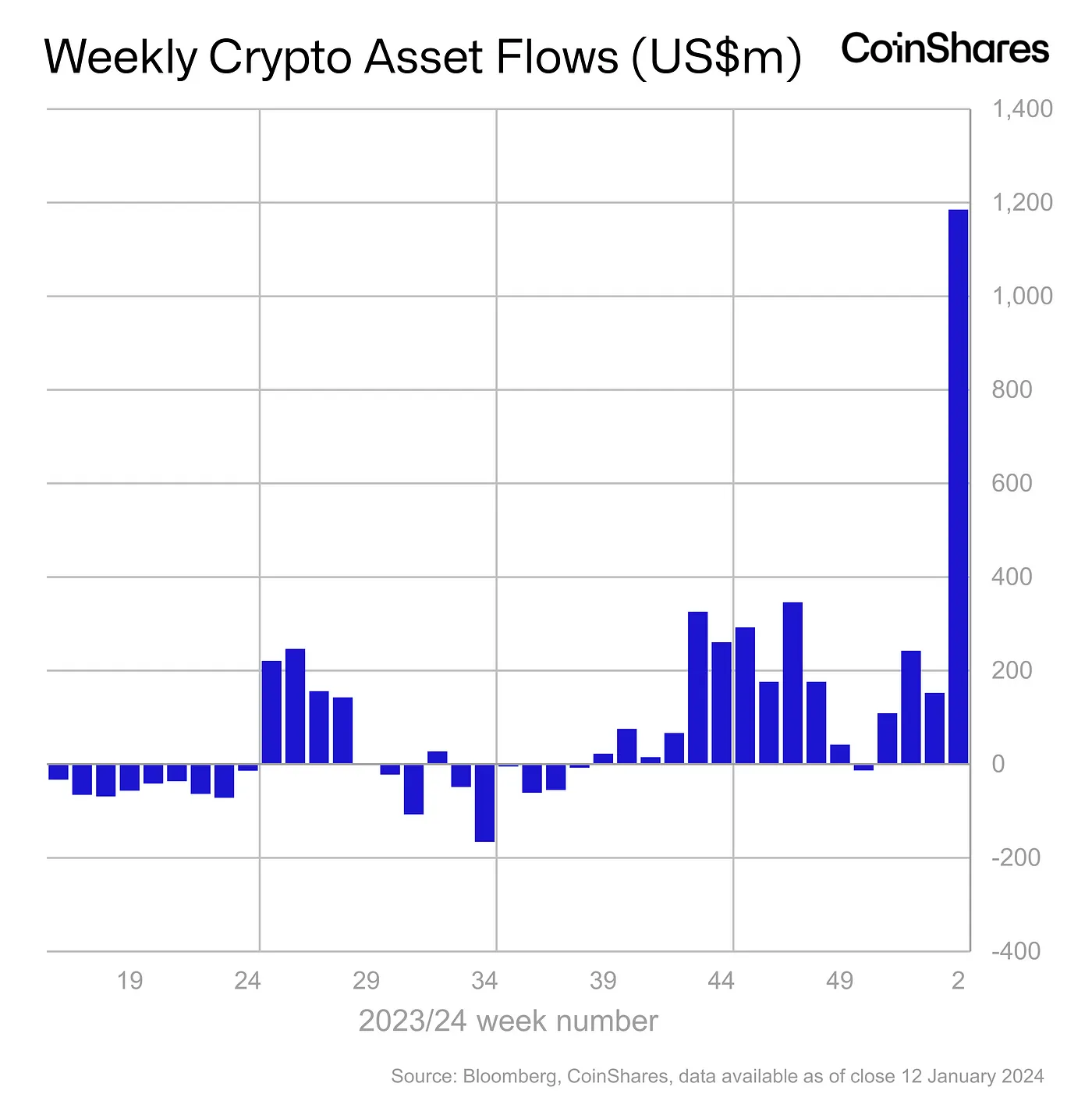

Bitcoin and altcoin-focused investment products experienced a notable inflow of 1.18 billion US dollars last week. Although this figure is below the record of 1.5 billion dollars set during the launch of Bitcoin ETFs based on futures in October 2021, it underscores the ongoing growth and interest in the digital asset market. Notably, trading volumes reached an all-time high of 17.5 billion dollars last week. This represents a significant increase compared to the weekly average of 2 billion dollars in 2022.

Unprecedented Trading Volumes and Geographical Trends

The increase in trading volumes, which constituted nearly 90% of the daily transaction volumes at reputable exchanges last Friday, indicates a significant deviation from the typical range of 2-10%. This surge points to an increased level of activity and engagement in the digital asset space.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

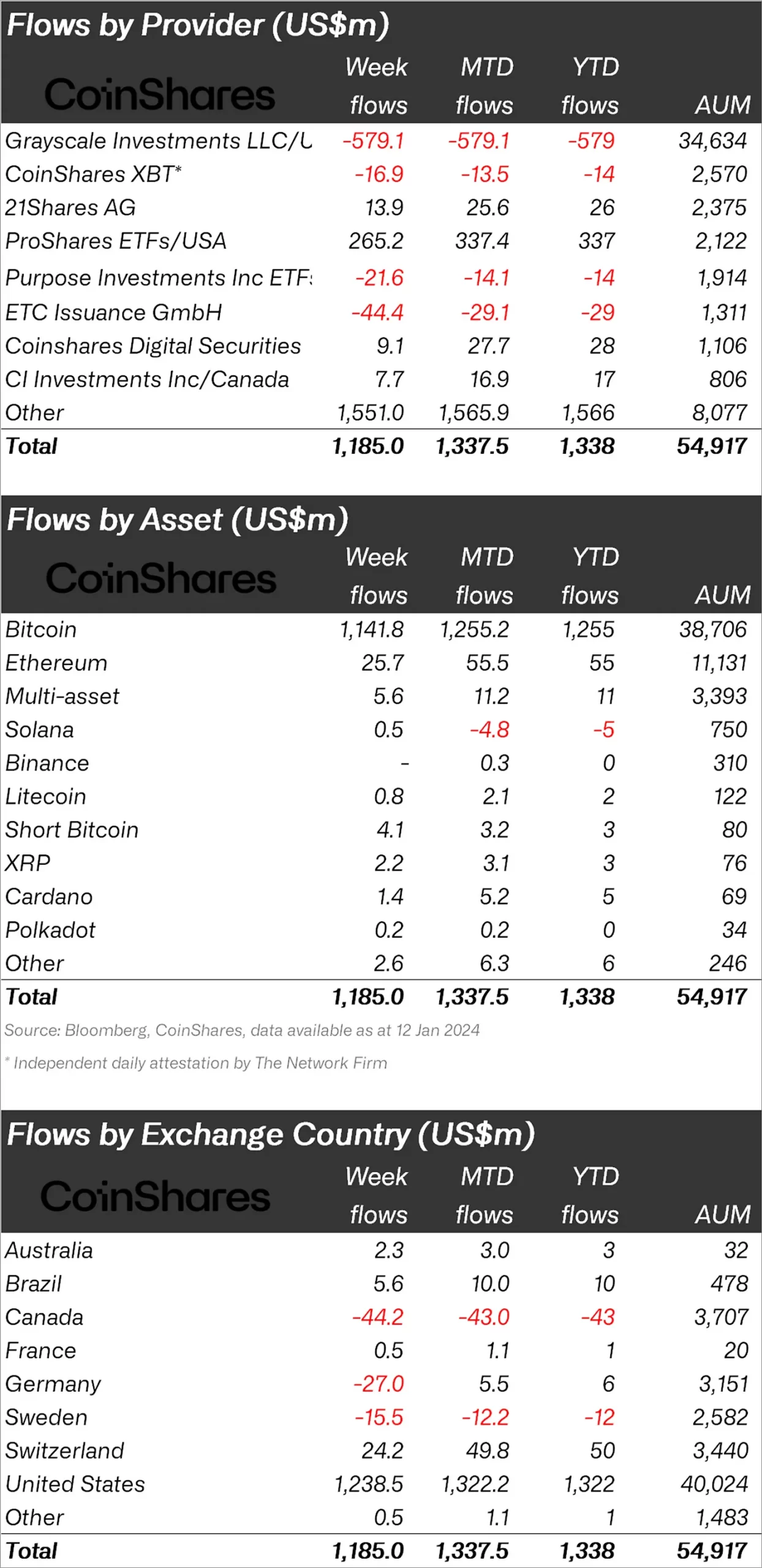

The US emerged as a dominant player, witnessing significant inflows of 1.24 billion dollars. In contrast, Europe experienced minor outflows; Canada saw an outflow of 44 million dollars, Germany 27 million dollars, and Sweden 16 million dollars. This trend suggests a potential shift in institutional investors reallocating their assets from Europe to the US.

Bitcoin Leads in Inflows

Bitcoin, the flagship cryptocurrency, continued to attract significant investor interest last week with total inflows of 1.16 billion dollars. This flow represents 3% of the total assets under management (AuM) in digital asset investment products. Interestingly, short-focused Bitcoin products also recorded a small inflow of 4.1 million US dollars.

Ethereum and XRP also witnessed positive movements with inflows of 26 million dollars and 2.2 million dollars respectively. However, Solana stood out as an exception with only 0.5 million US dollars in inflows during the same period.

Blockchain-Focused Stocks and Ongoing Momentum

Beyond cryptocurrencies, blockchain-focused stocks demonstrated resilience and sustainable momentum, securing a significant total inflow of 98 million dollars. This brings the cumulative inflows over the last seven weeks to an impressive 608 million US dollars.

The sustained interest in blockchain-related stocks highlights investors’ confidence in the potential of blockchain technology and applications. As the digital asset market continues to evolve, the recent increase in inflows and record-breaking trading volumes point to a dynamic landscape.

The dominance of Bitcoin, combined with varying trends in altcoins and blockchain stocks, emphasizes the multifaceted nature of investor preferences. Navigating this environment requires a strategic approach to understand global market dynamics and capitalize on emerging opportunities.

Türkçe

Türkçe Español

Español