Cryptocurrency has undergone significant transformations, evolving from an uncertain concept to a mainstream financial investment. The market has witnessed the launch of spot Bitcoin ETFs, raising expectations for accelerated mainstream adoption. However, a closer look reveals a stark reality: a significant number of cryptocurrencies are meeting their demise.

Cryptocurrency Ecosystem: A Story of Rise and Decline

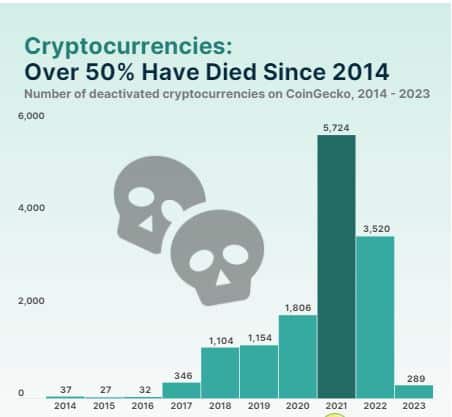

Following the 2021 bull market, the cryptocurrency space experienced an increase in project failures. The rapid expansion of the market led to the creation of numerous cryptocurrencies, many of which struggled to withstand the test of time.

A study conducted by CoinGecko, a leading cryptocurrency market tracker, sheds light on the fate of over 24,000 cryptocurrencies listed on the platform since 2014. Alarmingly, more than 50% of these projects are at risk of vanishing.

Understanding the Dynamics: Bull Markets and Project Failures

The report reveals a striking correlation between project failures and bull markets. The majority of failed crypto projects emerged during the 2020-21 bull market, totaling 7,530 discontinued cryptocurrencies. This period of exponential market growth unfortunately acted as a catalyst for the creation of projects that could not withstand the challenges of the evolving crypto environment.

Further analyses examine the failure rates of cryptocurrencies launched during the 2021 and 2017 bull markets. We encounter a significant failure rate again, with as much as 70%. The following year, 2022, witnessed approximately 60% of listed cryptocurrencies meeting a similar fate.

CoinGecko classifies a cryptocurrency as “failed” or “dead” if it has shown no trading activity in the last 30 days. This definition also encompasses projects proven to be fraudulent, rug pull operations, or situations where the founding team has requested deactivation.

A Glimpse of Hope in 2023: Market Maturation and Resilience

The year 2023 marks a significant improvement, with only 10% of all listed cryptocurrencies facing failure. This notable decline points to a maturing market where more significant and reliable ventures are gaining prominence over speculative “shitcoins.” It should be noted that the term “shitcoin” is used in the crypto world for coins that rank lowest in volume and are, so to speak, on the brink of extinction.

As traditional financial risks continue to penetrate the cryptocurrency space, a further reduction in the failure rate can be expected. Market maturity, combined with increased scrutiny, will promote more serious and sustainable projects, fostering a more robust and reliable crypto ecosystem.

A Maturing Cryptocurrency Market

CoinGecko is currently meticulously tracking over 12,000 cryptocurrencies across 972 exchanges. As the cryptocurrency market undergoes dynamic changes, the resilience and adaptability of projects will be crucial in shaping the future landscape.

Investors navigating this evolving terrain must stay alert, leveraging instructive developments derived from past trends to make informed decisions in the constantly changing world of cryptocurrency.

Türkçe

Türkçe Español

Español