Crypto currency markets have not seen a massive fluctuation following the data released a few minutes ago, but the data is bad. We may feel the impact of this data in the tone of Powell’s speech at the meeting at the end of January. So, what should crypto investors expect? How should we interpret the data that came in today?

US Data and Crypto

US Retail Sales data was announced and it was one of the few significant events on the macro front this week. The expectation here was for a weak increase. However, despite an expected monthly increase of 0.4%, the actual increase was 0.6%. Considering that the previous month’s data was 0.3%, this indicates data that could threaten the decrease in inflation.

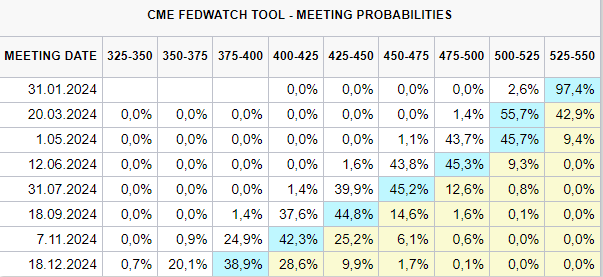

Indeed, following the strong data, investors’ expectations for an interest rate cut have also weakened. The longer and more delayed monetary easing is, the more it goes against risk markets, and the recent employment, inflation, wage increases, and retail sales data suggest it could be prolonged. The Fed may not raise interest rates at this point, but could talk about measures such as speeding up balance sheet reduction or delaying interest rate cuts to the third quarter.

Moreover, the IMF’s Gopinath said today in Davos;

“In 2024, we will be more concerned with politics than the economy. The economy performed better than expected in 2023. The job on inflation is not done. I think the markets are a bit exuberant. We will experience stickiness in inflation. China has issues encompassing demographics and real estate. Escalation of war in the Middle East will be an inflation problem. Europe had a tough 2023, but we expect a recovery in 2024. The UK is more flat in terms of our forecasts.”

Türkçe

Türkçe Español

Español