Altcoin Cardano (ADA) has recently experienced a significant increase in development activities. In terms of code commitments, it has surpassed major cryptocurrencies such as Ethereum, Polkadot, and Binance Coin (BNB). Code commitments, which represent changes in the source code, play a very important role in demonstrating the ongoing efforts to improve the Cardano network. The increase in code commitments positions Cardano as a pioneer of development in the cryptocurrency space.

Altcoin Cardano’s Code Commitments and 2024 Targets

The notable increase in code commitments for Altcoin Cardano (ADA) can be attributed to the development team’s determination to reach ambitious goals set for 2024.

While Altcoin Cardano (ADA) excels in development commitments, recent data presents a contrasting picture in terms of network activity. The number of daily active addresses on the Cardano network has seen a noticeable decline over the past few days. Additionally, there has been a decrease in daily transaction volume on the network, which has heightened concerns about its current performance.

DeFi and NFT Sectors: Mixed Signals

In the decentralized finance (DeFi) sector, altcoin Cardano (ADA) faced challenges due to a decrease in total value locked (TVL) and decentralized exchange (DEX) volumes. The slowdown in the DeFi sector could potentially affect Cardano’s future prospects and may require a strategic approach to address these challenges.

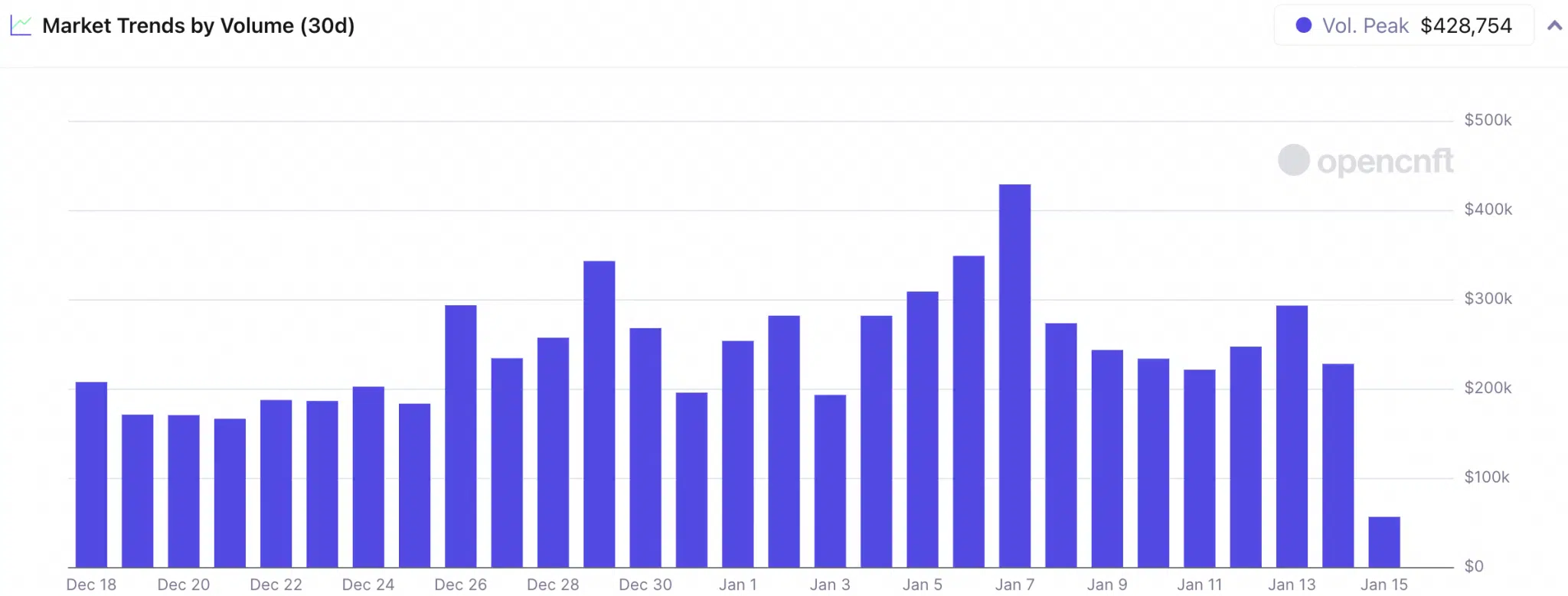

On the other hand, Cardano’s NFT sector has shown more stability. The transaction volume of Cardano NFTs maintained its stability throughout the past month, averaging around $120,000 per day. Dominant collections such as OMEN and Ape Society played a significant role by securing a considerable market share in the Cardano NFT space.

Bearish Outlook for ADA Price

When examining the price dynamics of ADA, Cardano’s native token, a downward trend emerges. Over the past month, altcoin Cardano (ADA) has shown multiple lower highs and lower lows, indicating a bearish trend. In addition, ADA’s trading velocity decreased, indicating a reduction in the frequency of trading activities.

These price trends suggest a cautious approach for ADA investors as market dynamics continue to evolve. In summary, the recent increase in Cardano’s development activities demonstrates its commitment to innovation and progress.

Türkçe

Türkçe Español

Español